Dominican Republic Retail Sector

April 28, 2025

Retail and consumer sectors in the Dominican Republic continue to grow at a healthy clip, aided by a large and growing upper middle class, strong overall economic growth with low inflation, thriving tourism, and a stable democracy. In response to sustained economic growth of 5% over the past five decades, the Dominic Republic retail sector has undergone significant changes with massive growth in the size and number of modern retail stores such as supermarkets and hypermarketsover the past two decades. However, traditional channelsstill account for nearly 80% of total retail sales in the country. Food remains the largest category while e-commerce is the fastest growing.

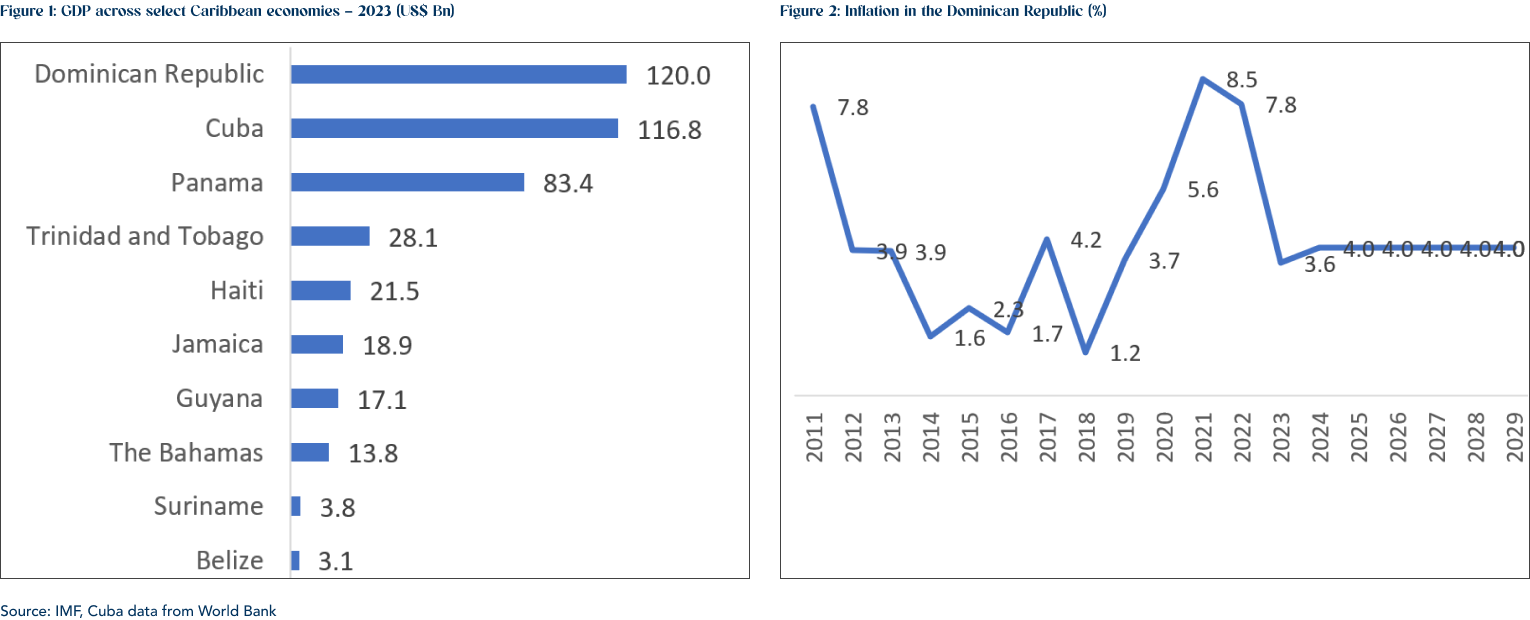

With a GDP of US$120 billion in 2023, the Dominican Republic (DR) is by far the largest economy in the Caribbean and the ninth largest in Latin America. Over the past five decades, the country has outperformed its neighbors in GDP growth, clocking 4.9% average growth per year over 1972-2002, well above the regional average of 3.2% per year. This growth has transformed the country from one of the poorest in the 1960s into a middle-income country with high living standards that reached convergence of 32% with the U.S. in 2002. A stable democracy, and a popular tourist destinations, and more importantly, right policies that have led to significant foreign investment have been instrumental in achieving this stupendous growth. If right policies are maintained, IMF projects the DR could become an advanced economy within the next 40 years. This strong growth bodes well for the retail and consumer sectors over the medium term.

Compared to the average inflation of about 3.5% over 2011-2021, inflation spiked in the DR in 2021 and 2022 to over 8.0% following the COVID-19 pandemic and tight monetary policy in the U.S. and globally and higher commodity prices during 2022. However, it cooled down to 3.6% in 2023 on lower commodity prices, primarily crude oil. With monetary policy easing globally as well as in the DR now, IMF projects inflation in the DR to stabilize at 4.0% annually through 2029. Lower inflation should help keep the prices of consumer goods stable, which bodes well for real GDP growth and positively impact the retail sector.

The retail landscape in the DR encompasses both modern and traditional channels with a clear distinction between the two. Over the past three decades, modern channels have significantly grown in size as well as in numbers. From just 200 — 500 sq. mt. in the early 1990s, the average store sizes of super markets increased to 10,000 square meters by the early 2000s, driven by the need to serve the expanding urban middle- and upper-middle classes. Consequently, the product selections also increased, from 30,000 products in the 1990s up to 85,000 in recent years. These stores also facilitate ‘one stop shopping’ for customers providing an array of diverse services spanning banking, household appliances, fast food, telecommunications, and pharmacies collocated with supermarkets. The number of supermarket chains have doubled over the last 20 years, and are primarily concentrated in Santo Domingo metropolitan area and other large urban centers. Currently, there are eight major supermarket chains in the DR – Grupo Ramos (Aprezio, Sirena, Sirena Market, Supermercados Pola), Plaza Lama, Centro Cuesta Nacional (Supermercado Nacional, Jumbo, Jumbo Express), Hipermercados Olé, Supermercados Bravo, PriceSmart, Supermercados La Cadena, and Carrefour.

Modern retail channels also include independent supermarkets and convenience stores. Mostly found in in Santo Domingo and Santiago, the independent supermarkets are part of the National Union of Low-Cost Supermarkets (UNASE). Convenience stores, mainly located in gas stations, offer pre-packaged and ready-to-eat foods and beverages such as snacks, sodas, other non-alcoholic beverages, rum, wine, and beer.

Despite the rapid progress in modern retail channels, they account for only a quarter (20-25%) of overall retail sales in the DR. The rest three-quarters of sales are generated from the traditional or informal channels, comprising three main components. These include neighborhood stores (colmados), walk-in food warehouses (almacenes), and public markets (mercados) that are located mainly in traditional street markets. Traditional channels sell a variety of products including groceries (fruit and vegetables) and non-grocery items (clothing and footwear, electronics and other digital items, media, car accessories, and flowers).

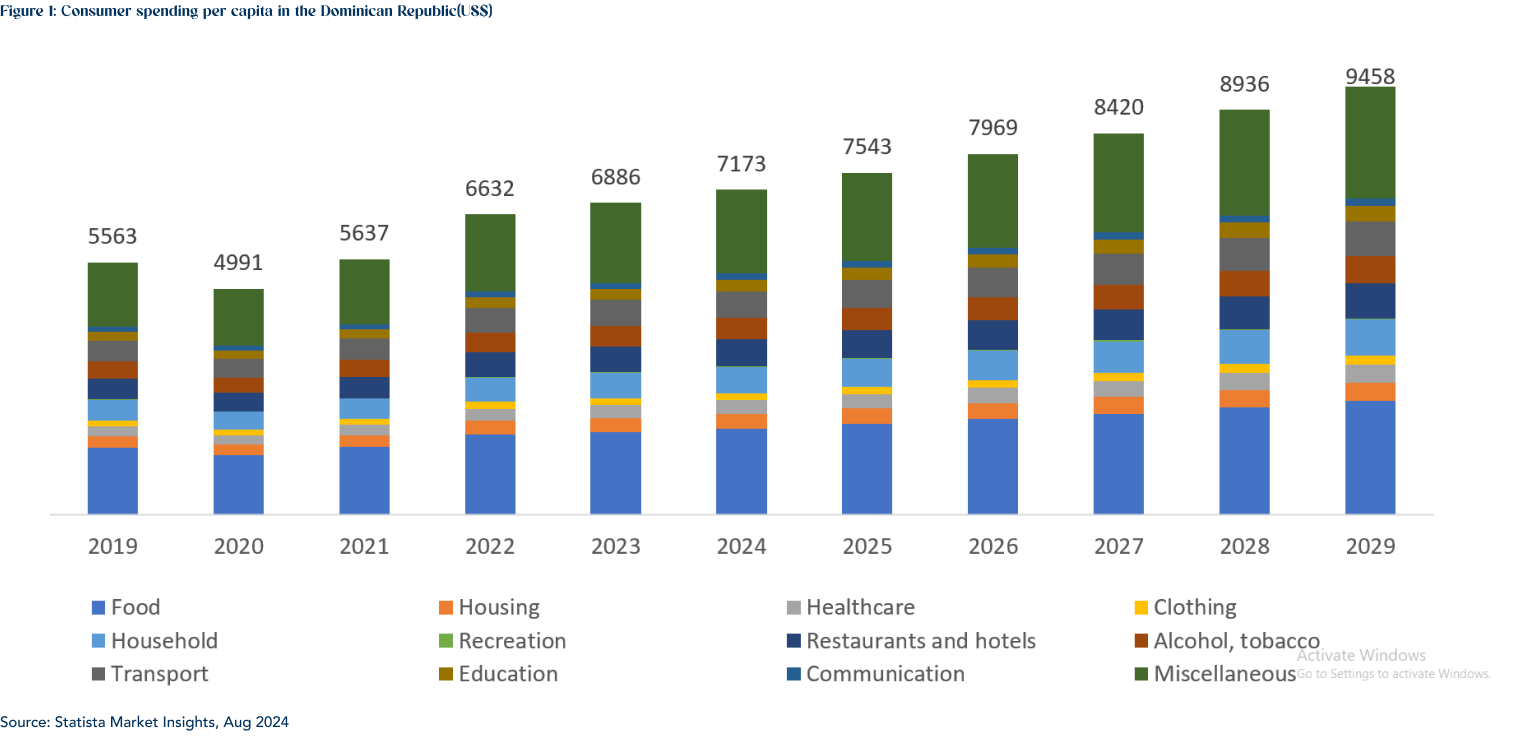

Average consumer spending per capita in the DR was an estimated US$6,900 in 2023 and is projected to reach US$9,500 in 2029. Consumers spent the most on food with an estimated 26% share in 2023. This is followed at a distant second by transport and restaurants and hotels, at 8.3% each.

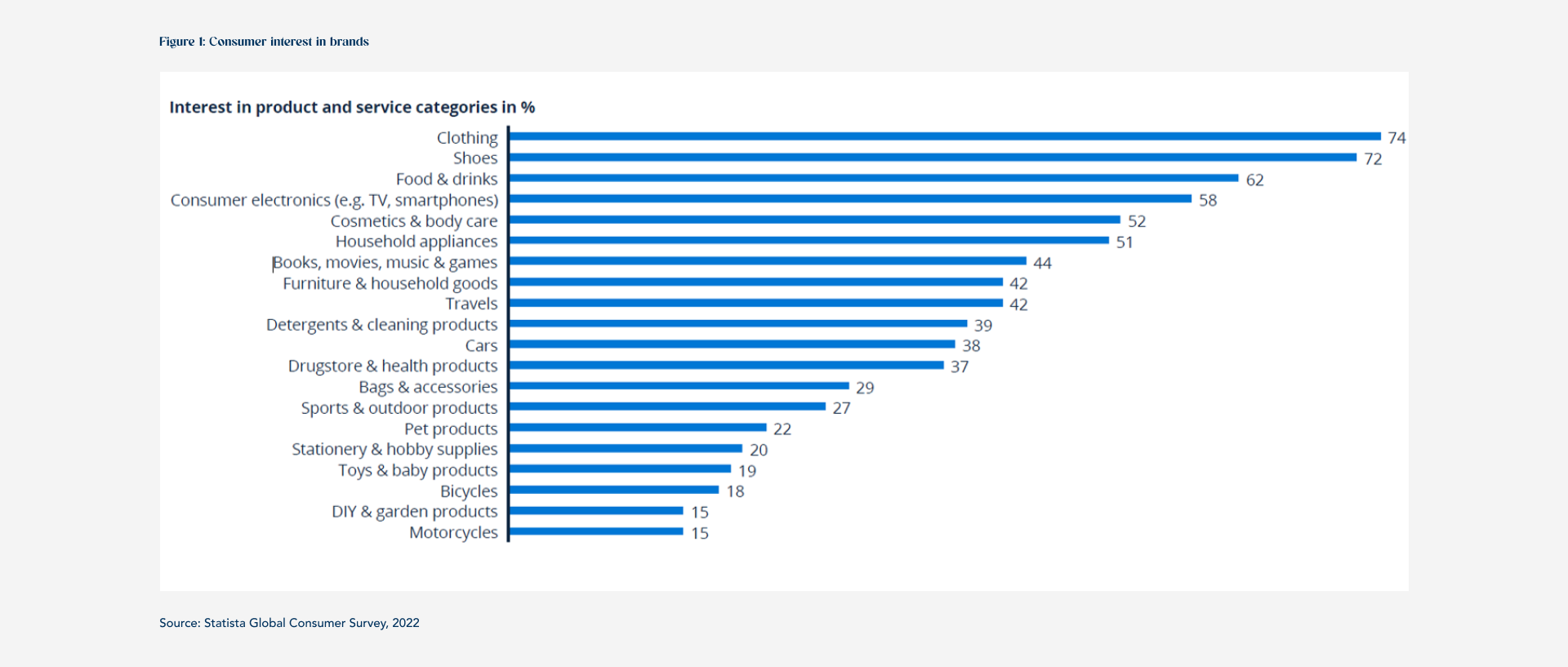

In terms of product interest, consumers value clothing brands the most at 74%, followed a close second by shoes at 72%. Food and drinks and consumer electronics follow, at 58% and 52% respectively.

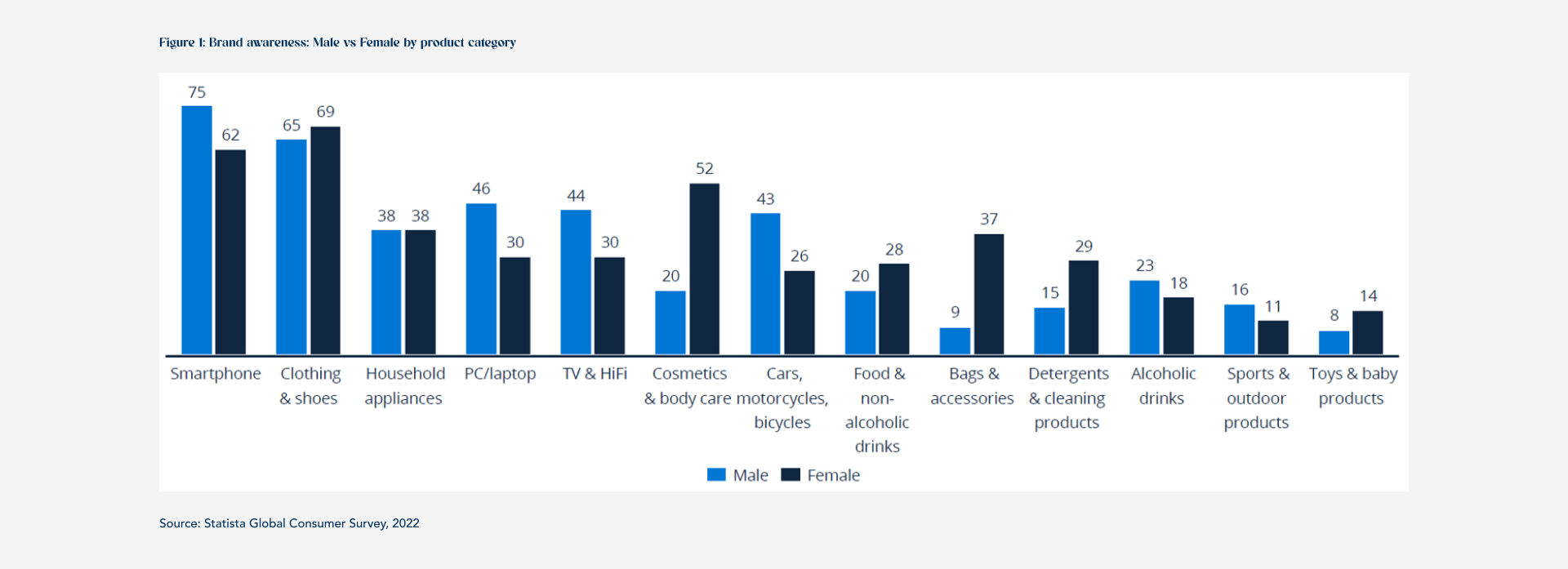

Analyzing by gender, male consumers in the DR value smartphone brands the most (75%) while female consumers value clothing and shoes the most (69%).

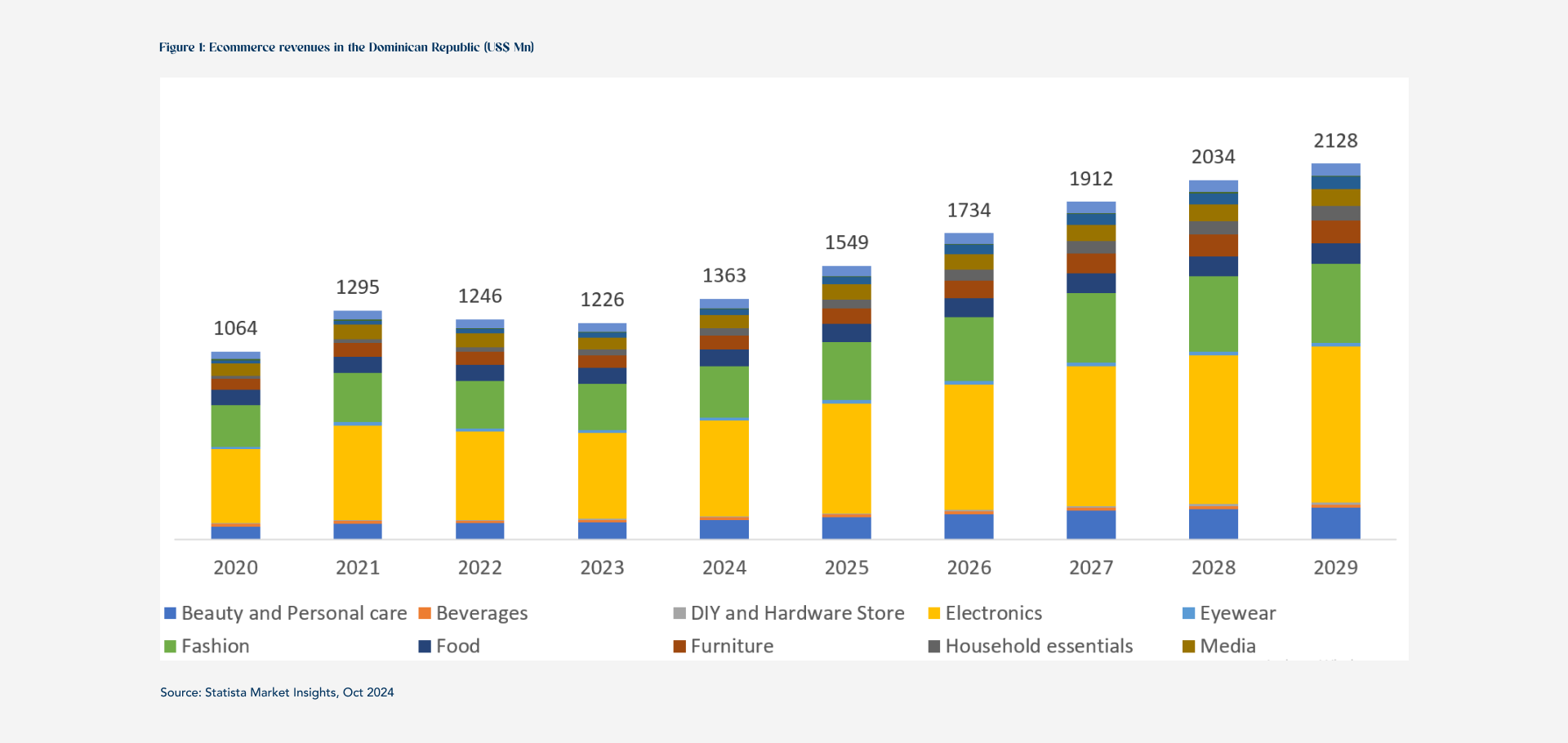

Compared to the America’s average spending per capita of 5.2% on digital expenditures, the DR spends only 2.8%. e-commerce generated the highest revenues of US$1.2 billion or ~80% of total digital expenditures in the DR in 2023, followed by digital media (12.2%) and eServices(6.1%). eCommerce is also the fastest growing category, expected to register a CAGR of 9.3% over 2024-2029, to reach US$2.1 billion by 2029. Electronics is the largest segment, with a value of over US$488million or 40% of total ecommerce sales in 2023. Fashion is the second largest segment, with US$290 million or 21% of total ecommerce sales in 2023. To accommodate online sales, retailers continue to invest in developing distribution centers and pick-up points for efficient delivery of products. Proliferation of internet and rapid technology adoption including acceptance of all mobile payments (Apple Pay, Google Pay, Samsung Pay, and Paypal) continues to drive ecommerce revenues in the DR.

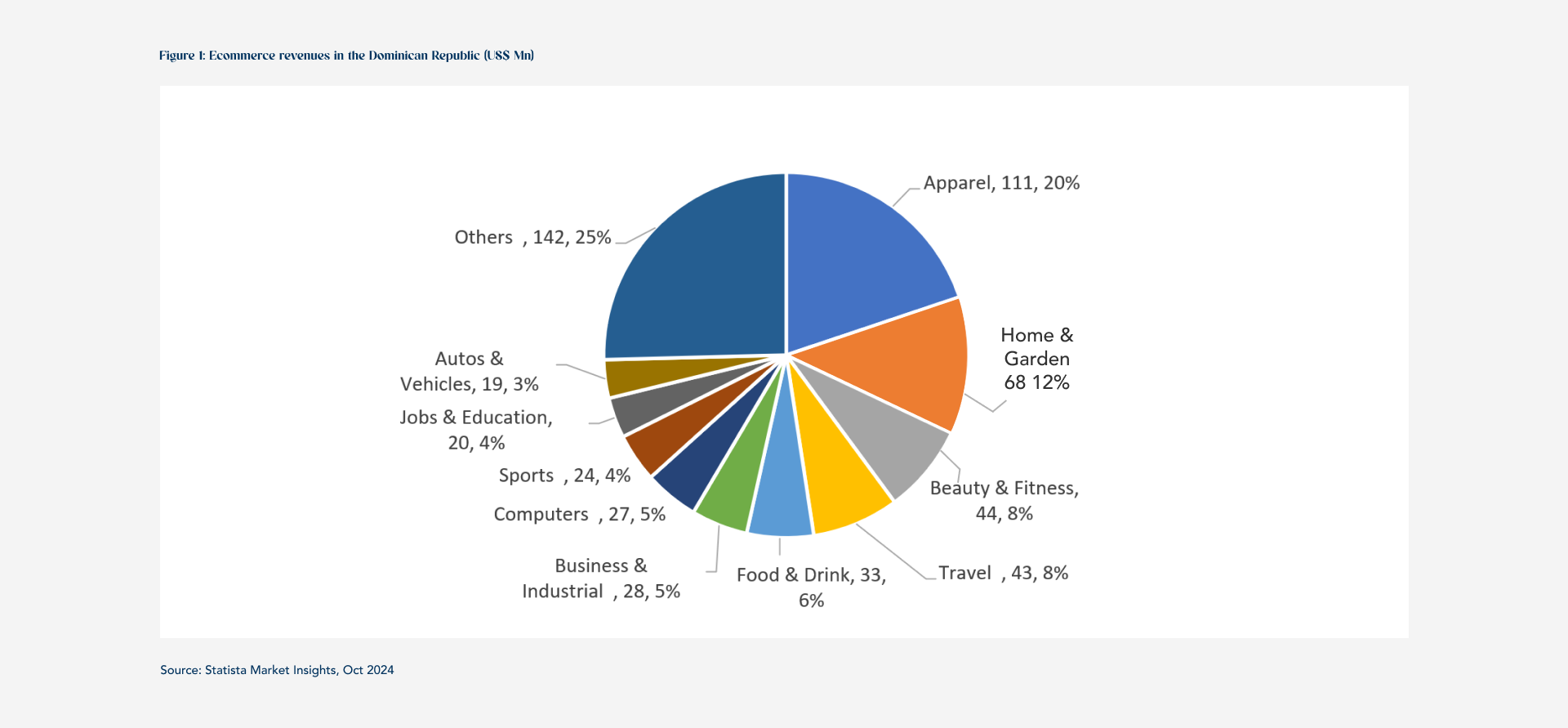

In terms of online stores by category, apparel has the largest number of stores at 111 or nearly 20% of total store count. Home and garden follows at 68 stores (12%).

The DR retail/consumer sector has witnessed strong growth over the past two decades, aided by a stable democracy, growing economy, and low inflation. Going forward, the sector is expected to maintain this momentum, piggybacking on a growing economy and rising middle class. With technology adoption led by mobile payments, ecommerce revenues are expected to be the key growth driver for retail sales over the coming years.