Dominican Republic Construction

June 2, 2025

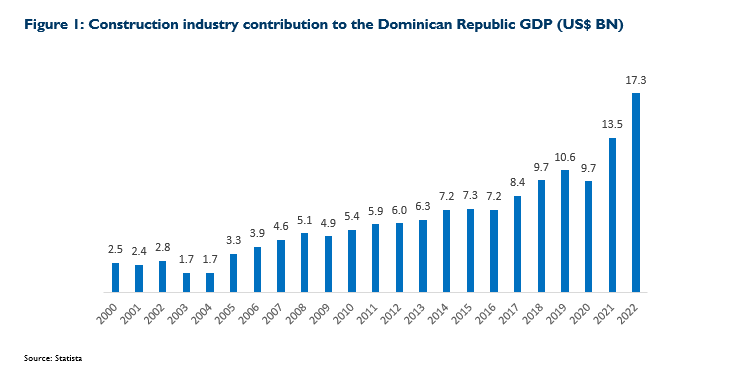

The construction industry is the largest contributor (15.2% of GDP in 2022) in the Dominican Republic (DR), driven by private and government investments. The Dominican Republic’s construction industry enjoyed robust growth from 2015 to 2020, but witnessed a downturn from 2020 to 2023. However, positive signs are emerging, with the industry expected to be a top performer in 2024. The Dominican Association of Home Builders and Developers (Acoprovi) had announced a standstill in growth in 2023 for the construction sector impacted by high interest rates and inflation. However, 2024 has seen a reduction in inflation and interest rates, which has driven the revitalization of the industry. As per market intelligence firm Mordor Intelligence, construction industry in the Dominican Republic is estimated to be $35.47 billion in 2024 and is projected to reach $54.36 billion by 2029 growing at a CAGR of 9.81%. The commercial construction sector is poised for growth over the next five years, fuelled by the resurgence of the tourism and retail industries. This growth will be driven by low-to-medium cost housing projects, commercial buildings, and government-funded infrastructure initiatives like highways and bridges. As of September 2023, more than 1,100 public construction projects have been approved across the country, reflecting significant investment in this area.

Sectors that will drive the construction activity in the country are commercial and residential construction, energy and utilities, and infrastructure projects. The commercial construction sector as well as the residential construction have seen an immense boost driven by the tourism sector. Increasing tourism also increases the demand for electricity and better infrastructure such as roads and airports.

The government’s renewable energy initiatives to improve the electricity mix from renewable sources to more than 25% by 2025 will drive the construction of wind and solar energy projects in the country. In March 2024, Dominican Republic based, Punta Cana Macao Energy Consortium announced its plan to build the FV3 photovoltaic park by 2030, in line with the country’s objective to increase the share of renewable energy sources in the electricity mix from 24% in 2019 to 30% by 2030. While the government is focused on building energy and infrastructure projects to support the growth of the economy driving the construction activity, private sector also plays a key role in the construction of infrastructure projects such as airports and ports.

Focus on developing transport network of road and rails will support the infrastructure construction over the coming years. Growth in the next five years will be supported by the launch of the National Road Infrastructure Connectivity and Transformation Plan by the Ministry of Public Works and Communications (MOPC). With an investment of DOP24.3 billion ($421 million), the project involves construction of a 15.3km road for reducing traffic congestion. It also includes construction of a 67.9km highway from San Pedro de Macoris to the municipality of Miches, with two new lanes. Growth will also be supported by Inter — American Development Bank’s (IDB) loan of DOP7.8 billion ($140 million) towards the country’s Road Infrastructure Rehabilitation and Maintenance Program as part of Vision 2025. The list below summarizes some of the infrastructure projects in the country.

| Project Name | Type | Investment ($ mn) | Construction period | Details |

| Hostos Project | Electrical Interconnection | 2200 | 2027 | To provide an efficient, affordable, and sustainable solution for DR and Puerto Rico |

| AILA terminal | Airport Terminal | 30 | 2025 | Modernization of International Airport of the Americas, José Francisco Peña Gómez including roofs, lighting, facades, etc |

| Domingo Maiz highway | Highway construction | 2 | 2024 | Reconstruction of the Domingo Maiz highway and its connection to Punta Cana Avenue |

| Mill construction | Mill construction | 18 | 2024 | Construction of new mill of Cooperative of Multiple Services of Flour Processors located in Santo Domingo Oeste Industrial Park |

| El Granero del Sur Domestic Airport | Airport Terminal | NA | 2024 | The airport is being constructed in the Barranca section, at Kilometer 7 of the San Juan de la Maguana – Las Matas de Farfán highway, covering 750,500 square meters |

| Cabo Rojo International Airport | Airport Terminal | 67 | 2025 | 62.4 million euro contract for the construction of the new Cabo Rojo International Airport in Pedernales |

| Holiday Inn Santo Domingo Airport | Hotel | 24 | 2025 | The hotel will feature 154 rooms across four levels, encompassing approximately 9,000 square meters of construction |

| Santo Domingo West cable car | Cable car | NA | 2025 | Fitram announces tender for Santo Domingo West cable car construction |

| Puerto Plata private flights terminal | Airport Terminal | NA | 2025 | During the remodeling and construction of a new hangar, they plan to introduce exclusive concierge services, valet parking, Barista coffee, a buffet, and a signature menu for air |

| Los Guandules Basic School | School | 3 | NA | It will have 22 classrooms, a laboratory, an infirmary, an administrative area, a dining room or multipurpose room, a sports field, and a civic square |

The construction sector is poised for growth, driven by several key factors. Government initiatives to increase housing development, combined with historically low mortgage rates, will stimulate demand for new homes. Growth is additionally supported by the Government of the Dominican Republic’s “Happy Family National Housing Plan”, which aims to increase access to affordable and resilient housing.

Increasing trend of FDI and foreign visitors in the country has increased the demand for luxury housing, luxury hotels, retirement homes, community villas, etc. driving the construction activity going forward. The rising population and ongoing urbanization trends are further expected to fuel growth in residential construction. Additionally, the increasing focus on sustainable construction practices, driven by climate change concerns, will create opportunities for eco-friendly building materials and energy-efficient designs. In the construction sector, low — cost housing is perhaps one of the main investment niches in the Dominican Republic. There is a need for more than 2 million homes and this housing deficit is increasing every year.

The main trends in the real estate market in the Dominican Republic continue to be the development of important projects in the tourism sector, as well as new projects for the cruise sector after the success story of the Amber Cove project in Puerto Plata. Major projects are underway in popular destinations like Punta Cana, Bani, Miches, Puerta Plata, Santo Domingo, and the southwest provinces, attracting investment from both local and international developers.

The cost of labour in the Dominican Republic is generally lower compared to other countries. The minimum wage for construction workers in the Dominican Republic is around US$10/US$15 per day. However, the wage can increase depending on the skill level of the worker and the complexity of the project. The cost of labour can also vary depending on the location of the project, with wages in more remote areas being lower. The availability of skilled labour can also impact labour costs. In some cases, there may be a shortage of skilled labour, which can drive up the cost of hiring workers with specialized skills. Additionally, some construction projects may require workers with specific certifications or training, which can also impact labour costs. The Ministry of Labour announced the approval of seven resolutions by the National Wage Committee, instituting a 20% salary increase for the construction sector. The salary increases will take effect retroactively from May 1, with a 12% increment, followed by the remaining 8% from January 1, 2025, upon publication in the upcoming days. The wage adjustments will apply to construction workers and related professions, as well as piece-rate or adjustment workers such as painters, plumbers, bricklayers, electricians, and carpenters.

Material costs are one of the major factors that can significantly impact the overall cost of a construction project in the Dominican Republic. The cost of materials can vary depending on the type and quality of materials used. For example, high-end finishes and fixtures will cost more than basic options. In the Dominican Republic, there are local and imported materials available in the market. Imported materials tend to be more expensive due to import taxes and transportation costs. The availability of building materials can also affect the overall cost of the project. The high cost of new homes being built in Greater Santo Domingo is due to “inflationary pressures” on the costs of some construction materials, such as steel and cement, according to the Dominican Association of Builders and Housing Developers (ACOPROVI). In the case of cement, from January 2020 to April 2024, in the Direct Cost Index of Housing Construction (ICDV), it has registered a significant increase of 49.63%.

Increasing trend of FDI and foreign visitors in the country has increased the demand for luxury housing, luxury hotels, retirement homes, community villas, etc, driving the construction activity going forward. The rising population and ongoing urbanization trends are further expected to fuel growth in residential construction. Additionally, the increasing focus on sustainable construction practices, driven by climate change concerns, will create opportunities for eco-friendly building materials and energy-efficient designs. In the construction sector, low-cost housing is perhaps one of the main investment niches in the Dominican Republic. There is a need for more than 2 million homes and this housing deficit is increasing every year.

The main trends in the real estate market in the Dominican Republic continue to be the development of important projects in the tourism sector, as well as new projects for the cruise sector after the success story of the Amber Cove project in Puerto Plata. Major projects are underway in popular destinations like Punta Cana, Bani, Miches, Puerta Plata, Santo Domingo, and the southwest provinces, attracting investment from both local and international developers.

The Dominican Republic’s cement industry contributes $764 million per year to the national economy, or 0.8% of GDP. Production in 2023 stood at 6.5Mt up from 5.1Mt in 2020. The Dominican Republic’s construction sector has experienced significant growth, driving domestic cement consumption to 5.4 million metric tons in 2023. The Dominican Republic’s strong cement production offers a significant advantage to the construction sector. A study conducted by the ACOPROVI association reveals that cement prices contribute only 10-17% to the overall increase in construction costs, with the remaining 83-90% attributed to other factors. To date in 2024, cement prices have advanced by 8% with an extra 6% anticipated before the end of this year. This is expected to result in a 3% increase in the cost of housing and represents a significant challenge for low-cost housing, according to the association. As a result, the 10,000 homes that originally qualified as low-cost housing and were approved in 2023 for 2024 delivery could lose their classification, affecting the ability of numerous Dominican families to buy their own home.

The mass deportations of undocumented Haitians are raising alarms in the construction sector, as the Dominican Confederation of Micro, Small, and Medium Construction Companies (COPYMECON) warns of a potential halt in operations. According to Elíseo Christopher, president of COPYMECON, the industry heavily depends on Haitian labour, and if this workforce is lost, construction activities could come to a standstill. Currently, over 90% of construction labour in the country consists of Haitian workers, underscoring the sector’s heavy reliance on this workforce.