Dominican Republic Real Estate Market

March 10, 2025

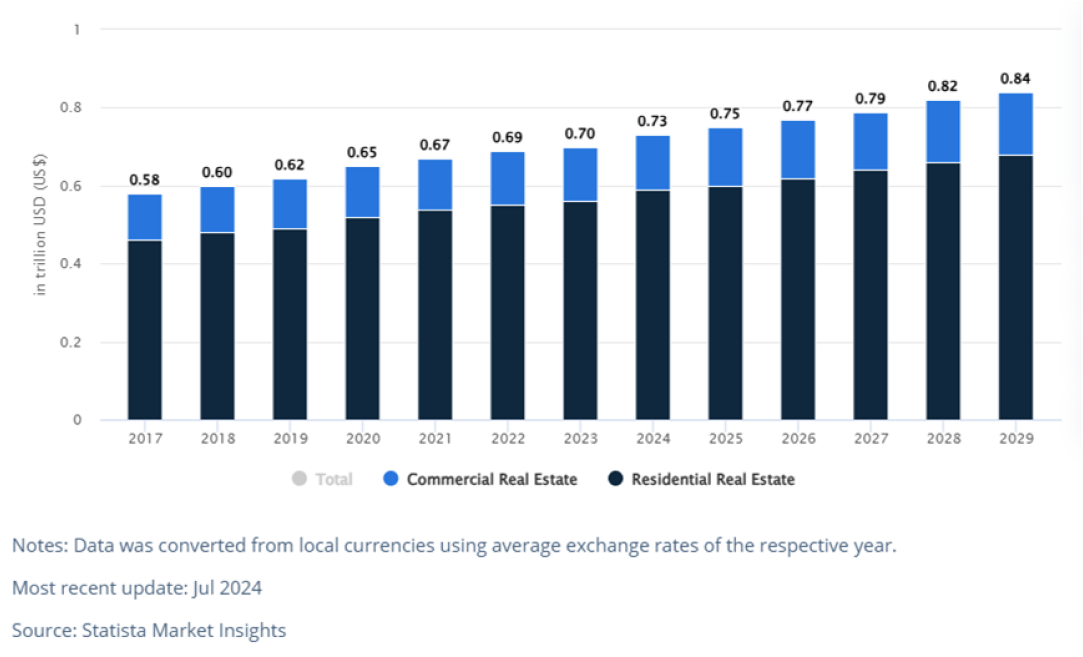

The Dominican Republic’s real estate sector is undergoing a transformation, embracing a more nuanced approach to hospitality and exploration. The real estate market in Dominican Republic is widely reported as the best value for money in the Caribbean. In 2023, the market attracted over US$600 million in investments and it has been the fastest growing over the years. The Real Estate market in the Dominican Republic is expected to reach a value of US$0.73tn in 2024. The residential segment dominates this market, with a projected market volume of US$0.59tn in the same year. According to Statista, it is anticipated that the market will experience an annual growth rate of 2.85% between 2024 and 2029, resulting in a market volume of US$0.84tn by 2029. The Dominican Republic’s real estate market is experiencing a surge in luxury beachfront properties due to increasing demand from international buyers.

Residential Real Estate Accounts for the Bulk of Real Estate Market

The Residential Real Estate market accounts for the bulk of total real estate market in the Dominican Republic, with an estimated value of US$0.59tn or over 80% of the total in 2024. The market is also expected to grow faster of the two segments, projected to experience a compound annual growth rate (CAGR 2024-2029) of 2.88%, leading to a market value of US$0.68tn by 2029.

The Commercial Real Estate market in the Dominican Republic is projected to reach a value of US$144.00bn in 2024. It is expected to demonstrate an annual growth rate (CAGR 2024-2029) of 2.09%, leading to a market volume of US$159.70bn by 2029.

Thriving tourism, Strong Foreign Investments, Higher Rental Yields, and a Better ROI are key drivers

The Dominican Republic has blossomed into a premier Caribbean destination since the mid-1980s, driven by its stunning landscapes, tropical climate, and rich culture. Tourism, once a secondary industry, has become the nation’s economic backbone, surpassing traditional sectors like sugar production. Statistics from the Ministry of Tourism indicate that real estate constructions account for 42% of investments in the travel and tourism sector, amounting to US$4.5 billion out of a total of US$10.7 billion as of July 2023 and Hotel investments follow closely at 41%, totalling US$4.4 billion. Initially, tourism development concentrated on cruise ship ports and all-inclusive resorts. By 2019, tourism emerged as the single largest revenue earner, surpassing US$7.4 billion and representing one-third of the nation’s total foreign exchange.

However, with improved security and infrastructure, tourists now seek authentic experiences beyond these traditional hubs. This shift has led to a diversification of tourism offerings, encompassing luxury developments, cultural exploration, and eco-tourism. The tourism sector continues to grow robustly this year. In the first four months of 2024, air arrivals increased again by 10.2% year on year to over 3 million while cruise arrivals rose by 12.8% to 1.1 million. The Dominican Republic has been the top vacation destination in the Caribbean since 2005, by a considerable margin, according to the World Bank.

During the financial crisis of 2008-2009, the country’s tourism sector remained stable, with around 3.98 million and 3.99 million stay-over tourist arrivals, respectively. By 2016, non-resident stay-over tourists had increased to almost 6 million, while cruise arrivals surged to 809,286 people. In 2017, tourism continued to grow, despite hurricanes Irma and Maria. Non-resident stay-over tourists rose by 3.8% year on year in 2017, while cruise arrivals soared by 36.9%. In 2018, non-resident stay-over tourist arrivals rose by 6.2% to 6.57 million people from a year earlier. Cruise arrivals fell by 11.3% year on year to 982,319 people, but still more than twice as much compared to a decade ago. In 2019, non-resident stay-over tourist arrivals fell slightly by 1.9% year on year to 6.45 million people while cruise arrivals increased by 12.4% to 1.1 million. However, the succeeding two years have been an exception, with tourist arrivals in the whole Caribbean region almost grinding to a halt after the imposition of travel restrictions and lockdown measures worldwide. Dominican Republic closed its borders during the onset of the Covid-19 outbreak, in an effort to prevent the spread of the virus to the country.

In 2020, non-resident stay-over tourist arrivals plunged 63% year on year to 2.4 million people and cruise arrivals dropped 69% to just about 343,000. To revive the industry, the government announced a tourism recovery plan, with measures to ensure the health and safety of both visitors and locals, including medical insurance and random breath tests on passengers. In 2021, non-resident stay-over tourist arrivals more than doubled from the prior year to almost 5 million people – more than any other country in the Caribbean – yet still below the annual average of 6.3 million air arrivals from 2016 to 2019. On the other hand, cruise arrivals remained depressed, falling by another 2.8% year on year to just 333,100 in 2021. Then in 2022, the tourism sector has fully recovered, with air arrivals surging by 43.4% to nearly 7.2 million people. Cruise arrivals also skyrocketed by almost 300% to 1.33 million people. The year 2023 registered new records. Air arrivals reached almost 8.1 million people – up by 12.5% from a year earlier and the highest level ever recorded. Likewise, cruise arrivals soared by 70.4% year on year to reach a new record high of 2.3 million people. The tourism sector continues to grow robustly this year. In the first four months of 2024, air arrivals increased again by 10.2% year on year to over 3 million while cruise arrivals rose by 12.8% to 1.1 million.

One of the key trends in both residential and commercial real estate market in the Dominican Republic is the increasing investment from foreign companies. The country’s stable political environment, favourable business climate, and strategic location have made it an attractive destination for international businesses looking to expand their operations in the Caribbean and Latin America. Specifically in the commercial real estate, this influx of foreign investment has led to a surge in demand for commercial properties, driving up prices and rental rates. This influx of foreign investment has led to the development of luxury resorts, condominiums, and vacation homes. The OECD has recognized the Dominican Republic as the fastest-growing economy in Latin America and the Caribbean since 2010.

Foreigners are further encouraged by a robust economic environment, stable government, an improving infrastructure, and easy access via its three international airports. The economy is projected to expand by 5.4% this year and by another 5% in 2025, according to the IMF, after growing by 2.4% in 2023, 4.9% in 2022, and 12.3% in 2021. In the past ten years, the Dominican Republic’s economy experienced some of the fastest growth in Latin America and the Caribbean. The same period saw a 24% increase in the hotels, bars, and restaurants industry. A vigorous government vaccination campaign and a rebound in international travel aided it. The fiscal expansion was another factor in growth.

Another trend in the market is the development of modern and sustainable commercial real estate projects. Developers are focusing on creating environmentally friendly and energy-efficient buildings that meet international standards. This trend is driven by both customer demand for sustainable properties and the government’s efforts to promote green initiatives and reduce the country’s carbon footprint.

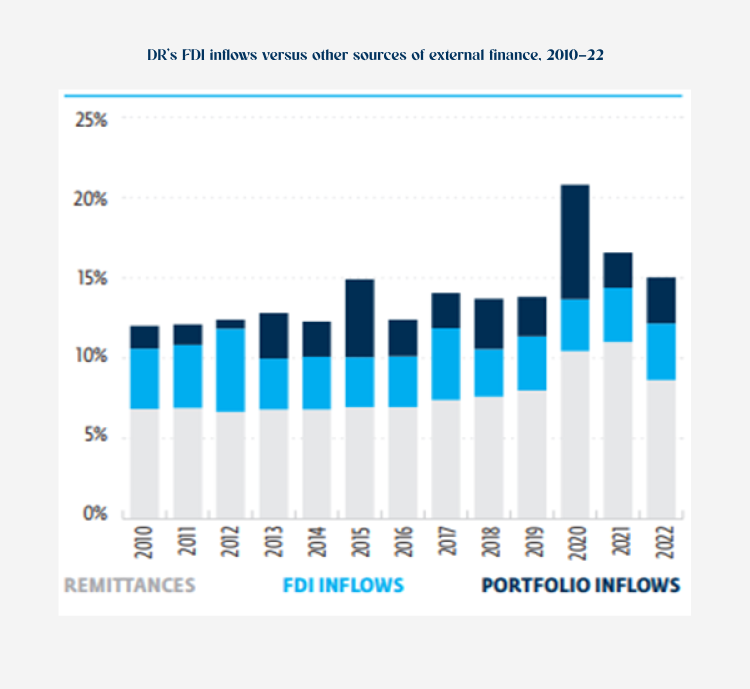

Increases in the middle class and a decline in poverty are both results of growth. But it also increased the number of people living in cities. More Dominicans relocated to urban areas in the last 15 years. The country transitioned from being an agricultural society to one dominated by vast metropolitan areas, with an increase in the urban population of 50%. Improvements are required for access to basic goods and services in the areas of education, health, water, and electricity that help increase economic opportunities, increase economic mobility, and protect the population of the poor and vulnerable. Growth sectors still need to support the creation of quality jobs. The population’s way of life, particularly that of the more vulnerable, is being impacted by rising inflation rates. End-of-year inflation in 2022 was 7.8% year on year, driven by the impact of supply chain disruptions on global markets and rising transport and food commodity prices. Foreign direct investment (FDI) plays an important role for the economy of the Dominican Republic, one of the main recipients of FDI in the Caribbean and Central America. The Dominican Republic performs roughly in line with comparator countries with respect to the inflow of FDI.

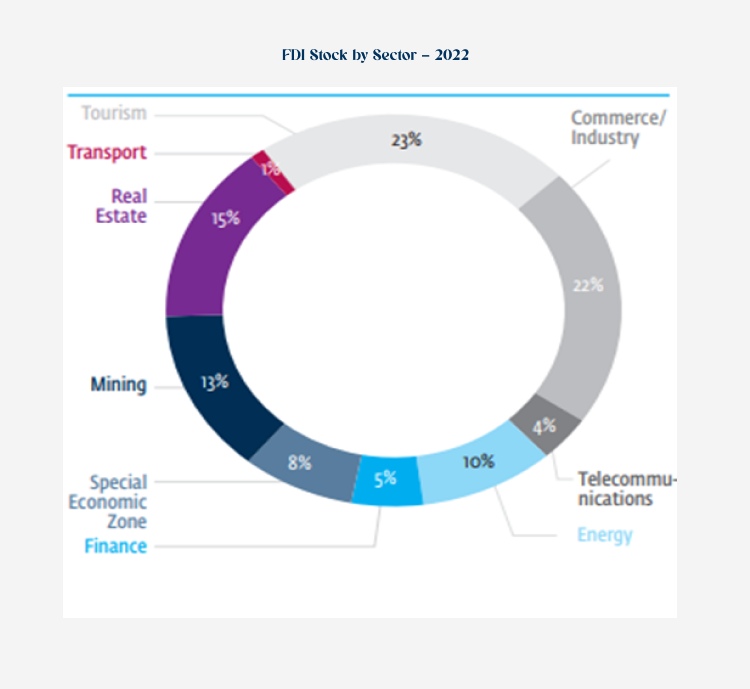

In the past decade, the inflow of FDI into the DR averaged about 3% of GDP and has consistently been a significant source of external finance for the country alongside remittances. The government actively courts FDI with generous tax exemptions and other incentives to attract businesses to the country. Statistics from the Central Bank of the Dominican Republic indicate that during the period 2010-2020 the trade/industry sector, the tourism, the real estate sector, and the mining sector were the four main destinations for FDI. The Dominican Constitution guarantees the right to own private property and provides that the state shall promote the acquisition of property, especially titled real property. There are no restrictions or specific regulations on foreigners or non-resident owners of land. Registering property in the Dominican Republic requires 6 steps, an average of 33 days, and payment of 3.4% of the land value as a registration fee. FDI in the DR has mainly been natural resource — seeking and has become increasingly concentrated in tourism and real estate during the past decade. Tourism represented 22.7% of FDI stock in 2022, followed by commerce, with 21.6% and real estate at 15%. There have been 39 new projects or expansions in the hospitality industry since 2009, far outpacing all other industries.

In the residential sector too, the market has accelerated, driven by a combination of strong domestic demand and renewed foreign interest. The country’s attractive investment climate, coupled with its stunning natural beauty, makes it a prime destination for property buyers. A newly built one-bedroom apartment near a beach can be bought for just US$150,000 or less. Over the past five years, an expanding tourism industry, a stable economy, and friendly tax laws have brought a wave of international buyers to this Caribbean nation. During 2023, air arrivals into the Dominical Republic reached almost 8.1 million people – up by 12.5% from a year earlier and the highest level ever recorded. Likewise, cruise arrivals soared by 70.4% year on year to reach a new record high of 2.3 million people.

Foreign property investment is also encouraged by incentives, which according to the country’s tourism office include: (i) Tax-free receipt of pension income from foreign sources, including moving belongings to the country, is guaranteed (Law 171-07 on Special Incentives for Pensioners and Persons of Independent Means), (ii) Foreign buyers receive a 50% exemption from property tax, (iii) Exemption from taxes on dividends and interest income, generated within the country or overseas, (iv) Foreign buyers receive a 50% exemption from taxes on mortgages when the creditors are financial institutions regulated by Dominican financial monetary law, (v) Exemption from payment of taxes for household and personal items, (vi) Exemption from taxes on property transfers, (vii) Partial exemption on vehicle taxes and (viii) Developers are relieved of all national and municipal taxes for ten years, including the tax on the transfer of ownership to the first purchaser of a property, by Law 158-01 on Tourism Incentive. Law 158-01 has been the catalyst for the DR’s booming real estate and tourism industry, fostering development across the country through tax and import incentives for tourism projects, including hotels, resorts, golf courses, and other related infrastructure. By providing attractive tax incentives and streamlined processes, this law has unlocked opportunities for developers and investors, fuelling the growth of diverse tourism projects nationwide.

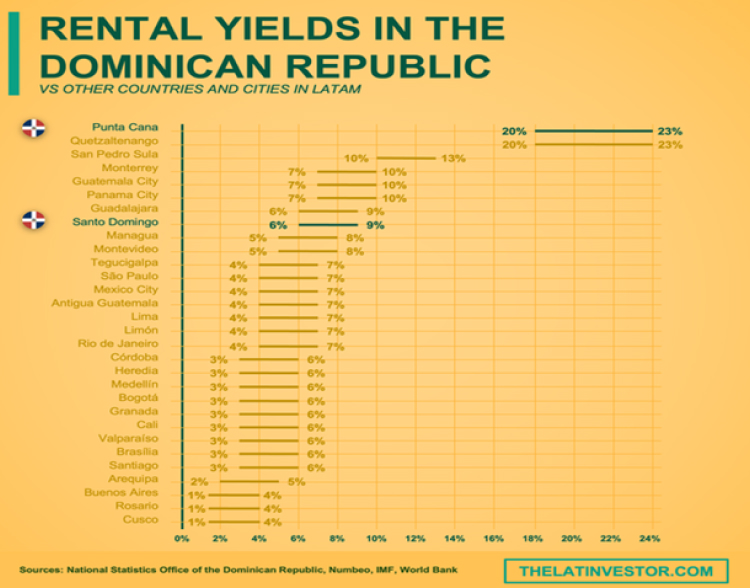

The Dominican Republic offers good rental yields, with some areas registering gross rental yields as high as 10% annually. In 2024, the average gross rental yield in the Dominican Republic was 6.74%. In 2024 in Santo Domingo, gross rental yields for apartments ranged from 6.26% to 9.82%, with a city average of 7.48%. Punta Cana offers rental yields ranging from 20.0% to 23.0%, with a city average of 6.01%. Currently, a two-bedroom apartment located in Santo Domingo is rented for about US$1,400 per month while a similar property in Punta Cana is offered for a slightly higher monthly rent of US$2,500. According to the Dominican Republic Real Estate Association, properties in Sosúa and Puerto Plata have an average occupancy rate of 75%. Investors in these areas report an average annual return on investment (ROI) of 12-15%. These statistics highlight the potential profitability of investing in the North Coast.

One of the major trends in the Dominican Republic’s Residential Real Estate market is the increasing popularity of luxury properties. High-end buyers, both local and international, are investing in luxury homes and villas that offer exclusivity, privacy, and top-notch amenities. These properties often come with breath-taking views, private pools, and access to golf courses or marinas. The demand for luxury properties is driven by the country’s growing economy and the desire for a luxurious lifestyle. Another trend in the market is the rise of gated communities and condominiums. These developments offer a sense of security and community living, which appeals to both local and foreign buyers. Gated communities often provide shared amenities such as swimming pools, tennis courts, and playgrounds, making them attractive to families and retirees. Condominiums, on the other hand, offer convenience and low maintenance, making them popular among young professionals and investors.

The growth in the residential sector will be supported by the government’s focus on housing development across the country. Demand for new housing is expected to grow in the short and medium term, driven by declining mortgage rates across the country. The rising population and ongoing urbanization are also expected to increase the demand for residential construction over the forecast period. The trend toward sustainable construction is expanding in DR due to growing concerns over accelerating climate change and greater knowledge of how the construction industry contributes to greenhouse gas emissions. Furthermore, top construction firms and regional governments are using sustainable and bio-based building materials to improve the energy efficiency of construction activities. The main trends in the real estate market in the Dominican Republic continue to be the development of important projects in the tourism sector, as well as new projects for the cruise sector after the success story of the Amber Cove project in Puerto Plata. Many well-known international developers continued with multiple projects, some of which are already operational, in the areas of Punta Cana, Bani, Miches, Puerta Plata, Santo Domingo, and the southwest provinces of Pedernales, Barahona, and Bani, Peravia.

The Dominican Republic’s property market is very diverse. Prices at the lower end of the luxury market range from around US$100 to US$420 per square foot (sq. ft) for a prime oceanfront home, according to ReMax. However high-end residential property prices can go as high as US$5 million in the north and US$9 million in the south. The highest-priced home in the Dominican Republic is listed for US$25 million. In Santo Domingo, the country’s capital and largest city, the average price of a two- or three-bedroom house in the city center stands at around US$150,000. In Casa de Campo, a luxury gated community in La Romana, about an hour east of Santo Domingo, villa prices range from US$300,000 to over US$6 million depending on the property’s size, age, and proximity to the ocean, according to an article from The New York Times/ In Puerto Plata, on the north coast, a 200 square meter (sq. m) apartment in upscale neighbourhoods of Puerto Plata, like Sosúa, costs around US$2,400 per sq. m. In May 2024, the average price of apartments rose by 7% to DOP118,304 (US$1,980) per square meter (sq. m.) as compared to the same period last year, according to figures from the real estate listing portal Properstar. Likewise, the average price of houses also increased by 5% year on year to DOP93,763 (US$1,569) per sq. m. over the same period.

In the Cabarete area, the price of an older two- or three-bedroom condominium farther from the water starts at about US$200,000, while oceanfront homes in newer luxury developments, like Sea Horse Ranch, sell for at least US$700,000, said William Holden of Holden Sotheby’s International Realty. Several new oceanfront luxury condominium developments have been built in the past several years, with unit prices ranging from US$500,000 to US$2 million. In other beachside destinations such as Sosúa, Las Terrenas, and Punta Cana, growing interest from foreign investors has led to a residential construction boom. At least 90 projects are underway in the area, ranging from oceanfront villas in resort communities to condominium buildings and golf course-adjacent single-family homes. The construction of major hospitality projects like Cap Cana, the Moon Palace Resort in Punta Cana, and San Souci Port in Santo Domingo are also expected to boost tourism, as well as the real estate market. Other tourism-related developments include, the luxurious Carnival Cruise Lines port-and-tourist village at Maimon, located just west of Puerto Plata, which opened in October 2015. Royal Caribbean is also planning to open a new port near Playa Dorada, between Puerto Plata and Sosúa. Though the Dominican Republic has its own currency, the peso, most real estate listings and transactions, especially of high-end properties, are quoted in U.S. dollars.

Since the global financial crisis, foreign property investors have been a major force in the Dominican Republic’s real estate market, contributing to average annual price increases of 10%. Currently, prices for residential properties with an ocean view typically start at about US$140,000 while beachfront properties start as low as US$160,000. Recently, the Dominican Republic is moving beyond the retiree market and becoming a more desirable destination for families. At the high-end market, prices of luxury homes, which typically have an asking price of at least US$5 million, are stable, but in some areas, these prices are also rising robustly. The volume of luxury property transactions has been rising strongly since the country reopened and economic activity has returned to pre-pandemic levels, according to local property experts. Tourist developments are concentrated in the east and north. Southern areas such as Barahona and Pedernales are less developed and less visited, but there have been efforts to promote them as eco-tourism destinations. Punta Cana is the most popular tourist destination. Punta Cana’s international airport, situated in the country’s popular eastern region, receives around 65% of all tourists traveling to the country every year. Some of the most desirable residential areas are in tourist hot spots such as the capital, Santo Domingo, and the areas on the country’s beautiful Atlantic coast, such as the tourist towns of Sosúa Cabarete, the peninsula of Samaná, and Puerto Plata. Luxury beachfront apartments in places such as Punta Cana and BavaroLas Terrenas, and Boca Chica have been built in recent years. One of the most high-profile developments has been the Cap Cana project on the East Coast, a high-end residential and tourist mixed development of hotels, oceanfront homes, golf courses, and commercial establishments.

Compared to other Caribbean and Latin American countries, the Dominican Republic offers significant advantages for quick-turn investments. For instance, while property prices in the Bahamas or Barbados may be higher, the Dominican Republic provides more affordable entry points, allowing investors to acquire properties at a lower cost and resell them at a competitive price. The Dominican Republic offers lower acquisition and renovation costs compared to other regions, while also providing higher resale profit margins. This combination makes it an ideal market for investors aiming to achieve quick returns. One of the major factors contributing to the attractiveness of the Dominican Republic for real estate investors is its straightforward and welcoming immigration policy. Unlike many other countries, the Dominican Republic does not require foreign investors to obtain a specific residency visa. This flexibility allows investors to enter the country to manage their properties, and execute sales without the bureaucratic hurdles that are common in other regions. The legal framework in the Dominican Republic also supports quick real estate transactions. The Foreign Investment Law (No. 16-95) guarantees equal treatment for foreign and national investors, allowing them to repatriate profits and capital freely. Additionally, there is no capital gains tax for foreign investors, which means that the profits made from reselling properties are not subject to taxation.

This contrasts sharply with countries like Brazil or Mexico, where capital gains taxes can significantly reduce an investor’s profit margin. Another advantage of investing in Dominican real estate is the availability of affordable labor. Whether you’re purchasing a property to renovate or building a new Development, the cost of labor in the Dominican Republic is significantly lower than in many other countries. According to the International Labour Organization, the average wage in the Dominican Republic is approximately $400 per month, compared to over $2,000 per month in the Bahamas or $1,500 per month in Puerto Rico. This affordability extends to construction and renovation costs, allowing investors to enhance properties without breaking the bank. By improving a property’s value through renovations or upgrades, investors can increase the resale price, thereby maximizing their ROI. The lower labor costs also enable investors to remain competitive in the market by offering high-quality properties at attractive prices. In April 2024, construction costs for houses were more or less unchanged from a year earlier, following a year-on-year decline of 1.8% in 2023 and annual increases of 10.1% in 2022, 15% in 2021, 10.2% in 2020, 2.4% in 2019, 9.1% in 2018, 5.1% in 2017, according to the Oficina Nacional de Estadística.

| Region | Average Property Price (per sq. meter) | Average Renovation Cost (per sq. meter) | Typical Resale Profit Margin |

| Dominican Republic (North Coast) | $ 1,200 | $ 200 | 30-40% |

| Bahamas (Nassau) | $ 4,500 | $ 800 | 20-25% |

| Mexico (Riviera Maya) | $ 2,200 | $ 600 | 25-30% |

| Puerto Rico (San Juan) | $ 3,800 | $ 700 | 20-30% |

| Jamaica (Montego Bay) | $ 2,600 | $ 500 | 25-30% |

| Costa Rica (Guanacaste) | $ 3,000 | $ 600 | 20-25% |

| Belize (Ambergris Caye) | $ 2,500 | $ 550 | 25-35% |

Shortage of Affordable Housing and High Mortgage Interest Rates Remain Key Issues

The construction sector accounted for more than 7% of the country’s GDP in recent years. During 2023, the number of permits for construction of apartments fell by 13.6% from a year ago, in contrast to year on year increases of 31.6% in 2022 and 24.6% in 2021, according to the Oficina National de Estadistica. Likewise, permits granted for housing construction also declined by 19.4% last year, after increasing by 14.9% in 2022 and 21.3% in 2021. Most residential construction is aimed at the high-end market. The low-end market has an acute shortage of accommodation, and the country has a housing deficiency of about 2.1 million homes. According to the United Nations Development Programme, the housing deficit in the Dominican Republic is almost 2.1 million units, of which about 60.6% is qualitative. Compared to those who are homeless, there are more people living in inadequate housing. The housing shortage is growing annually by an average of 50,000 to 60,000 homes. Frequent hurricanes and flooding have exacerbated the shortage. Economic damage from natural disasters in the Dominican Republic costs around US$420 million a year, according to a recent study conducted by the World Bank and the Ministry of Economy, Planning and Development. For instance, in September 2017 alone, two strong hurricanes, Hurricane Irma and Hurricane Maria, devastated a large number of houses, particularly those built of low-quality materials near the sea. Around 80% of all homes in the Dominican Republic are detached houses.

In May 2024, Banco Central de la República Dominicana held its benchmark interest rate unchanged at 7%, where it stayed since December 2023. This followed five consecutive rate cuts in the past twelve months, from 8.5% in May 2023. As such, average interest rates on housing loans remain high. However, with the trajectory heading southwards, real estate demand should pick up. On the National currency-denominated housing loans, the average interest rate was 12.15% in May 2024, slightly up from 12.09% a year earlier and 11.06% two years ago. Foreign currency-denominated housing loans: the average interest rate was 8.98% in April 2024, up from 7.62% in the previous year and 5.69% two years earlier. Most property transactions in the Dominican Republic are done in cash. The country’s mortgage market was equivalent to just 5.3% of GDP in 2023, even though housing loans grew by almost 17% per year from 2000 to 2023. More mortgages have been offered by local banks since 2012’s Law on Mortgage Market Development and Trusts provided tax incentives and established the Trust as a legal instrument. As a result, mortgages with a loan-to-value ratio of 70% of the appraised value of the property are offered. In May 2024, the total value of loans for house purchases was DOP 375.21 billion (US$6.28 billion), up by 15.6% from a year earlier and about 34 times the amount in 2000, according to figures released by the Banco Central de la República Dominicana.