Dominican Republic Economy Growth

February 28, 2025

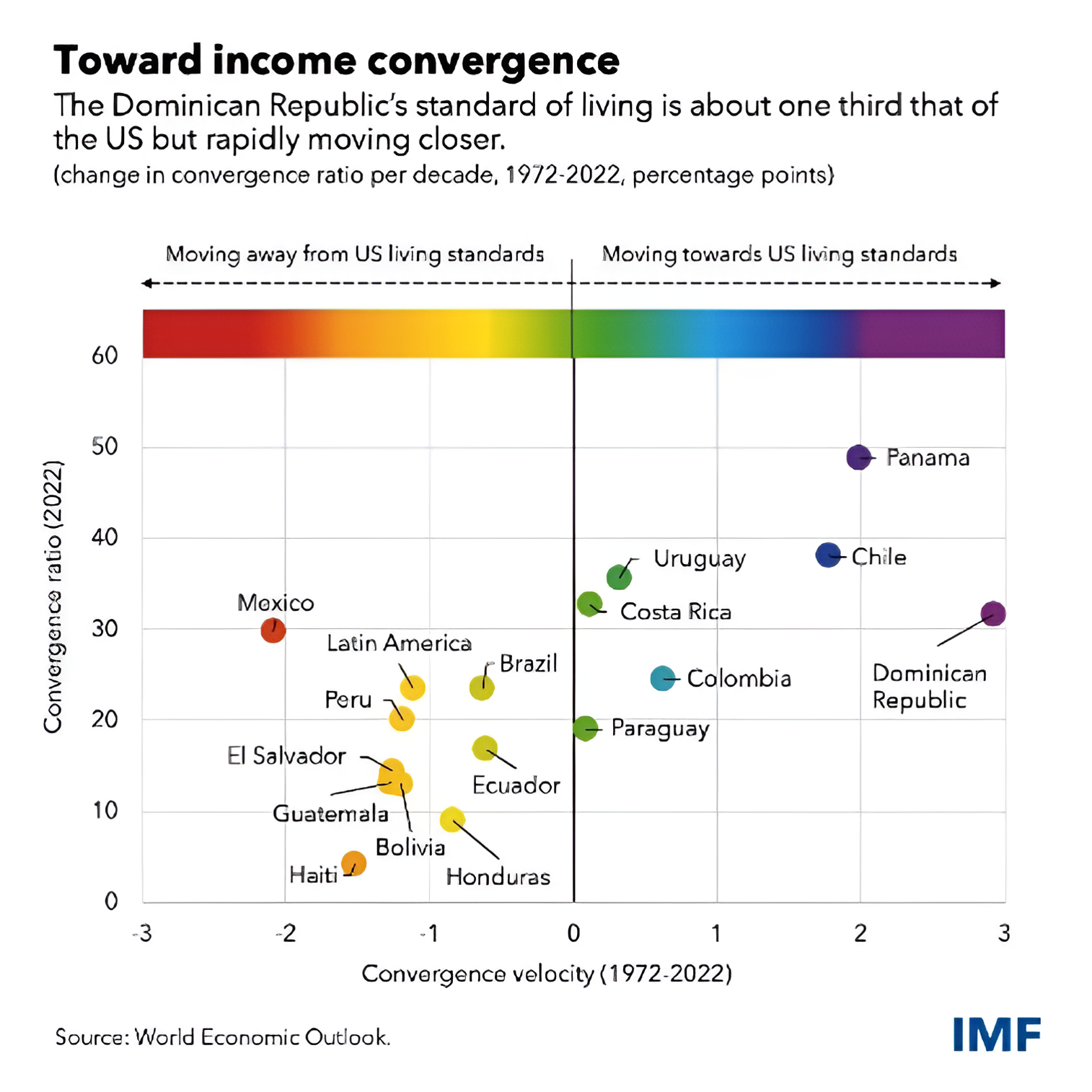

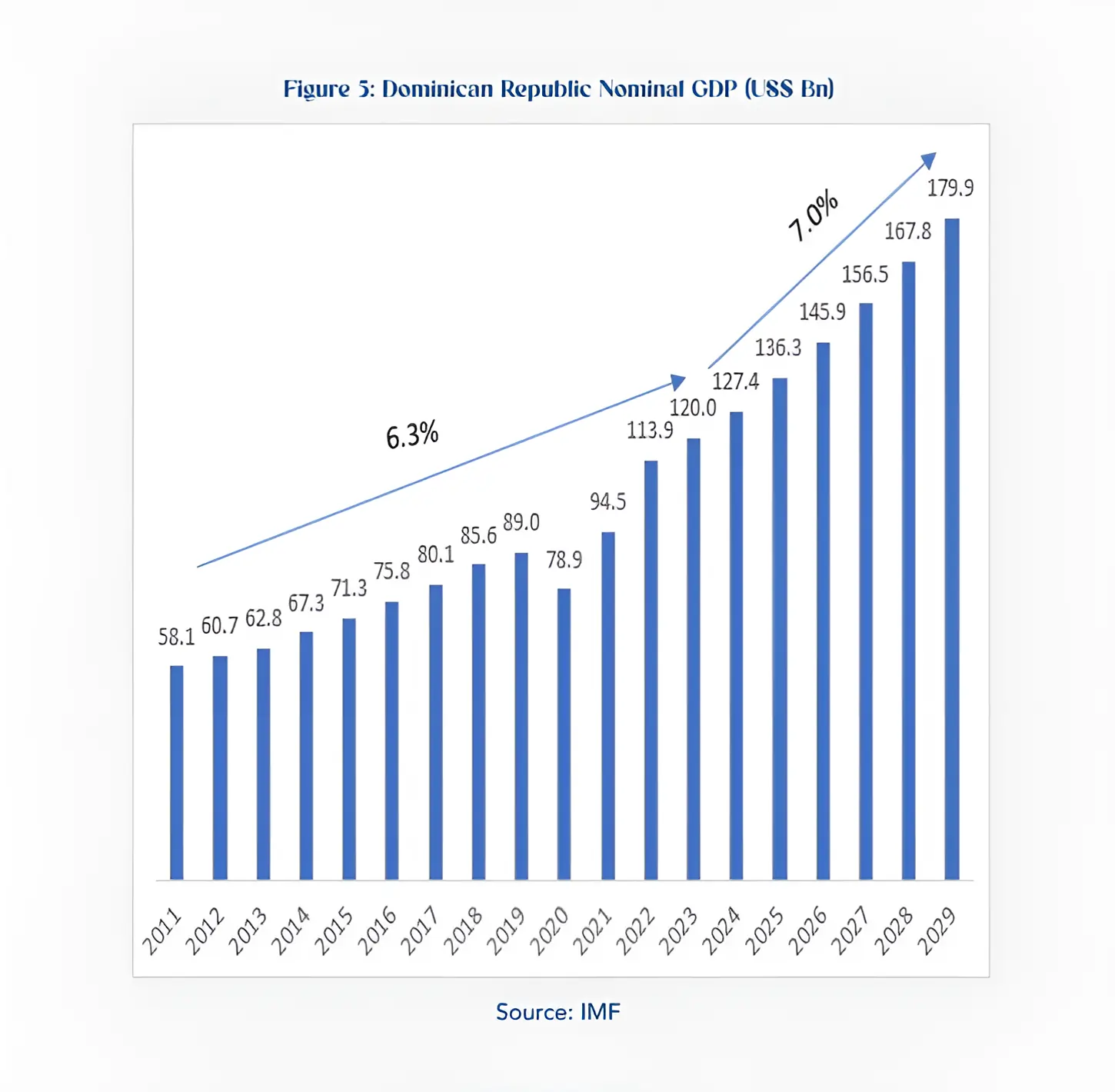

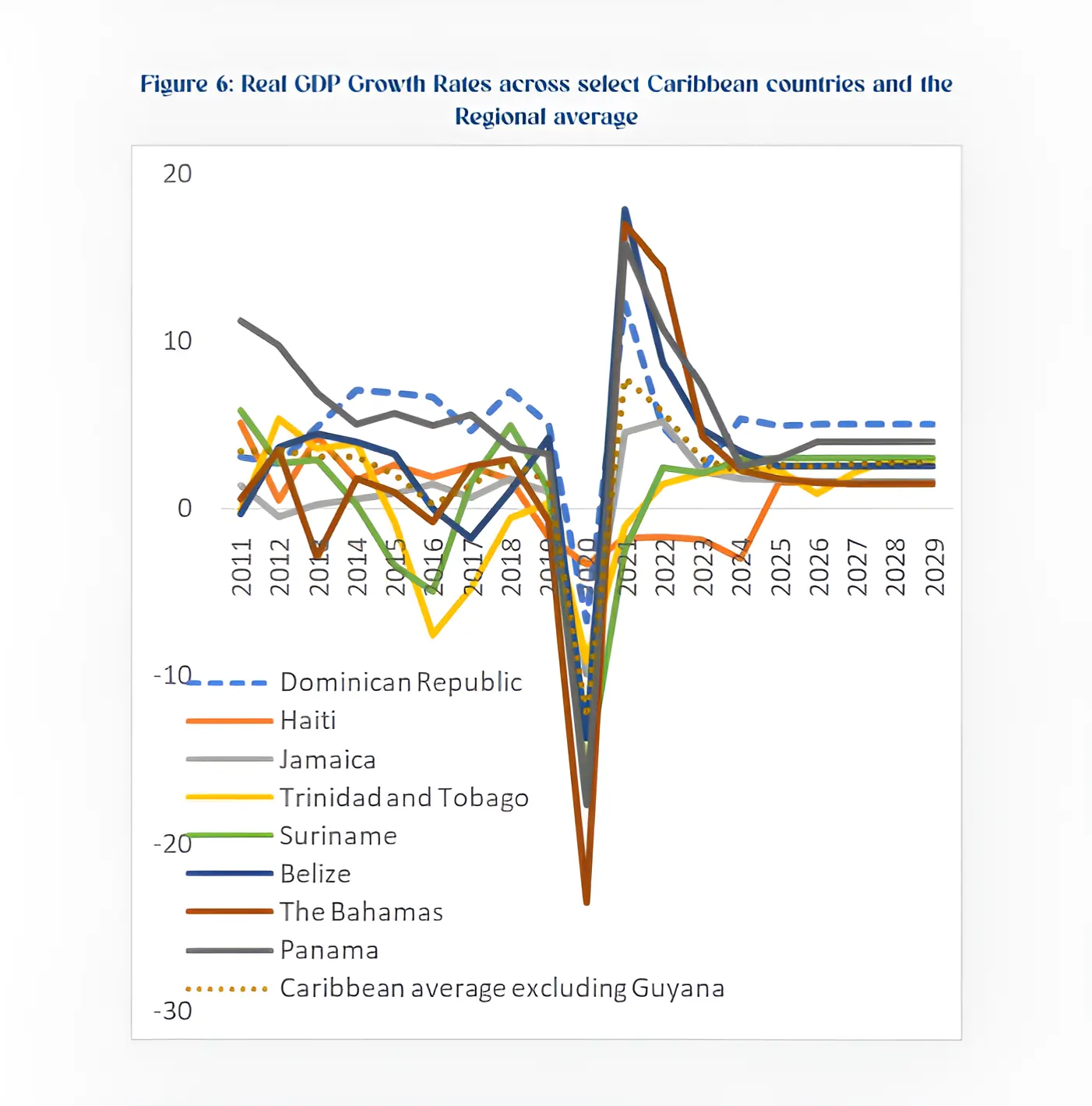

With a GDP of US$120 billion in 2023, the Dominican Republic(DR) is by far the largest economy in the Caribbean and the ninth largest in Latin America. Over the past five decades, the country has outperformed its neighbors in GDP growth, clocking 4.9% average growth per year over 1972-2002,well above the regional average of 3.2% per year. This growth has transformed the country from one of the poorest in the 1960s into a middle-income country with high living standards that reached convergence of 32% with the U.S. in 2002. A stable democracy, popular tourist destinations, and more importantly, the right policies that led to significant foreign investment have been instrumental in achieving this stupendous growth. If right policies are maintained, IMF projects the DR could become an advanced economy within the next 40 years.

Spread over 78.7 sq.km. comprising two-thirds of the island of Hispaniola, the DR is the fourth largest country in the Caribbean and the third largest in terms of population at 11.0 million, close behind Haiti (11.4 mn) and Cuba (11.3 mn). However, the DR is the largest in terms of economy owing to its stable democracy and right policies. Haiti and Cuba lag in economic growth, plagued by political unrest (Haiti) and human rights violations and state-sponsored terrorism in Cuba that has led the U.S. to impose a decades-long trade embargo.

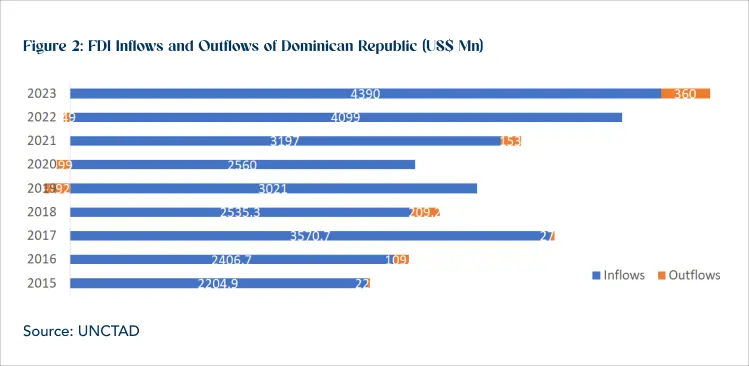

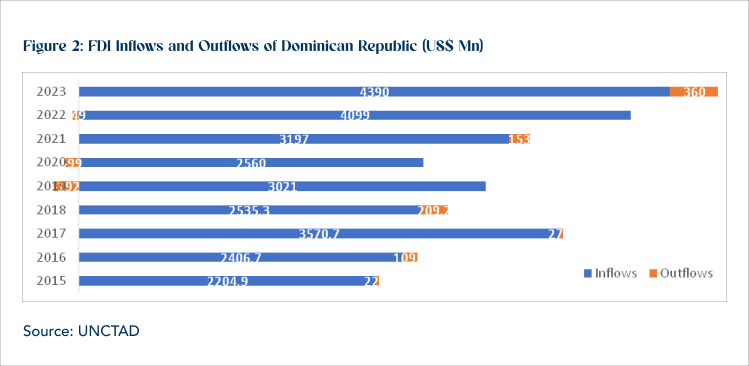

The DR witnessed strong growth of ~5.0% over the past five decades, well above the Caribbean average of 3.2%, primarily driven by right policies and structural reforms. Foundations of a new economic model were laid in the early 1990s when the government removed restrictions on foreign investment and focused on building up the country’s export sector.

As part of this, the government set up free trade zones that comprised industrial parks offering 100% tax exemption. This led to significant foreign investments initially in the textile and apparel industries. Subsequently, in 2004, the DR joined the Central America Free Trade Agreement(CAFTA), renamed DR-CAFTA (Dominican Republic–Central America–United States Free Trade Agreement) that accelerated foreign investment with the U.S. becoming the largest trading partner of the DR. The initial focus on the garment industry received a setback when China entered the World Trade Organization in the early 2000s. To deal with this, the DR shifted to other sectors such as medical devices and electronics. Currently, these two industries contribute the most to the exports, and operate more than 80 free trade zones across the country. Apart from the industrial sector, foreign investment has poured into tourism, telecommunications, real estate (hotels/other construction), mining, and financing.

Another important reform came in the early 2000s, following the banking crisis in 2003 that resulted in inflation spike, currency devaluation, and economic contraction. To deal with the situation, the country received financial aid from the IMF in exchange for tighter fiscal policy aimed at reducing government spending and borrowing. As part of this, the government cut electricity and gas subsidies for businesses and reduced its payroll.

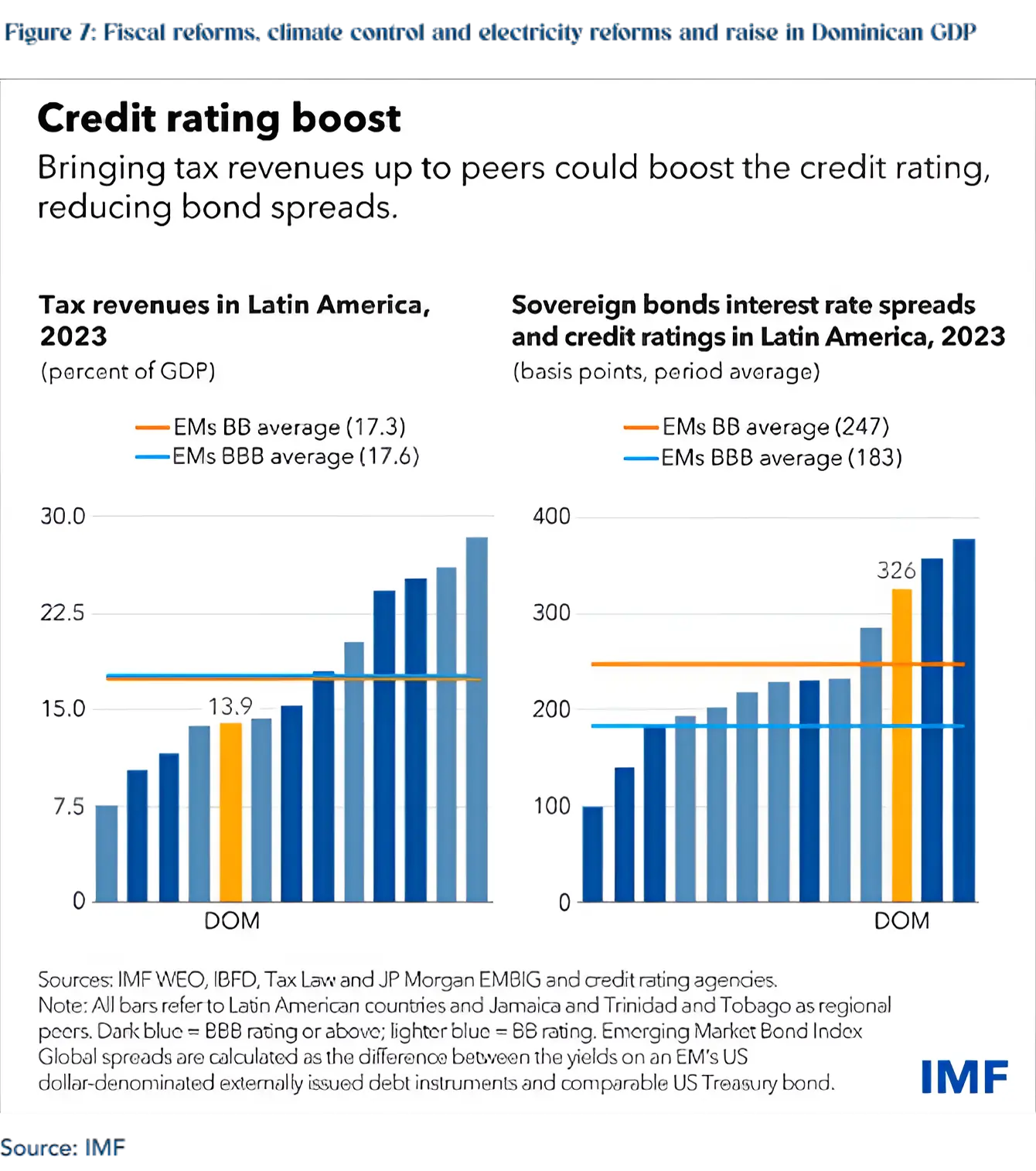

Latest reform that could significantly help in fiscal consolidation is the approval of Fiscal Responsibility Law (FRL) in August 2023. The FRL caps primary expenditure growth at 7% starting in 2025 and aims to reduce debt to 40% by 2035. The re-election of President Abinader to 2nd term in May 2024 could set the stage for the long-awaited reforms in tax overhaul, the resumption of the energy pact, and pension reforms.

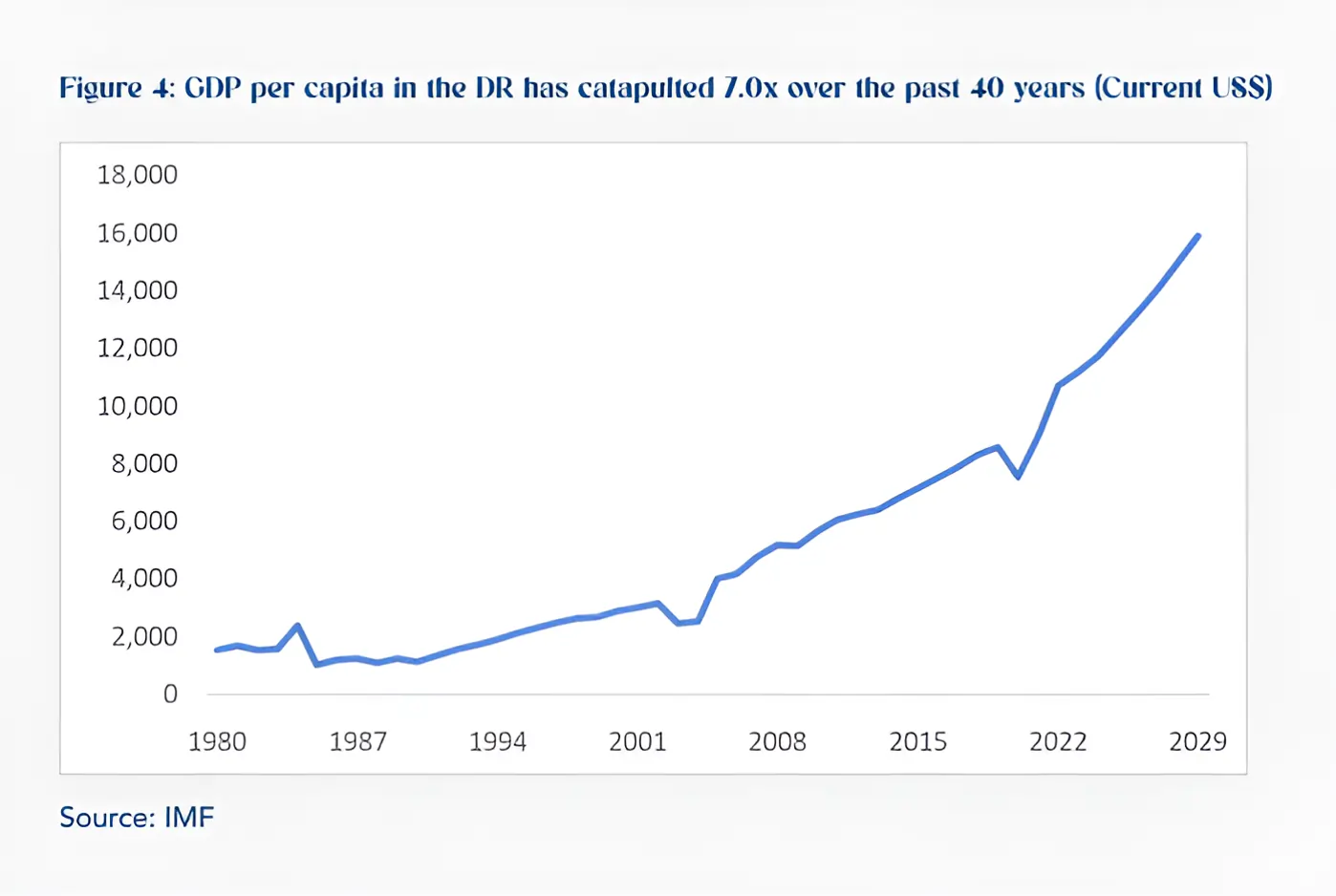

The steady and fastest growth in the DR discussed above has accelerated the country into a middle-income country, raising 2.8 million people out of poverty, with middle-class surpassing the poor. This growth has also accelerated the convergence of living standards in the DR with more developed countries such as the U.S. As per IMF, the country’s standard of living is now one-third of the U.S. with the rate of convergence at 32% in 2002, compared to the region’s average of 25%. Over the past two decades (2005-2023), GDP grew an average 5.2% while poverty more than halved, from 48.2% to 17.9%. Middle class doubled from 21% to 43% during this period and the Gini Index declined from 50 to 38. As per IMF, if the right policies are maintained, the DR could become an advanced economy in the next 40 years. The World Bank believes the DR is on track to achieve its goal of becoming a high-income (GDP per capita of US$14,005 or more) country by 2030.

GDP per capita in the DR in current US$ has catapulted 7.0x over the past 40 years, from about US$1000 in early 1980s to about US$11,000 in 2023. By 2029, the IMF projects this metric to touch nearly US$16,000.

The DR witnessed a sharp 20% jump in nominal GDP (12.7% in real GDP) in 2021, after a 11.4% slump in 2020 (6.7% in real GDP). The momentum continued into 2022, witnessing another 20% increase (4.9% in real GDP). The growth slowed down to 2.4% in 2023 on tighter monetary policy and lower investment spending by the government. With monetary easing in both the U.S. and the region, increased public investment, and a record influx of tourists, IMF forecasts real GDP growth of 5.1% in 2024, and maintains it at that level through 2029. This growth is double that of the Caribbean, estimated to grow at 2.8% (excluding Guyana) in 2024, as per ECLAC. Nominal GDP growth rates, which includes inflation, are expected to average about 7.0% over 2024-2029.

After lowering the policy rate by 150 bps in 2023, the country’s central bank reduced it by a further by 50 bps to 6.5% in September 2024. The central bank also injected $3.2 billion liquidity support into the system in 2023.

Latest data showed that the DR economy grew 5% in January – July 2024. That confirms the growth could match full year estimates of 5.1%. This growth was driven by the construction sector that grew 4.6% due to lower interest rates and liquidity support as well as service sectors, hospitality, and financial services, which surged 8.0% on strong tourist arrivals.

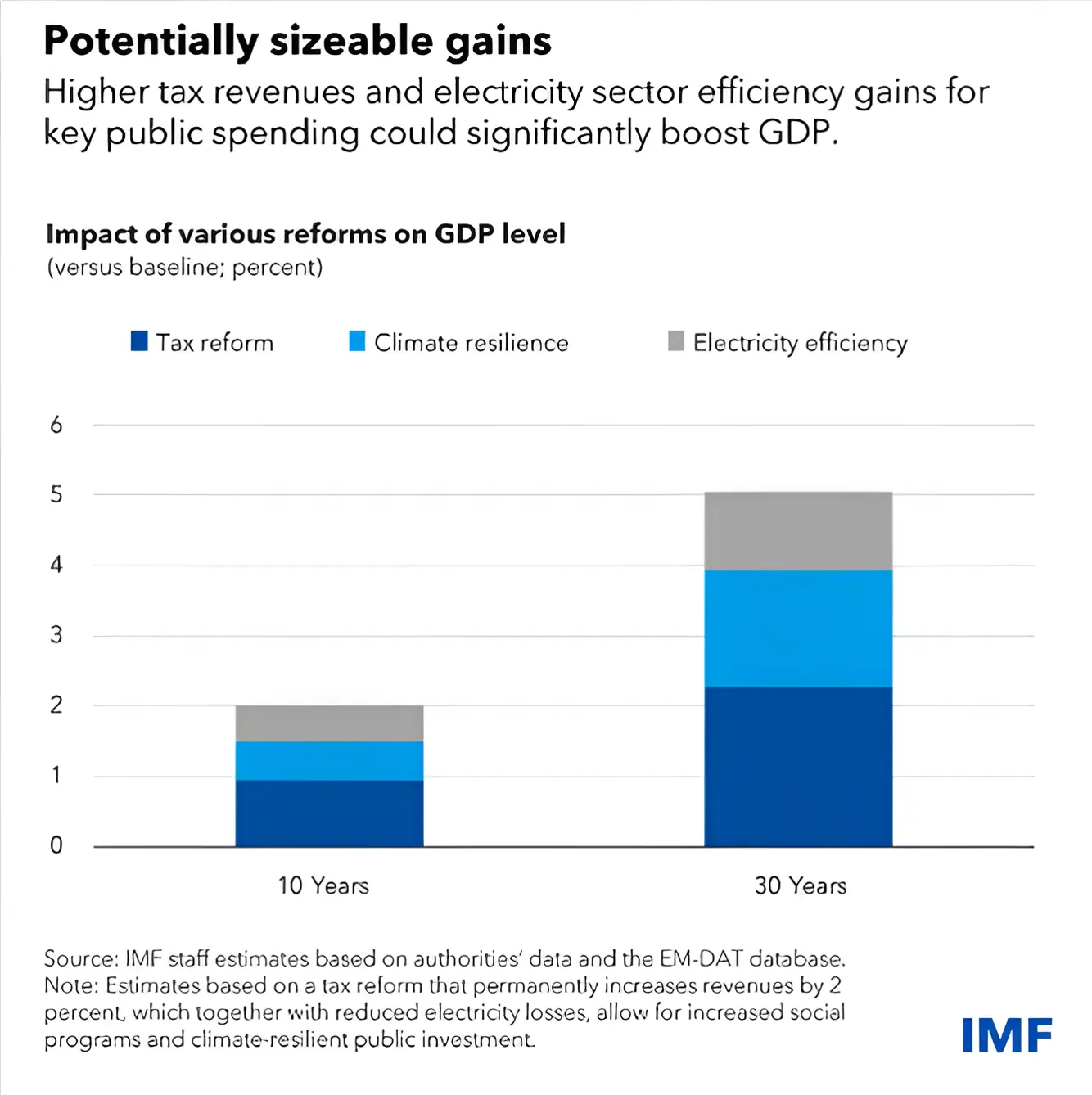

In a recent note published in June 2024, IMF highlights fiscal reform could help the DR attract greater investment and that could drive GDP by 2 percentage points. IMF notes that interest rates on public debt in the DR are high relative to peers, implying fewer resources for spending on infrastructure, social services, and making the economy more resilient to climate change. A key factor constraining the credit rating is elevated public debt relative to low tax revenues. Hence, a comprehensive tax reform that streamlines tax incentives and exemptions could help the country boost revenues and earn an investment grade rating, per the IMF. Raising tax revenues by 2% of GDP would allow for sustainable increases in key public investment and social spending. Climate shocks cause around annual average losses of 0.5% to GDP and investments to make public infrastructure more resilient to such shocks to reduce their impact by 40% could further boost GDP by around 0.5% after 10 years and by 1.75% after 30 years. Another key reform that could raise the country’s GDP is addressing the inefficiencies in the electricity sector that have resulted in high losses, averaging between 1 and 2% of GDP per year in the last decade. Cutting these losses by half could increase GDP by 0.3% after 10 years as efficiency improves.

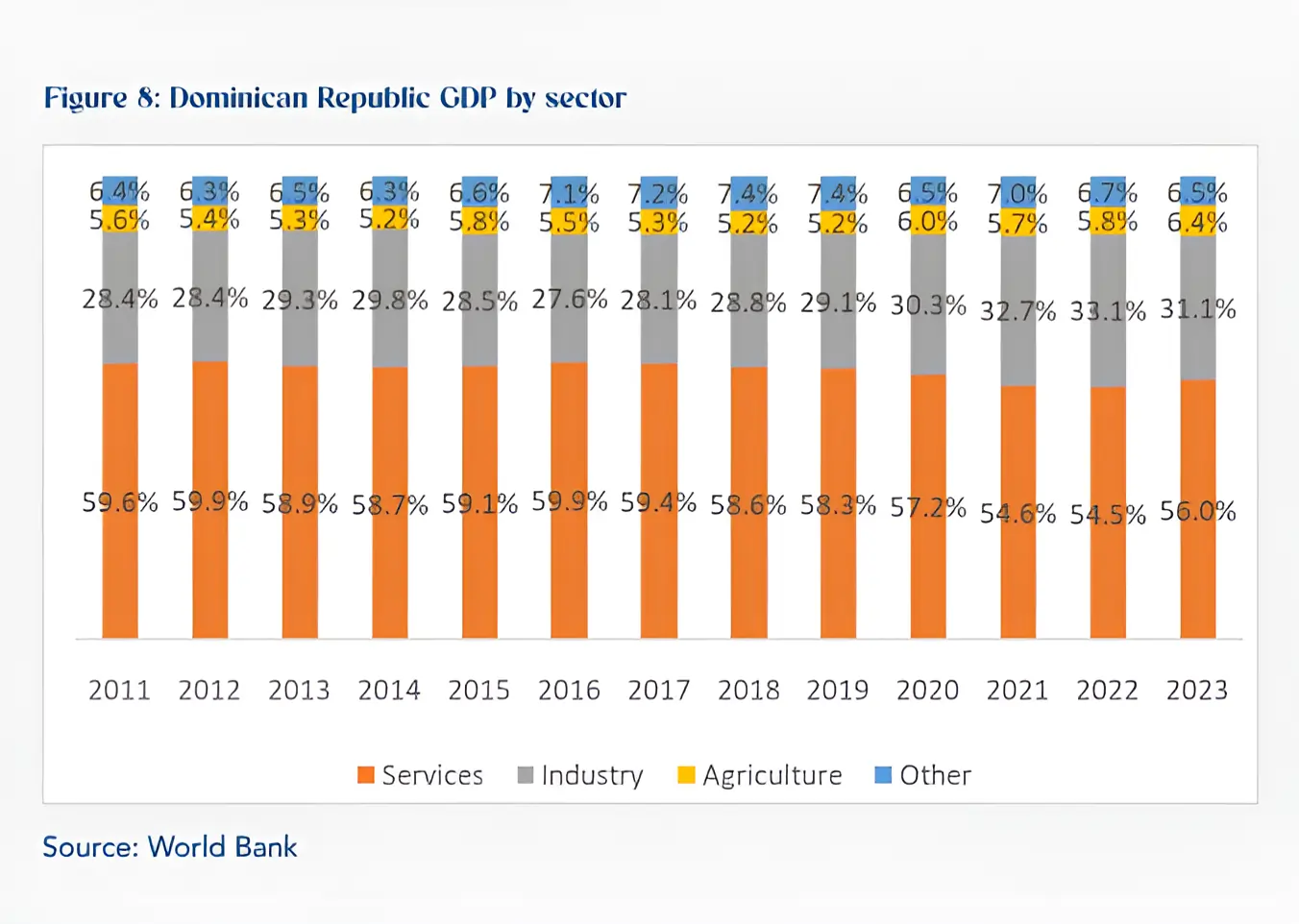

In 2023, services accounted for the largest share of 56.2% in the country’s GDP, but the trend has largely been down since 2011. Within services, tourism is the biggest contributor with revenues of $7.4 billion in 2019 or about 8% of GDP. The DR is the most popular tourist destination in the Caribbean, with more than 10 million visitors in 2023. In the first seven months (Jan-July) of 2024, tourism revenues surged 14.1% percent boosted by 5.3 million arrivals.

Industry sector’s contribution has stayed around 30% over the last several years with a slight upward bias. The industry primarily comprises mining and the manufacture of goods in free trade zones for export to the U.S., Europe, and Asia. Agriculture’s share in the country’s GDP has been gradually increasing over the past ten years, reaching 6.0% in 2020 from 5.2% in 2014. The country is a major producer of avocados (world’s fifth largest), papaya (second largest producer), and sugarcane.

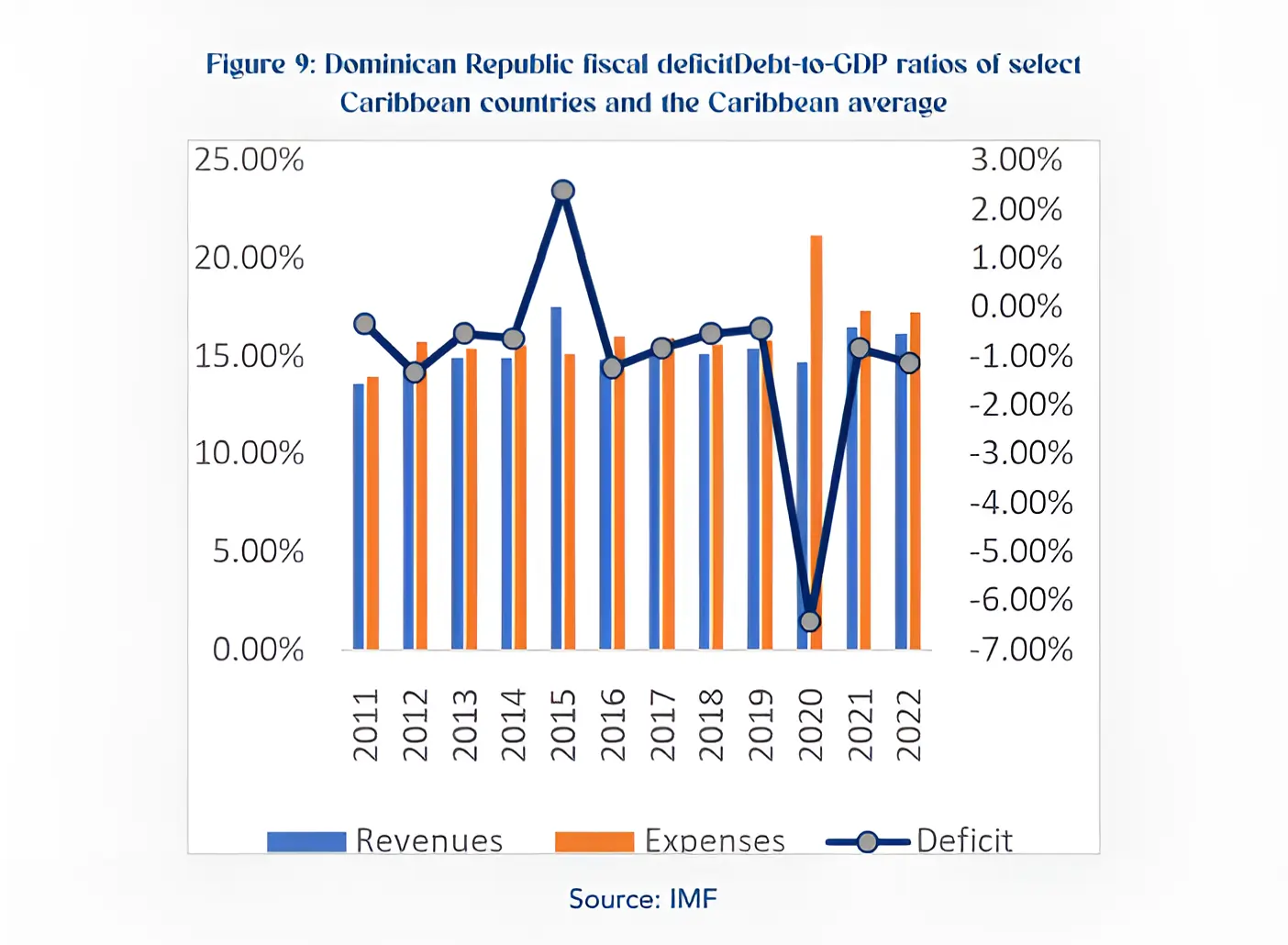

The DR has maintained a low fiscal deficit of less than 1% over the past decade, aided by prudent fiscal measures implemented in early 2000s. The exception was 2020 and 2021 when the Government spending increased significantly on COVID-related health and welfare measures. However, starting 2022 post the pandemic, tourist arrivals returned to normal, resulting in normalization of deficit. In 2023, deficit was less than 1.0%. In the first half of 2024, the fiscal deficit increased slightly to 1.1% from 0.6% in the same period of 2023.

While revenue grew 9.4% YOY, driven by improved tax administration and exceptional income from the renegotiation of airport concessions, expenditures surged 15.1% YOY, led by sharp increases in goods and services (31.6%) and interest payments (25.2%).

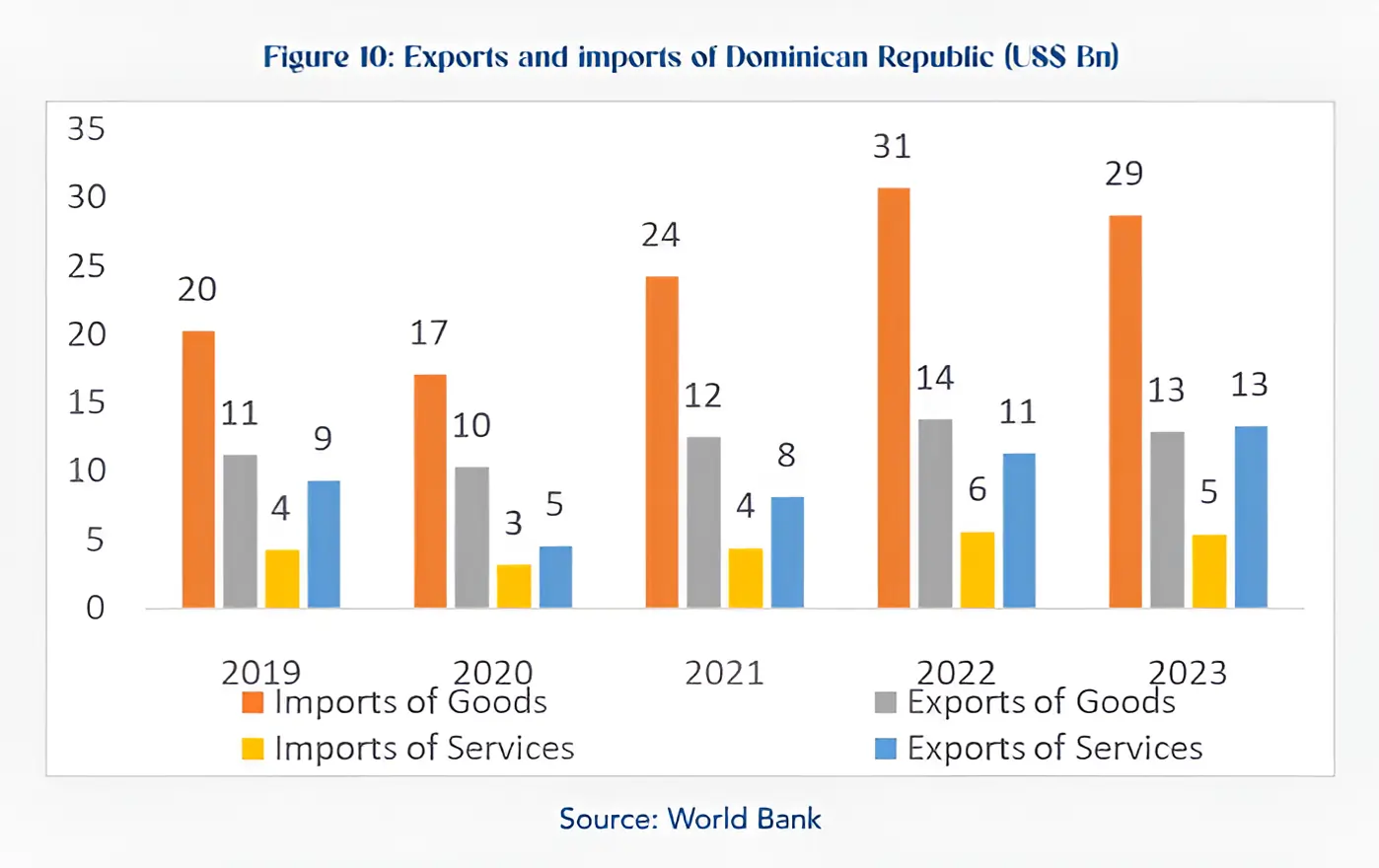

As of 2023, foreign trade represented 54% of the DR’s GDP, up from 51% in 2021. In 2023, overall trade in goods decreased 6.0% to US$41.6 billion, comprising US$28.7 billion in imports (down 6.6% over 2022) and US$12.9billion in exports (down 6.1% over 2022). Free trade zone accounted for two-thirds of total goods exports in 2023. However, overall trade in services rose 11% to US$18.7 billion in 2023, led by exports of services (+17.7%) partially offset by imports of services (-3.7%).

United States is by far the largest trading partner, accounting for 60.0% of exports and 40.7% of imports. In terms of products, medical and surgical instruments (12.7%), gold (9.8%), and cigars (8.7%) lead in exports; whereas petroleum oils (10.4%) and motor cars (4.9%) are major imports.

Analyzing region-wise, overall Latin American fiscal deficit widened to 3.1% in 2023, up from 2.2% in 2022 as revenues lost momentum on retreating tax receipts and lower commodity prices while public expenditure remained stable. The Caribbean region on the other hand reduced its fiscal deficit in 2023 as tourism returned to normal while the public spending on COVID reduced in 2023 from 2022.

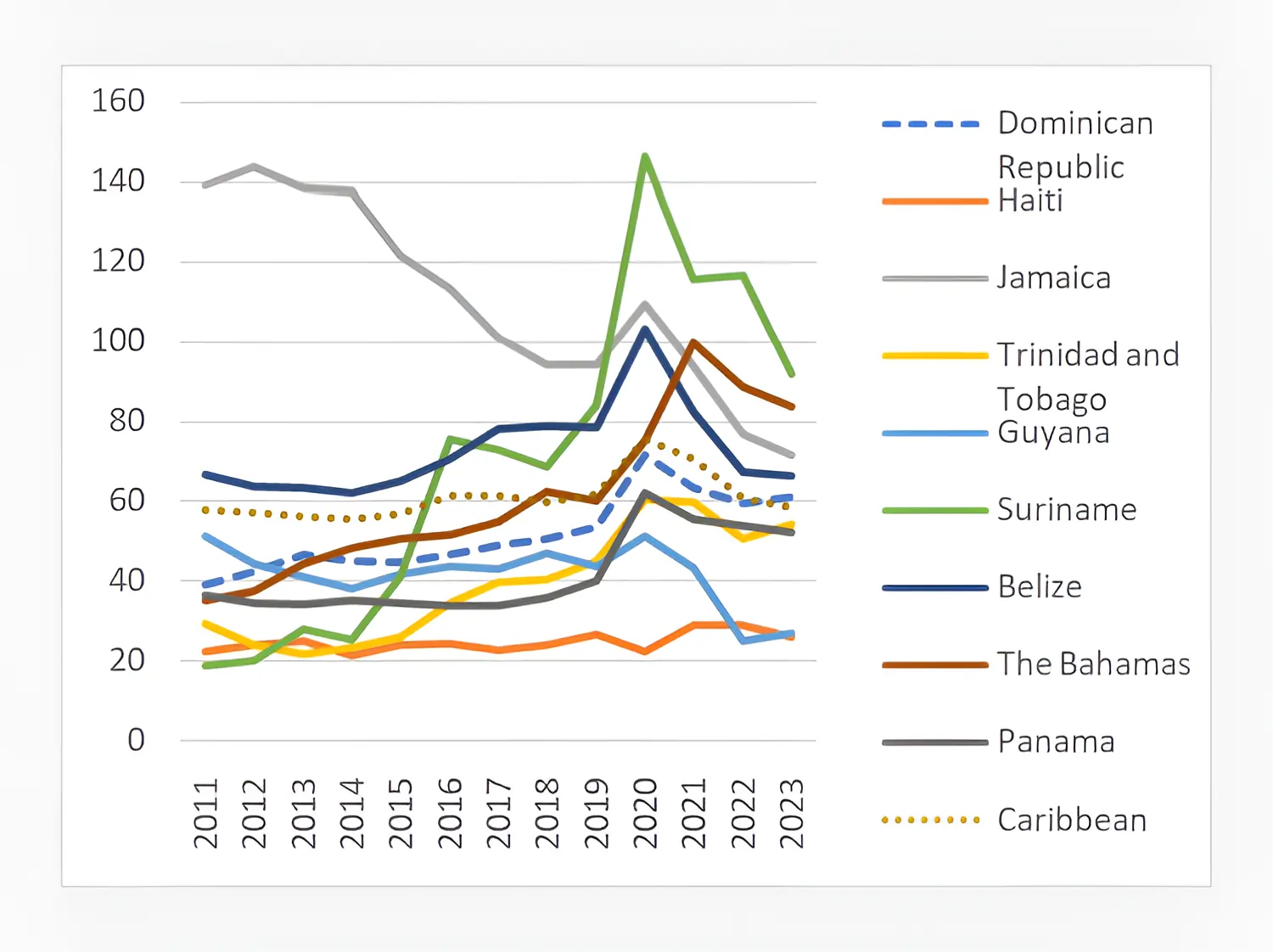

Following prudent fiscal measures of early 2000s, Debt-to-GDP ratios in the DR have stayed below the regional average as well as most neighbors. After hitting a peak of 71% in 2020 owing to the COVID-19 pandemic, it has stayed at around 60 over the past three years (2022-2024). Additionally, following the recent implementation of the Fiscal Responsibility Law, the phase-out of untargeted subsidies, and measures to improve spending efficiency, the debt-to-GDP ratio is expected to decrease progressively, falling below 57% post-2026.

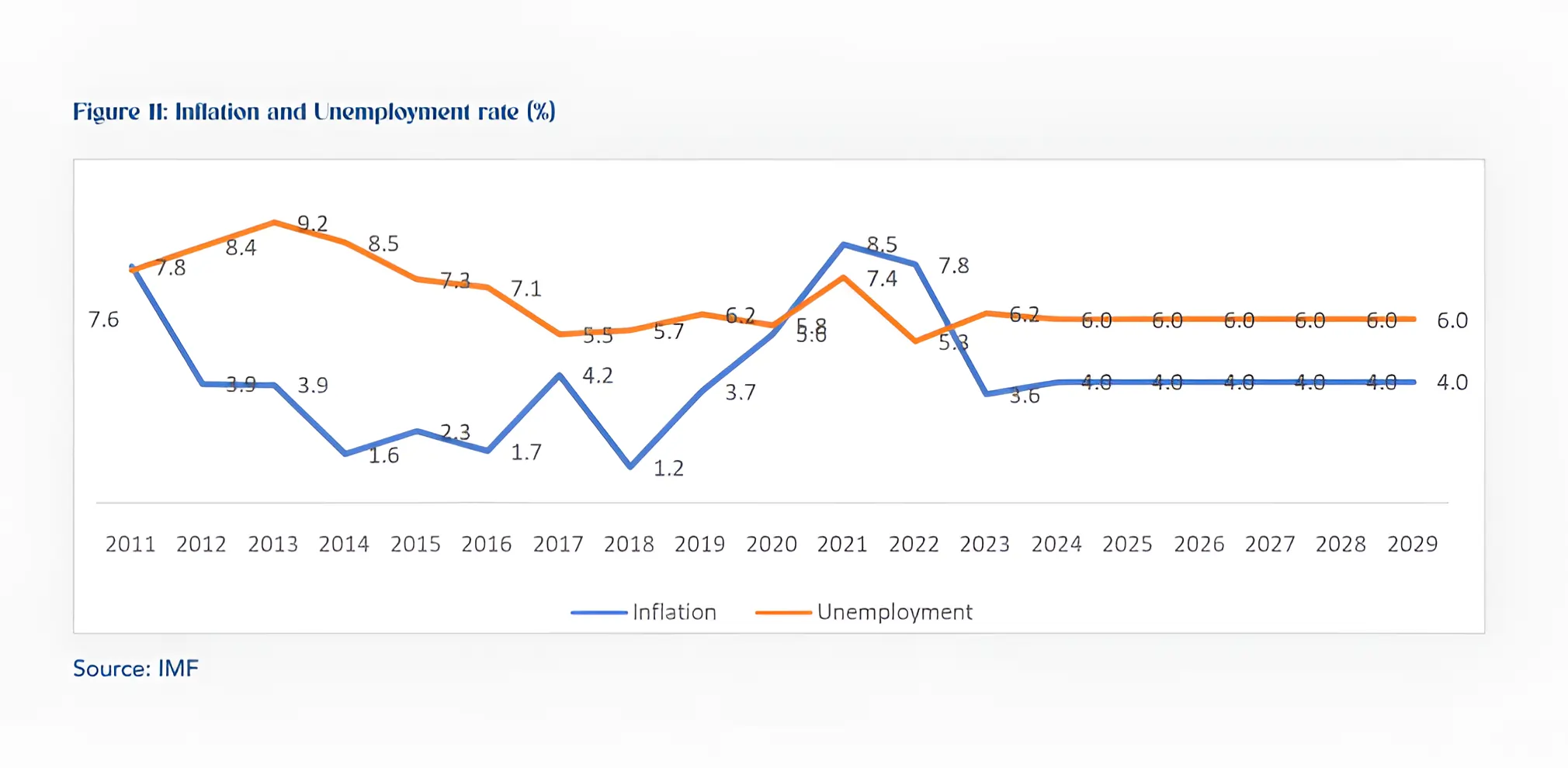

Compared to the average inflation of about 3.5% over 2011-2021, inflation spiked in the DR in 2021 and 2022 to over 8.0% following the COVID-19 pandemic and tight monetary policy in the U.S. and globally and higher commodity prices during 2022. However, it cooled down to 4.8% in 2023 on lower commodity prices, primarily crude oil. With monetary policy easing globally as well as in the DR now, IMF projects inflation in the DR to stabilize at 4.0% annually through 2029. This should bode well for real GDP growth.

Unemployment rate has averaged 6.5% over the past ten years and was estimated at 6.2% in 2023. Going forward, the unemployment rate is expected to stay steady at 6.0% through 2029.

The Dominican Republic will continue to outperform its peers in the Caribbean over the coming decade, aided by a stable democracy, booming tourism sector, and right policies. Average GDP growth rates through 2029 are expected to be at 5.0%, similar to what it had clocked over the past 5 decades. Additional reforms for streamlining taxes, climate control, and electricity could add a couple of percentage points to the GDP growth over the longer term.