Comparing DR vs. Other Caribbean Markets

May 1, 2025

The Dominican Republic (DR) offers a compelling economic proposition compared to Mexico, Costa Rica, and Panama, especially for manufacturing and export-oriented businesses. Its lower labor costs, robust free trade agreements, and stable macroeconomic environment make it an attractive destination for investment. While Mexico and Costa Rica offer strong growth potential and developed economies, the DR’s cost competitiveness and access to large markets like the US and EU through free trade agreements like CAFTA-DR and the Economic Association Agreement with the EU give it a distinct advantage.

As per BMI, a Fitch solutions company, real GDP growth in the Dominican Republic is estimated to remain stable and robust, inching up slightly from 4.60% in 2024 to 5.0% in 2025. President Luis Abinader said he is confident the Dominican Republic will achieve a long-desired investment-grade credit rating before the end of his term. The Caribbean nation has recorded average economic growth of about 5% a year for more than two decades while keeping inflation at bay and preventing sharp devaluations of its currency. That’s helped it win a series of upgrades since 2011. The country also recently finished a survey of its rare earth deposits which are in high demand globally as part of the energy transition. Its dollar bonds have returned 6% in the past year compared with an average 7.9% for a basket of 72 emerging market countries, according to data compiled by Bloomberg. Notes due in 2032 trade at about 91 cents on the dollar to yield 6.3%.

Like many emerging markets, the Dominican Republic experienced a surge in inflation following the COVID-19 pandemic, driven by

- Global supply chain disruptions

- High fuel and commodity prices

- Import-driven inflation due to supply shortages and currency pressures

- Increased domestic demand from rapid economic reopening and remittance inflows

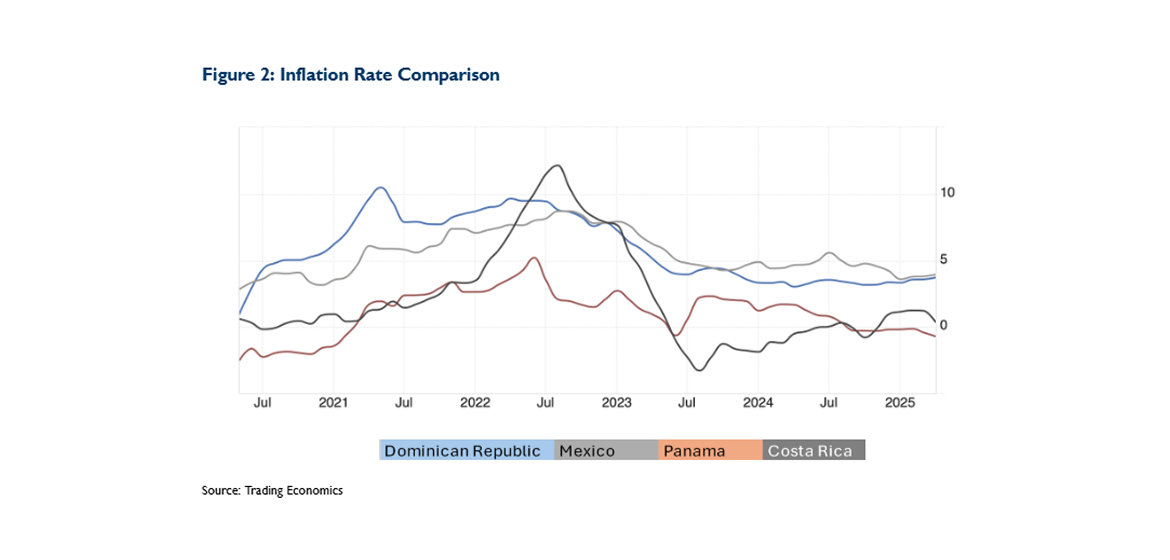

In 2022, inflation in the DR peaked at over 9%, prompting swift action from policymakers. The Central Bank of the Dominican Republic (BCRD) implemented a targeted inflation-fighting strategy. Between 2021 and 2023, the BCRD progressively raised its benchmark interest rate from 3.0% to a peak of 8.5%, signaling its inflation-fighting credibility. The bank issued central bank certificates (CDs) to soak up excess liquidity and cool down consumption. The BCRD maintained a clear target range (4.0% ± 1.0%), which helped anchor expectations. Regular inflation reports and policy bulletins helped build investor confidence and reduce volatility. By early 2025, headline inflation dropped to 3.8%, within target and among the lowest in the region.

In Dominican Republic, inflation rose to a 17-month high of 3.71% in April 2025 but remains within the central bank’s target range. Core inflation eased slightly to 4.1% (April 2025), down from 4.2% in March. Forecast to stabilize near 3.5% by 2026, supported by prudent monetary policy.

Mexico accelerated inflation to 4.419% in May 2025, exceeding the central bank’s upper target limit. Core inflation remains elevated at 3.9%, driven by services and non-tradable goods. The OECD warns of persistent inflationary pressures due to trade disruptions and fiscal challenges.

Panama is experiencing deflation (-0.7% in April 2025), the sharpest decline since 2021, driven by falling transport and housing prices. Annual average inflation dropped to 0.1%, reflecting weak domestic demand. Dollarization limits monetary policy tools, leaving fiscal measures as the primary counterweight.

In Costa Rica, inflation slowed sharply to 0.37% in April 2025, the lowest in 4 months, due to price declines in transport and communications. OECD projects a gradual rise to 1.8% in 2025 and 2.5% in 2026, nearing the 3% target. Fiscal consolidation and trade diversification efforts are expected to stabilize prices.

Mexico is still managing the tail-end of inflationary pressures due to lingering effects from global supply shocks and currency volatility. High energy and food price sensitivity, along with relatively slower policy transmission, are contributing factors. The central bank (Banxico) maintains tight monetary policy with high interest rates (11%) to combat inflation.

Inflation in Costa Rica has been more volatile due to its high dependency on imported goods and exchange rate pass-through effects. While efforts to stabilize inflation have seen partial success, persistent cost-push pressures (utilities, food) remain.

Panama stands out with the lowest inflation among the four, largely due to its dollarized economy, which imports monetary stability from the U.S. Limited domestic monetary tools mean Panama relies heavily on fiscal discipline and open market price dynamics.

The Dominican Republic is showing strong inflation management while sustaining economic growth, making it attractive for medium- to long-term investors. Panama remains the most inflation-stable, thanks to dollarization. Meanwhile, Mexico and Costa Rica, though larger and developed in certain sectors, are still navigating inflationary headwinds.

A graphical comparison of monetary policy in 2025 for the Dominican Republic, Mexico and Costa Rica, highlights key differences in their central bank interest rates and approaches. In Dominican Republic, the central bank has held its policy interest rate steady at 5.75% throughout early 2025, after a series of cuts in 2024. This reflects confidence in stable inflation (within the 3–5% target range) and robust economic growth, with the bank adopting a wait-and-see approach amid global uncertainty. In Mexico, the central bank has been actively cutting rates, with the policy rate reduced to 8.50% in May 2025, marking the third consecutive 50 basis-point cut. This easing is in response to weak economic activity and inflation within the 2–4% target range, with further cuts expected as growth risks persist. Costa Rica has kept its policy at 4.00% since October 2024. While inflation remains below target, the bank is cautious due to global trade uncertainties and expects only minor adjustments by the end of 2025. Panama as a dollarized economy does not set its own monetary policy rate. Instead, its financial conditions are determined by U.S. Federal Reserve policy and market forces.

The Dominican Republic, Mexico, Panama, and Costa Rica exhibit distinct foreign direct investment (FDI) trends in 2025, shaped by sectoral priorities, policy frameworks, and macroeconomic conditions.

The Dominican Republic presents one of the most attractive FDI environments the Americas have to offer. A key driver of the Dominican Republic’s economic growth has been FDI in the country’s 87 free zones (FZs) that underpin advanced manufactured goods production—notably of electronics products and medical devices/instruments—for export to regional (though principally North American) markets.

In the decade from 2013 to 2022, the Dominican Republic attracted a total of $27.7 billion in inbound FDI, with annual investment levels more than doubling from $1.9 billion in 2013 to $4.01 billion in 2022. Just under 20 percent of the inbound investment goes toward industry/manufacturing (tourism and energy being the Dominican Republic’s other leading FDI sectors). In 2024, the Foreign Direct Investment (FDI) reached $4,512 billion, setting a record and reaffirming the country as a strategic destination for real estate development. FDI is highly diversified, with tourism, renewables, and real estate leading, and strong support for manufacturing via free zones.

Foreign direct investment (FDI) in Mexico hit a new record high of $21.4 billion in the first quarter of 2025. “Plan Mexico” offers tax breaks for semiconductors and advanced manufacturing but growth is hindered by political and trade risks. The success of the initiative will depend on the country’s ability to capitalize on nearshoring opportunities, while ensuring that its domestic industrial base is strengthened to meet both local and international demand. While the plan’s strategic vision is comprehensive, external factors may influence its implementation timeline and outcomes. As seen in other jurisdictions and in previous infrastructure plans developed by Mexico, a multi-layered financing approach will be critical to advancing the plan combining multilateral and development bank funding, commercial lending, and capital markets to support large-scale investments.

Costa Rica stands out in the Caribbean and Central American region for its strong commitment to sustainability and its rapidly growing technology sector. However, the scale of investment opportunities tends to be more modest compared to larger economies like the Dominican Republic or Mexico. The market size is limited by the country’s population and geography, and many investments, especially in agriculture and tourism, are tailored to small and medium enterprises or niche ventures. Costa Rica’s model is less about mass-market appeal and more about long-term resilience, environmental leadership, and high-value, sustainable business. The country’s approach is attractive to investors seeking alignment with ESG (Environmental, Social, and Governance) principles and those targeting specialized sectors rather than large-scale industrial or commercial projects.

If we compare tourism, DR is the undisputed tourism capital of the Caribbean in 2025, offering scalable returns in hotel, villa, and mixed-use real estate assets. Costa Rica focuses on eco-tourism but lacks DR’s infrastructure scale. Mexico’s tourist zones face saturation and higher operating costs. Panama’s tourism is primarily business oriented.

The Dominican Republic’s 5.0% growth trajectory, controlled inflation, and pro-business reforms position it as the Caribbean’s top investment hub in 2025. While Mexico struggles with stagnation, and Panama/Costa Rica face scalability limits, the DR offers balanced risk-reward dynamics across high-growth sectors like tourism, manufacturing, and renewables. Investors prioritizing macroeconomic stability and sectoral diversification will find the DR’s environment uniquely advantageous.