The Impact of New Airports & Infrastructure in the Dominican Republic

September 15, 2025

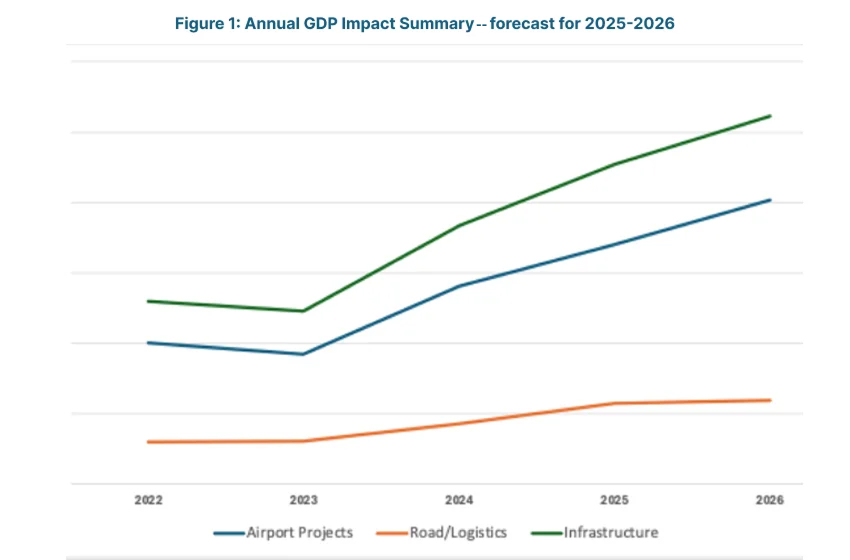

The Dominican Republic (DR), due to its outstanding aviation growth and dynamic interaction with the States and the region, serves as a model to the Small Island Developing States (SIDS). Other SIDS share many of the same characteristics as the DR, such as the reliance on tourism and air transport as the primary means of transportation. Over the past years, the island has emerged as one of the safest and most reliable countries to fly to, owing to several reforms in the aviation sector that brought the nation’s air transport into compliance with the ICAO SARPs. These reforms, coupled with other policies to foster tourism on the island, increased the number of passengers who fly to the Dominican Republic, thus positively impacting island’s economy. As of 2025, the Dominican Republic’s targeted investments in airport development and infrastructure modernization have become central to its economic growth strategy. With an expanding tourism base, growing exports, and a maturing logistics sector, these infrastructure enhancements are delivering strong returns across employment, investment, and regional integration.

Key projects that have contributed to the growth are Pedernales Cabo Rojo Airport (under construction), La Romana & Barahona Airport Expansions, Santiago Airport Modernization (Cibao International – STI), and Punta Cana International Airport (PUJ) – Regional Leader. Broader infrastructure developments such as transport corridors are port modernization and digital infrastructure have also contributed majorly to the economic growth.

Designed to be the gateway to the Cabo Rojo–Pedernales Tourism Development Zone, Pedernales Cabo Rojo Airport is a flagship public-private initiative to transform the southwestern region. It is aimed at decentralizing tourism away from the saturated Punta Cana region and bringing economic growth to one of the country’s least-developed areas. It will accommodate medium- and long-haul international flights.

It is located within the Pedernales Special Economic Zone to facilitate foreign investment. Envisioned as an anchor for a new tourism corridor featuring 12,000 hotel rooms, ecotourism, and beachfront resorts by 2030. It is expected to serve 1+ million tourists annually by 2030. It will aid in job creation and local development (construction, hospitality, and services) and promotes more inclusive regional development and access to untouched natural areas like Bahia de las Aguilas.

La Romana & Barahona Airport Expansions is aimed to support cruise tourism (La Romana is a cruise port) and high-end resorts in Casa de Campo and Bayahibe. A key node for private jet traffic and European charters, especially Italian and Spanish tourists. It is aimed to boost regional tourism and luxury travel market and enhance connectivity between Santo Domingo and eastern resort areas.

Maria Montez International Airport is the closest airport to the southwestern development zone (Pedernales)—complementing Cabo Rojo airport. Currently underutilized, but vital for regional equity and access. This will help decentralize tourism, promote agriculture, mining, and export activity in the region, and could serve as an overflow airport and logistics backup for Pedernales region.

Santiago Airport Modernization (Cibao International – STI) serves the Cibao Valley, the most densely populated part of the country outside Santo Domingo. Critical for Dominican diaspora travel, especially from the U.S. (New York, New Jersey, Miami). Key node for business travel and cargo, supporting local agriculture and manufacturing exports. This has enhanced capacity (up to 4 million+ passengers per year) improved diaspora connectivity and regional competitiveness, and is a significant economic stimulus for northern cities like Santiago, Moca, and San Francisco de Macoris.

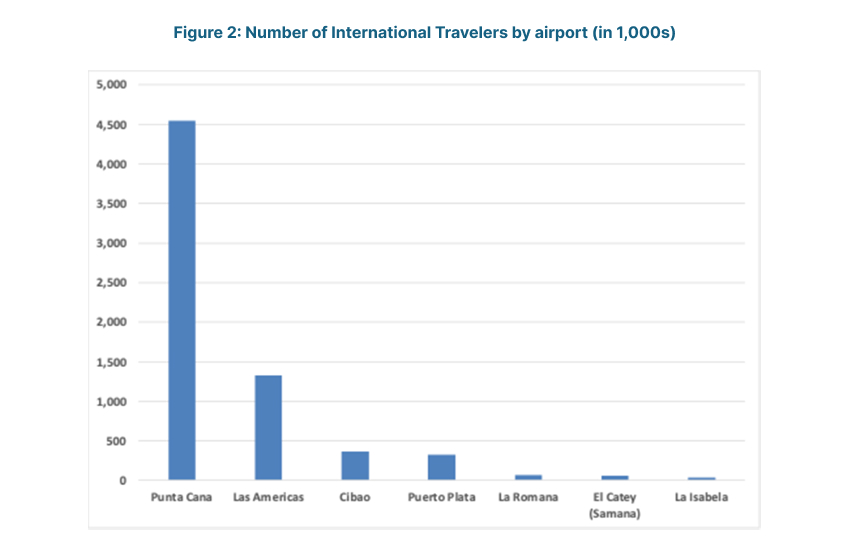

The development of Punta Cana International Airport is a wonderful story of how a little private airport has grown to create a community and a major tourism industry in the Dominican Republic. Through an aggressive marketing campaign and regular meetings with major tour operators, airlines, local business developers, and the Dominican government agencies, Punta Cana has developed from a virtually unknown tourism location to one of the most dynamic and sought after major tourism destinations in the Caribbean and Latin America.

The expansion of Punta Cana International Airport (PUJ) has been a catalyst for sustained economic growth in the region, supporting both direct and indirect employment and contributing an estimated nine percent to the Dominican Republic’s total annual GDP. The airport now handles over 5 million passengers annually, a dramatic increase from its early years, and is recognized as one of the most connected airports in Latin America, with flights from Europe, South America, and the United States. Investments in new terminals, a runway, and an air traffic control tower have modernized the airport, increasing its capacity and efficiency to match growing tourism demand.

The surge in passenger arrivals has directly fueled the growth of the tourism sector. The number of hotel rooms in Punta Cana soared from 4,000–5,000 before the airport’s opening to over 55,000 today, supporting around 800,000 jobs (direct and indirect). In 2015 alone, the expenditure of 3.2 million tourists arriving at PUJ supported over US $2.6 billion in gross value added (GVA) and sustained 188,000 jobs, representing 4.9% of the Dominican Republic’s economy-wide GVA and 4.6% of total employment.

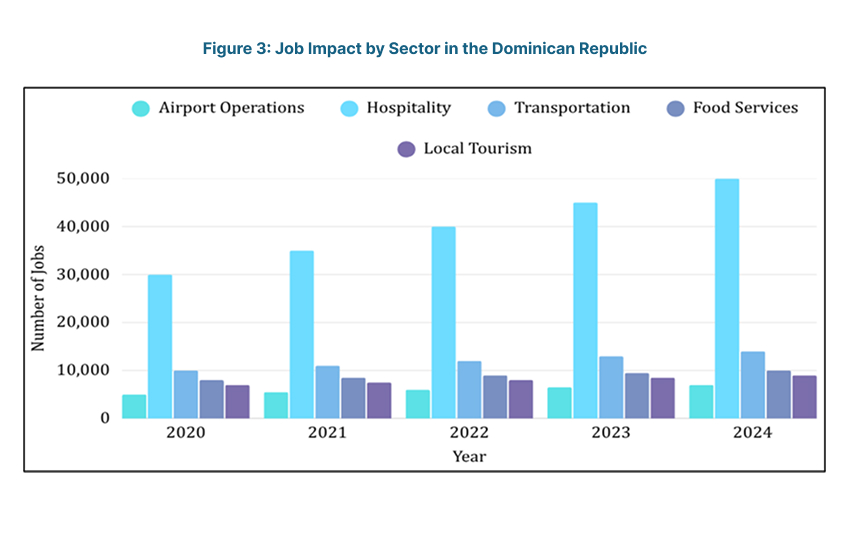

Direct employment includes jobs within the airports themselves, such as those in airport operations, airline services, ground handling, and retail concessions. Punta Cana International Airport, which handles most of the country’s tourist arrivals, supports tens of thousands of direct jobs due to its scale and the volume of international traffic it manages. By 2025, it is estimated that PUJ alone will support over 91,000 jobs, reflecting its central role in the tourism economy. Las Americas and Santiago airports, while smaller in scale, also contribute significantly to direct employment, particularly in the capital and northern regions. Beyond the airport grounds, the indirect employment impact is even more substantial. Jobs in hospitality, transportation, food services, and local tourism enterprises are all supported by the influx of visitors arriving through these airports. The World Travel & Tourism Council (WTTC) estimates that for every direct tourism job, up to two additional jobs are created indirectly. This multiplier effect means that even smaller airports like STI, which supports around 13,000 jobs by 2025, play a vital role in sustaining regional economies and livelihoods. Finally, the resilience of the Dominican Republic’s tourism sector post-COVID has been closely tied to the performance of these airports. The country was among the first in the Caribbean to recover, thanks in part to its robust airport infrastructure and proactive tourism policies. Employment in tourism-related sectors has rebounded strongly since 2021, with projections indicating continued growth through 2025, driven largely by air travel.

Airport expansion and infrastructure development have been pivotal in transforming the Dominican Republic into a premier tourism and investment destination in the Caribbean. These infrastructure upgrades have significantly boosted Foreign Direct Investment (FDI), particularly in tourism, real estate, and related sectors. Improved airport infrastructure has made the Dominican Republic more attractive to foreign investors, facilitating the flow of executives, business delegations, and capital into tourism and hospitality projects. Total FDI inflows of $4.01 billion is the highest in Dominican Republic history, with 25% (US$1.01 billion) directed to tourism. The diversification and entry of new projects, as well as the expansion of existing ones, have contributed to the sector’s growth.

Modern airports and highways signal stability and growth potential, encouraging foreign investors to commit capital to large-scale tourism, real estate, and logistics projects. The surge in tourist arrivals directly increases demand for hotels, resorts, and vacation rentals, prompting new FDI in property development and hospitality. In 2022, the Dominican Republic captured 76% of all FDI flows to the Caribbean, reflecting its dominance as the region’s top investment destination, largely due to its infrastructure upgrades. FDI is increasingly diversified, with significant flows to energy, commerce, and real estate, all benefiting from improved infrastructure and connectivity.

FDI in the tourism sector accounted for 21.35% of all accumulated FDI flows from 2010 to 2020, averaging US$2.539 billion per year. Between 2016 and 2020, more than 26 greenfield tourism projects brought nearly US$5.7 billion in capital investment, second only to Mexico in the region. The expansion of airport infrastructure has made the surrounding areas prime locations for new hotels, resorts, and residential complexes, directly boosting real estate investment.

New infrastructure is helping less developed regions (southwest and north-central zones) integrate with national and international markets. This supports regional equity, reducing pressure on saturated hubs like Santo Domingo and Punta Cana.

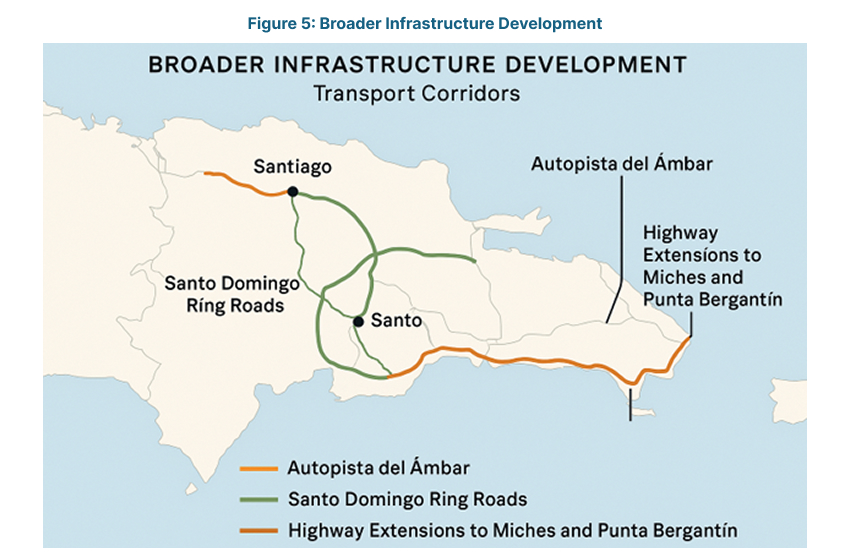

Autopista del ambar is a major new highway that will link Santiago (the second–largest city) with Puerto Plata on the northern coast. It is expected to reduce travel time from ~1.5 hours to under 30 minutes. This will unlock tourism and trade potential in Puerto Plata by streamlining access for domestic and international travelers. It also enables logistics efficiencies for goods moving from Cibao Valley (agriculture and manufacturing hub) to ports. It supports the northern tourism circuit by connecting with other key projects like the Cibao Airport modernization and cruise terminals.

Santo Domingo Ring Roads (Circunvalaciones) is a network of bypass highways (e.g., Circunvalación de Santo Domingo, Circunvalación de Los Alcarrizos) encircling the capital. It is designed to divert freight and through–traffic away from the congested urban core. This reduces urban congestion and emissions in Santo Domingo, cuts freight transit times for goods moving from ports like Haina and Caucedo to the rest of the country, enhances last-mile connectivity for logistics firms, improving reliability for import/export operations, and also stimulates industrial growth in peri-urban areas (logistics parks, free zones).

Highway Extensions to Miches & Punta Bergantín — Miches (east) and Punta Bergantín (north coast) are emerging luxury tourism hubs. New and improved highway links are being built to connect these destinations to major airports (e.g., Punta Cana, Puerto Plata) and national highways.

New infrastructure is helping less developed regions (southwest and north-central zones) integrate with national and international markets. This supports regional equity, reducing pressure on saturated hubs like Santo Domingo and Punta Cana.

Autopista del Ambar, A major new highway that will link Santiago (the second-largest city) with Puerto Plata on the northern coast. Expected to reduce travel time from ~1.5 hours to under 30 minutes. This will unlock tourism and trade potential in Puerto Plata by streamlining access for domestic and international travelers. It also enables logistics efficiencies for goods moving from Cibao Valley (agriculture and manufacturing hub) to ports. Supports the northern tourism circuit by connecting with other key projects like the Cibao Airport modernization and cruise terminals.

Santo Domingo Ring Roads (Circunvalaciones), a network of bypass highways (e.g., Circunvalación de Santo Domingo, Circunvalación de Los Alcarrizos) encircling the capital. It is designed to divert freight and through-traffic away from the congested urban core. This reduces urban congestion and emissions in Santo Domingo. Cuts freight transit times for goods moving from ports like Haina and Caucedo to the rest of the country. Enhances last-mile connectivity for logistics firms, improving reliability for import/export operations. It also Stimulates industrial growth in peri-urban areas (logistics parks, free zones).

Highway Extensions to Miches & Punta Bergantín – Miches (east) and Punta Bergantín (north coast) are emerging luxury tourism hubs. New and improved highway links are being built to connect these destinations to major airports (e.g., Punta Cana, Puerto Plata) and national highways.

The expansion of airports and development of modern infrastructure have been central to the Dominican Republic’s tourism boom and its record FDI inflows. These projects have improved accessibility, increased investor confidence, and positioned the country as a leader in tourism-driven investment and economic diversification in the Caribbean.