Private Equity’s Playbook: Capitalizing on U.S. Sports Franchise Investments

February 3, 2025

Private equity (PE) has accelerated its involvement in North American sports over the past five years. Following structural changes in league regulations, financial investors are now able to participate in team ownership in a regulated and scaled fashion. This report presents a comprehensive update on the current investment landscape across U.S. sports franchises, with league-specific regulatory detail, asset performance trends, and future investment pathways, underlining how investors can capitalize on this evolving asset class.

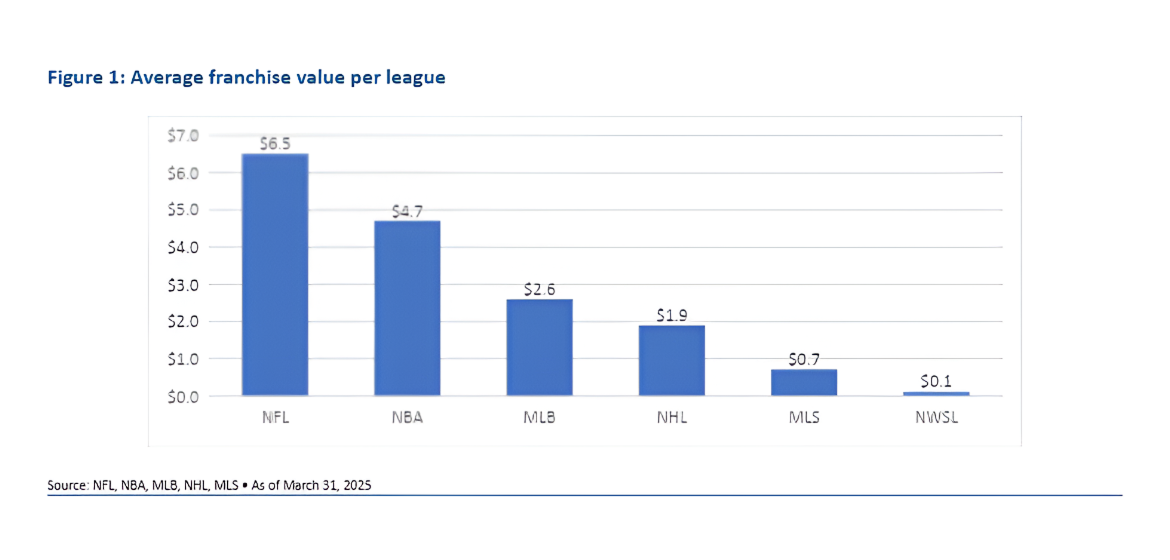

Franchise valuations across major leagues have soared. With average franchise valuations ranging from $6.5 billion in the NFL to $0.1 billion in the NWSL as of March 31, 2025, the market has matured into a distinct asset class with stable cash flow and non-cyclical appeal. The rise in valuations has closely tracked the increase in broadcast rights and media revenue, which continue to outpace broader market expectations.

From 2014 to 2024, average team valuations have increased over 2000% in the NBA, 1200% in the NFL, and more than 1000% in some cases. Even relatively newer leagues such as the MLS and NWSL are seeing consistent appreciation, fueled by growing media rights and investor interest. This outsized appreciation—compared to 687% growth in the S&P 500—reflects growing media rights deals, global fandom, and scarcity of franchises available for acquisition. The stability of revenues and scarcity of assets support a favorable risk-return profile, despite limited liquidity.

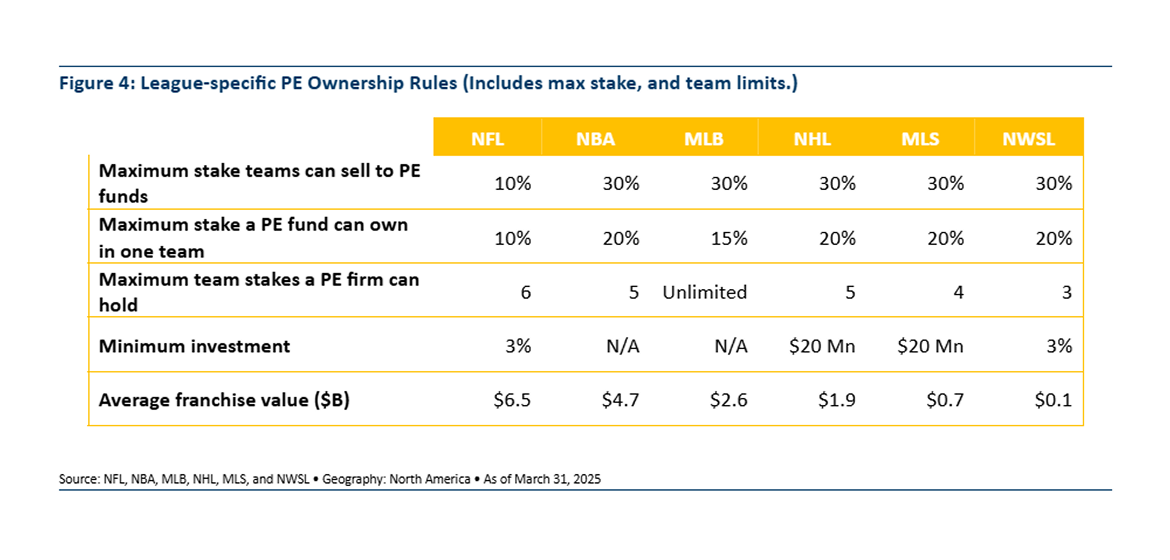

Historically, ownership rules in leagues such as the NFL and MLB discouraged institutional capital. However, regulatory liberalization has transformed the landscape. Since 2019, the NBA and MLB have allowed institutional investors to acquire passive interests in franchises. By 2023, over 20 institutional investors had taken stakes across teams, leveraging league-level vehicles and SPVs.

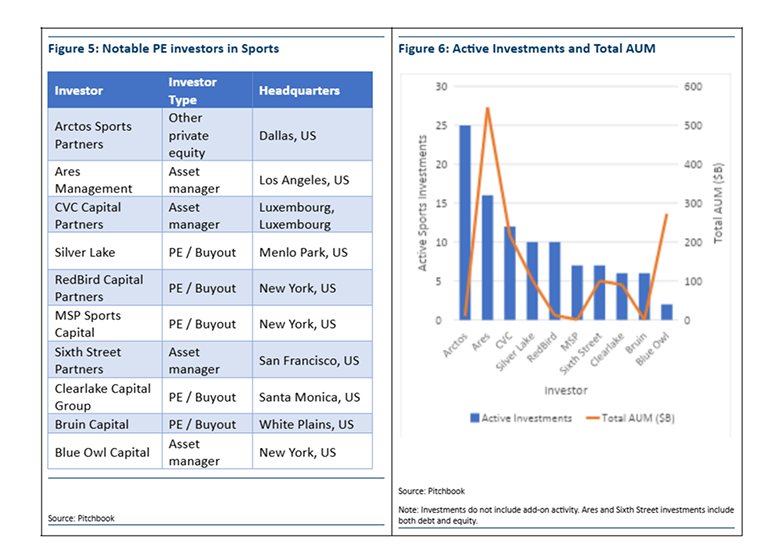

Private equity’s sports footprint is rapidly diversifying. From single-team stakes to multi-team holdings and investments in ancillary assets (e.g., stadiums, esports teams, IP rights), the capital deployment strategies have grown more sophisticated. Notable transactions include Arctos Sports Partners’ holdings in over a dozen franchises, and Dyal HomeCourt Partners’ investment in the NBA.

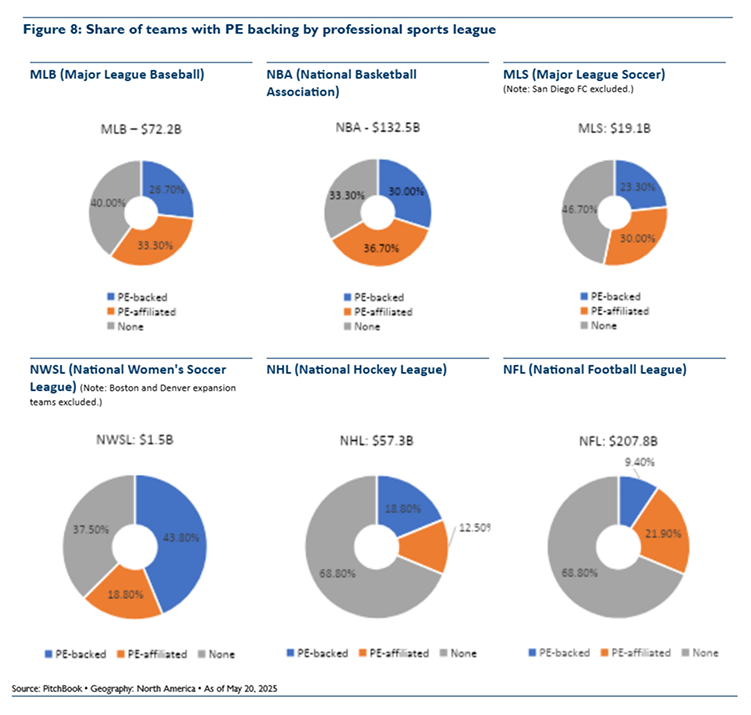

The growing popularity of women’s sports presents new investment opportunities. PE investments are aiding in the expansion and professionalization of leagues. NWSL alone attracted nearly $400 million in capital over the past year. This interest is underpinned by rising attendance, viewership, and favorable entry valuations.

NBA exhibits the most openness to institutional capital, with a significant portion of teams involving PE-backed groups. Its global reach and younger demographic appeal position it for international expansion. While NFL, is more restrictive, the league’s limited number of franchises creates a scarcity premium. High-profile sales, such as the Denver Broncos, have set new valuation benchmarks. MLB & NHL are witnessing growing PE involvement, with long-term returns linked to localized fan bases and infrastructure investments.

Valuation-to-revenue multiples vary by league, influenced by media rights, gate receipts, and merchandise sales. The NBA currently trades at ~10x revenue, while the MLB is at ~5x.

A key driver of franchise valuation growth is the substantial increase in media and broadcasting rights revenues. Between 2014 and 2024, national media rights revenues in leagues such as the NFL and NBA have doubled, propelled by the enduring appeal of live sports content in the streaming era. Leagues are exploring direct-to-consumer platforms and regional sports networks (RSNs) to further monetize content.

Private equity firms have yet to significantly penetrate media rights in North American sports, unlike in European football, despite media rights being a vital recurring revenue stream that enhances team valuations. The surge in demand for live sports content from streaming platforms and traditional broadcasters has driven up the value of media rights, reaching nearly $56 billion in 2023 and expected to surpass $60 billion soon. Live sports dominate U.S. television viewership, with 81 of the top 100 broadcasts in 2024 being sporting events, emphasizing their unparalleled audience pull. While NFL franchises now allow PE investment, college football still restricts it, despite its viewership strength. For now, PE firms benefit indirectly from media rights growth, though their direct involvement in scaling sports media remains limited.

Sports betting has rapidly expanded in the U.S., now legal in 39 states and generating billions in revenue, attracting major private equity interest. Teams, leagues, and media companies are forming deep partnerships with sportsbooks, while firms like Fanatics and Yahoo are entering the market through acquisitions. Commercialization is also growing through advertising, with leagues like the NBA, MLB, and NHL adding sponsor patches to uniforms. The NFL, despite its profitability, has resisted these changes. Together, these trends signal growing monetization opportunities across the sports ecosystem.

Beyond broadcasting, revenue diversification is accelerating. Naming rights, real estate development, data monetization, and fan engagement platforms are yielding attractive returns. Additionally, teams are leveraging intellectual property and merchandising on a global scale.

As franchise valuations continue to rise, direct ownership opportunities may become more limited. In response, investors are increasingly exploring secondary stakes in existing ownership groups and investments in ancillary assets such as stadium infrastructure, media platforms, and athlete-focused data solutions. While some market participants are evaluating emerging opportunities in alternative formats and international partnerships, these remain early-stage and speculative. Continued growth will be driven by demographic shifts, expanded media monetization, and the legalization of sports betting, though careful navigation of governance and liquidity constraints will remain critical.

Sports investments offer the potential for long-term, inflation-hedged returns with performance that is often uncorrelated to traditional markets. Internal assessments suggest that gross internal rates of return (IRRs) are in the mid-teens, although cash yields may be modest. Investors should be cognizant of risks including league regulatory changes, liquidity constraints, and exposure concentration.

Exit opportunities in sports investments remain limited due to illiquidity and league-imposed ownership restrictions. Most exits occur through secondary sales to other investors or ownership groups, as IPOs and large-scale roll-ups are rare. Holding periods tend to be long, with liquidity events often dependent on league approval. These constraints make strategic planning and alignment with co-owners essential for private equity investors.

Private equity’s role in professional sports has evolved from exploratory to strategic. As funds continue to pursue differentiated, inflation-resistant assets and leagues expand international reach, new deal structures and regional partnerships are expected to emerge. The next wave of investment will likely target women’s leagues, second-tier markets, and adjacent infrastructure such as stadium rights, betting platforms, and athlete data platforms.

While regulatory hurdles and liquidity limitations persist, the fundamental appeal of the asset class remains strong. With smart structuring and league cooperation, private capital in sports is well positioned for another decade of growth.

The content herein and in the report is provided for informational purposes only. Nothing above or in the report constitutes investment, legal, or tax advice or recommendations. Such content should not be relied upon as a basis for making an investment decision and is not an offer of advisory services or an offer to invest in any product or asset class. It should not be assumed that any investment in an asset class described herein will be profitable. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice. Opinions or beliefs expressed in these materials may differ or be contrary to opinions expressed by others. Certain information above and in the report has been obtained from third-party sources. Hines has not independently verified such information.