Best Real Estate Sectors to Invest in the Dominican Republic

May 12, 2025

Fueled by robust economic growth, government incentives, and a thriving tourism sector, infrastructure development, increasing foreign investment, Dominican Republic (DR) has emerged as one of the most dynamic real estate markets in the Caribbean. Samana, Punta Cana and Santo Domingo emerged as hotspots offering unique opportunities. The thriving tourism industry has spurred demand for accommodations, presenting lucrative opportunities in the real estate market. Gross rental yields in the Dominican Republic averaged 6.74% in Q2 2024. In Santo Domingo, yields ranged from 6.26% to 9.82%, while in Punta Cana, they varied between 3.87% and 7.92%. The real estate market is projected to grow by 2.85% from 2024 to 2029, reaching a market volume of $0.84 trillion by 2029.

The Real Estate market in the Dominican Republic is expected to reach a value of U.S $750.99bn in 2025. The residential segment dominates this market, with a projected volume of US$603.96bn in the same year. It is anticipated that the market will experience an annual growth rate of 2.75% between 2025 and 2029, resulting in a market volume of US$837.16bn by 2029. In comparison to other countries, United States is expected to generate the highest value in the Real Estate market, reaching US$136.6tn in 2025.

The Dominican government actively supports tourism-related investments through initiatives like the CONFOTUR Law (Law No. 158-01), offering significant tax exemptions and benefits for qualifying projects. Additionally, the administration has improved the business environment by enhancing legal security and streamlining administrative procedures, making it an opportune time for investors.

Real estate investors are increasingly targeting three high-potential segments: luxury villas, resort-style condominiums, and commercial real estate. These segments are attractive not only for strong rental yield and capital appreciation but also for their alignment with the country’s expanding tourism economy, growing expat community, and urbanization. The Dominican Republic’s real estate market is experiencing a surge in luxury beachfront properties due to increasing demand from international buyers.

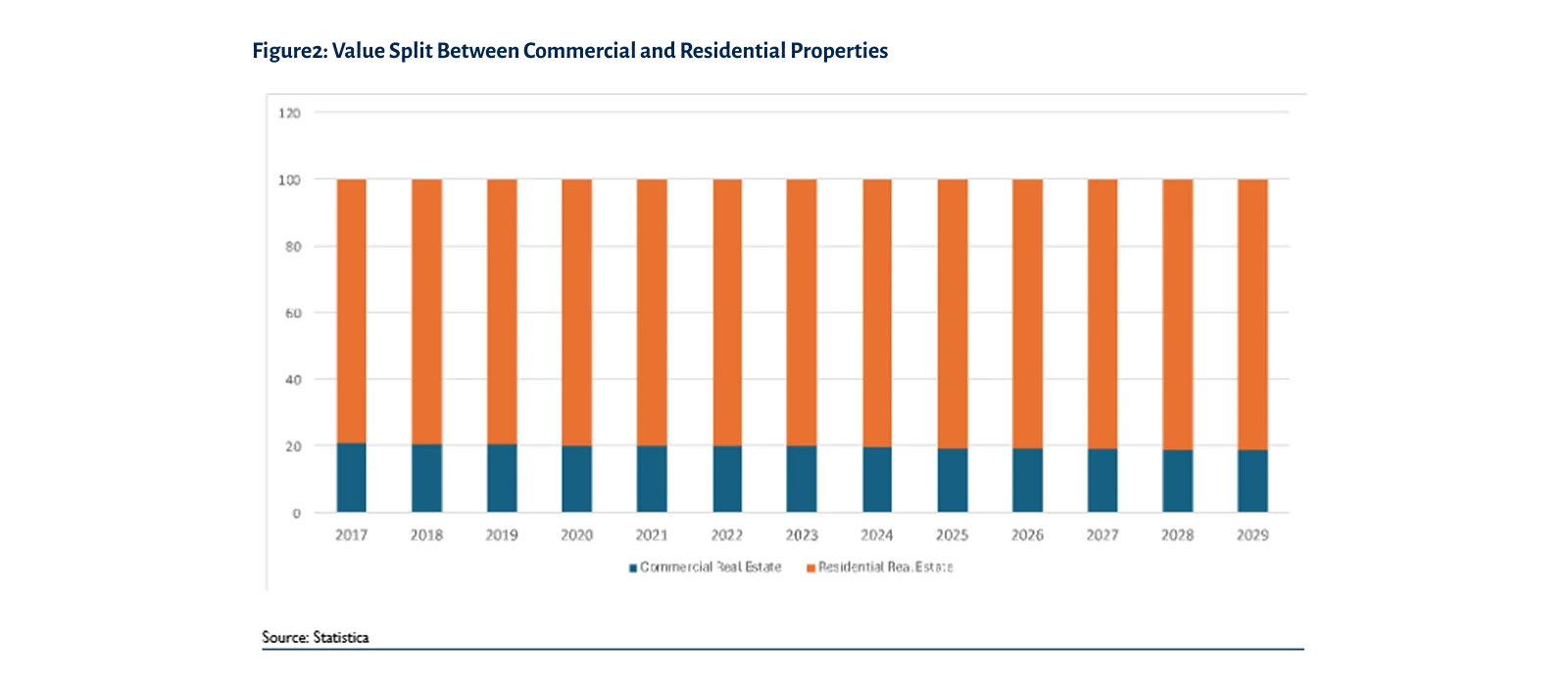

As of the most recent data from 2023 and early 2024 and forecast to 2030, residential real estate accounts for approximately 75-80% of total market value driven largely by high demand for vacation homes, condominiums, and affordable housing for locals and expats. This dominance reflects sustained interest from foreign buyers in popular tourist zones like Punta Cana, Cap Cana, Las Terrenas, and the metropolitan growth in Santo Domingo. The short-term rental boom (Airbnb, Booking.com) has further elevated the income potential of residential properties, especially for beach-facing condos and villas.

Conversely, the commercial real estate sector comprises less than 20% of market value, with growing demand in subsegments such as hospitality (hotels and resorts), retail, logistics parks, and office spaces. The sector is benefiting from strong foreign direct investment (FDI), particularly from U.S., Canadian, and Spanish firms setting up regional hubs or supply chain facilities. Urban centers like Santo Domingo and Santiago are experiencing an uptick in Class A office developments and mixed-use commercial complexes.

Moreover, the government’s push for logistics and trade corridor development, fueled by port and airport expansion projects, is catalyzing commercial property growth along key industrial and transportation zones. While residential real estate offers greater liquidity and rental yields, commercial assets generally provide higher long-term appreciation and stable lease-backed returns, especially in retail and hotel assets tied to the country’s booming tourism sector.

In evaluating real estate opportunities in the Dominican Republic, investors must weigh three critical factors: Return on Investment (ROI), Liquidity, and Risk. Each property segment—Luxury Villas, Condos, Commercial Properties, and Raw Land—offers a distinct profile, appealing to different types of investors based on their strategic goals and risk tolerance.

Commercial real estate—spanning retail centers, hotels, and office space—offers the highest ROI potential, especially in high-growth corridors like Santo Domingo, Punta Cana, and port-adjacent free trade zones. Long-term leases and business-focused tenants provide stability in cash flows. However, these assets carry moderate liquidity, with longer sale cycles, and operational complexity that introduces moderate risk, particularly during market downturns or tourism lulls.

Luxury villas in resort zones (e.g., Cap Cana, Casa de Campo) offer strong premium rental yields, especially from high-end travelers. Their ROI can be significant when marketed as part of vacation rental platforms or resort-managed portfolios. However, liquidity is moderate, and they pose a higher risk due to substantial capital requirements, seasonal demand sensitivity, and higher maintenance costs.

Condos represent the most balanced and accessible investment category. They deliver stable income, benefit from the booming short-term rental market, and have high liquidity due to constant demand from locals, expats, and tourists. Condos are also lower risk due to standardized maintenance, affordability, and relatively resilient resale values even during market corrections.

Raw land is a speculative but potentially lucrative play, especially in emerging tourist zones or near infrastructure development projects. While appreciation can be strong over time, ROI is long-term and dependent on market timing, zoning changes, and infrastructure availability. Liquidity is typically the lowest, and risk is higher, particularly for foreign buyers unfamiliar with local regulatory frameworks.

Beachfront condos and luxury villas in top tourist areas (Punta Cana, Cap Cana, Las Terrenas, Cabarete) offer the best combination of high rental yields and strong capital appreciation. Condos are particularly attractive for their affordability, liquidity, and consistent demand. Commercial properties in Santo Domingo and Punta Cana provide stable returns and benefit from the country’s economic and tourism growth but require more expertise and capital. Luxury villas in gated communities or exclusive resorts (Cap Cana, Casa de Campo) are ideal for investors seeking both lifestyle and investment returns.

Overall, beachfront condos and luxury villas in prime tourist destinations are the top choices for most investors in the Dominican Republic in 2025, combining strong yields, appreciation, and lifestyle appeal. Commercial properties remain a solid option for those seeking diversification and long-term stability in urban centers.