Dominican Republic Credit Rating

January 13, 2025

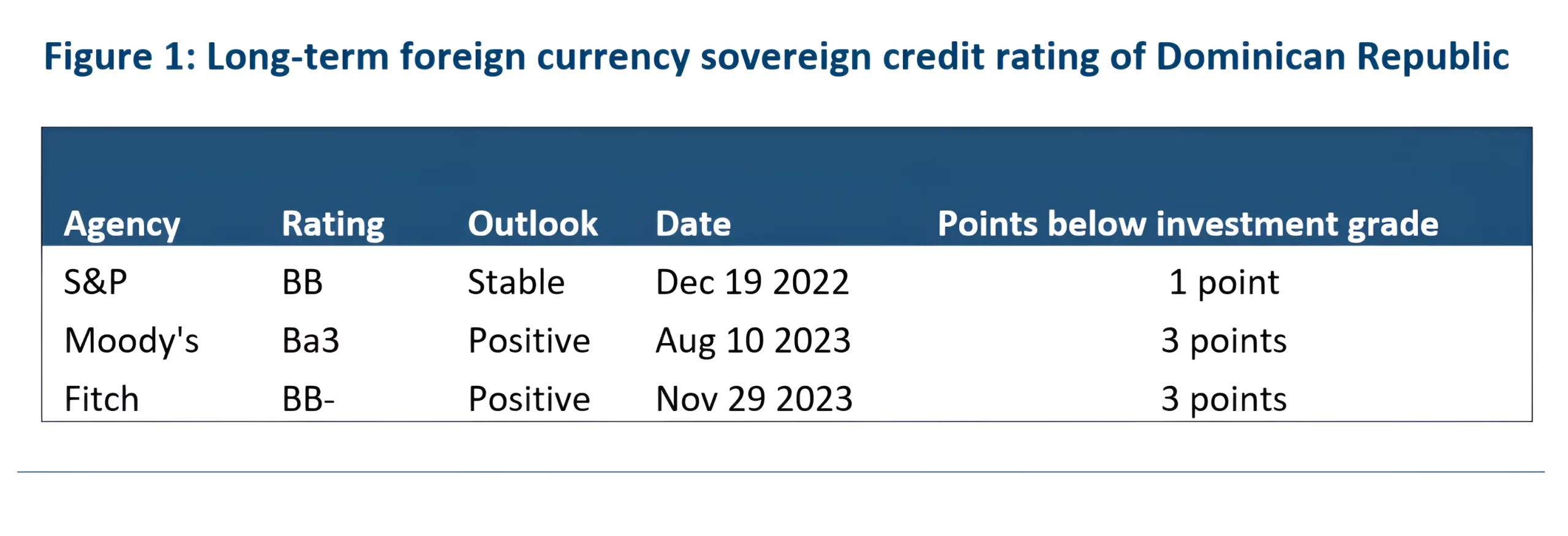

Although still in speculative grade, Dominican Republic’s credit rating has improved over the past decade, from B+ in 2011 to BB in 2024 (S&P) and B1 in 2010 to Ba3 in 2023 (Moody’s). Strong economic growth driven by thriving tourism and improving governance have been key factors driving the rating upgrades. However, to move into investment grade (BBB and above in S&P and Baa3 and above in Moody’s), the country has to significantly enhance its weak fiscal strength by widening the revenue base and reducing interest burden. Recent withdrawal of the fiscal reform project limits credit positive revenue reforms, delaying the country’s prospects of moving into investment grade rating.

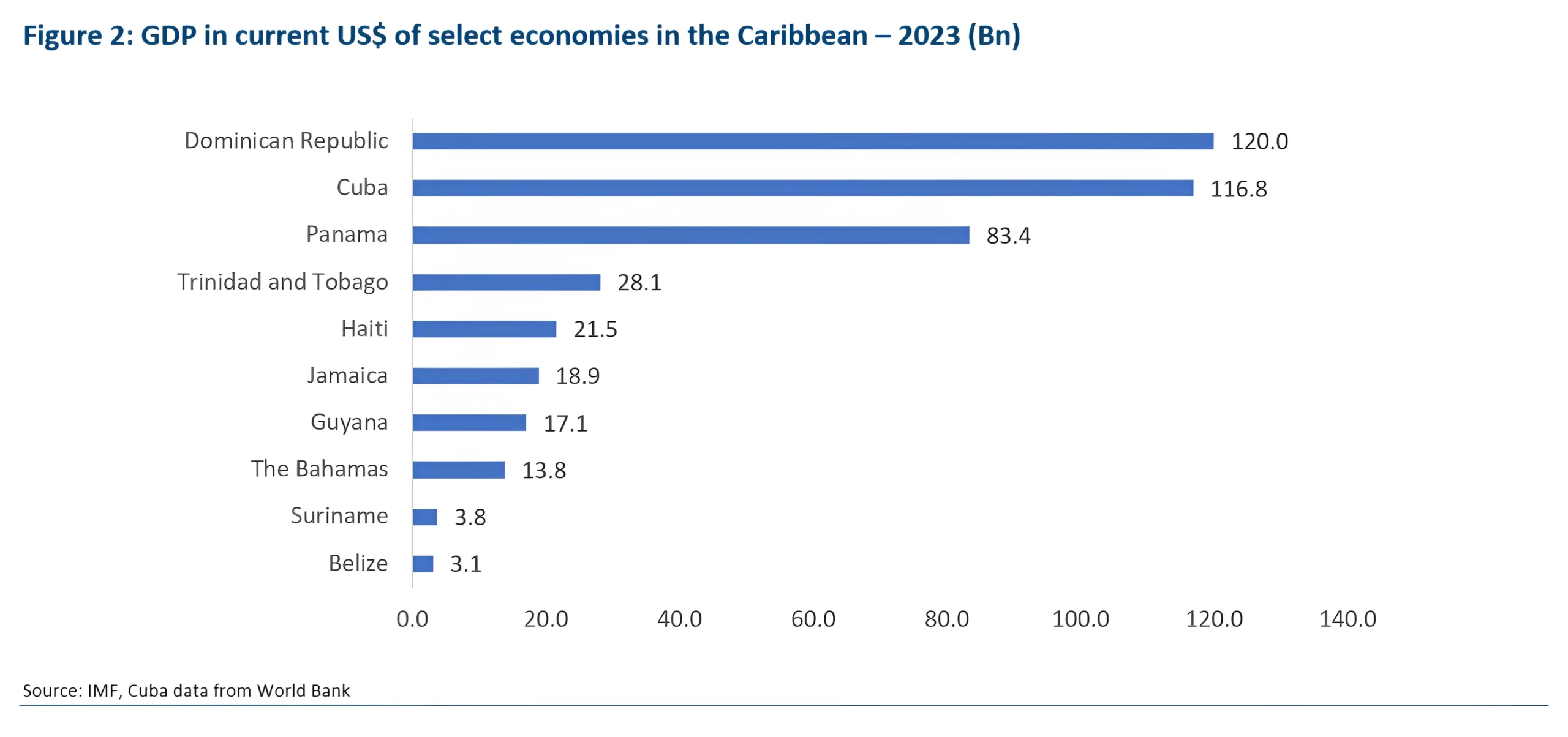

With a GDP of US$120 billion in 2023, the Dominican Republic (DR) is by far the largest economy in the Caribbean and the ninth largest in Latin America. Over the past five decades, the country has outperformed its neighbors in GDP growth, clocking 4.9% average growth per year over 1972-2002, well above the regional average of 3.2% per year. This growth has transformed the country from one of the poorest in the 1960s into a middle-income country with high living standards that reached convergence of 32% with the U.S. in 2002. A stable democracy and a popular tourist destination and, more importantly, right policies that led to significant foreign investment have been instrumental in achieving this stupendous growth. If right policies are maintained, IMF projects the DR could become an advanced economy within the next 40 years.

This strong growth has catapulted GDP per capita in the DR 7.0x over the past 40 years, from about US$1000 in early 1980s to about US$11,000 in 2023. By 2029, the IMF projects this metric to touch nearly US$16,000.

The DR witnessed a sharp 20% jump in nominal GDP (12.7% in real GDP) in 2021, after a 11.4% slump in 2020 (6.7% in real GDP). The momentum continued into 2022, witnessing another 20% increase (4.9% in real GDP). The growth slowed down to 2.4% in 2023 on tighter monetary policy and lower investment spending by the government. With monetary easing in both the U.S. and the region, increased public investment, and a record influx of tourists, IMF forecasts real GDP growth of 5.1% in 2024, and maintains it at that level through 2029. This growth is double that of the Caribbean, estimated to grow at 2.8% (excluding Guyana) in 2024, as per ECLAC. Nominal GDP growth rates, which includes inflation, are expected to average about 7.0% over 2024-2029. This strong growth forecast is reflected in rating agencies stable (S&P) and positive (Moody’s) outlook.

After lowering the policy rate 150 bps in 2023, the country’s central bank reduced it by a further 50 bps to 6.5% in September 2024. The central bank also injected $3.2 billion liquidity support into the system in 2023. Latest data showed that the DR economy grew 5% in January-July 2024 that confirms the growth could match full year estimates of 5.1%. This growth was driven by the construction sector that grew 4.6% due to lower interest rates and liquidity support as well as service sectors, hospitality, and financial services, which surged 8.0% on strong tourist arrivals.

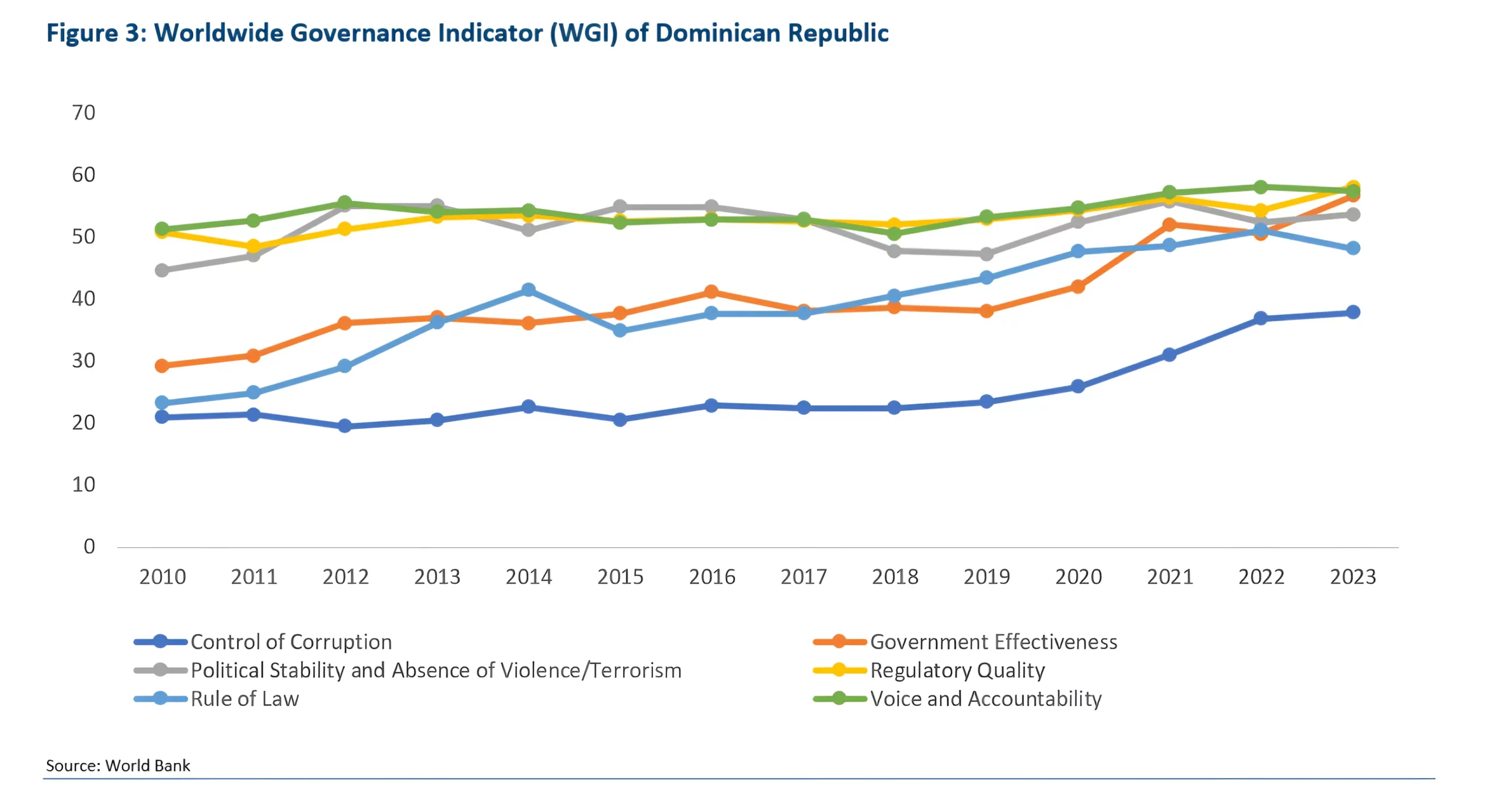

The Dominican Republic is a stable democracy with limited diversity of ideology across political parties. The re-election of President Abinader to 2nd term in May 2024 ensures post-election political stability and policy continuity and could set the stage for the long-awaited reforms in tax overhaul (withdrawn on Oct 22 and discussed later in this report), the resumption of the energy pact, and pension reforms. The country’s composite Worldwide Governance Indicator (WGI) rose from the 37th to 50th percentile over the past decade, scoring high in political stability (57 percentile), government effectiveness (56.6), and regulatory quality (58) in 2023. These have positively impacted credit rating in the past and will continue to do so in future.

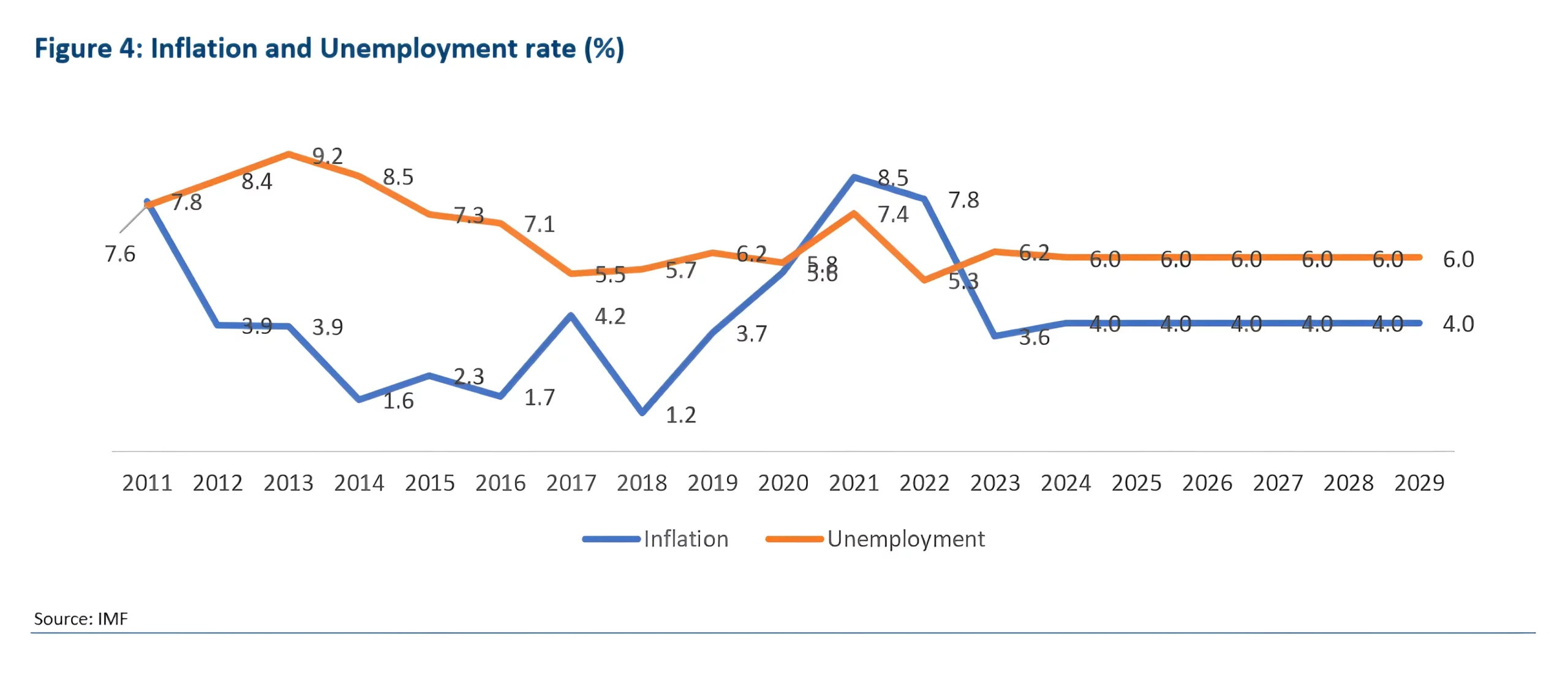

Compared to the average inflation of about 3.5% over 2011-2021, inflation spiked in the DR in 2021 and 2022 to over 8.0% following the COVID-19 pandemic and tight monetary policy in the U.S. and globally and higher commodity prices during 2022. However, it cooled down to 4.8% in 2023 on lower commodity prices, primarily crude oil. With monetary policy easing globally as well as in the DR now, IMF projects inflation in the DR to stabilize at 4.0% annually through 2029. This should bode well for real GDP growth.

Unemployment rate has averaged 6.5% over the past ten years and was estimated at 6.2% in 2023. Going forward, the unemployment rate is expected to stay steady at 6.0% through 2029.

The Dominican Republic current account deficit (CAD) declined to 3.6% of the GDP in 2023 from 5.8% in 2022, driven by lower fuel imports and robust tourism receipts and remittances, offsetting a slowdown in exports. In the first half of 2024, the CAD further contracted due to higher exports and remittances. The DR CAD is mostly funded by FDI inflows, which have reached US$4.0 billion per year, and in the first half of 2024 it exceeded US$2.3 billion.

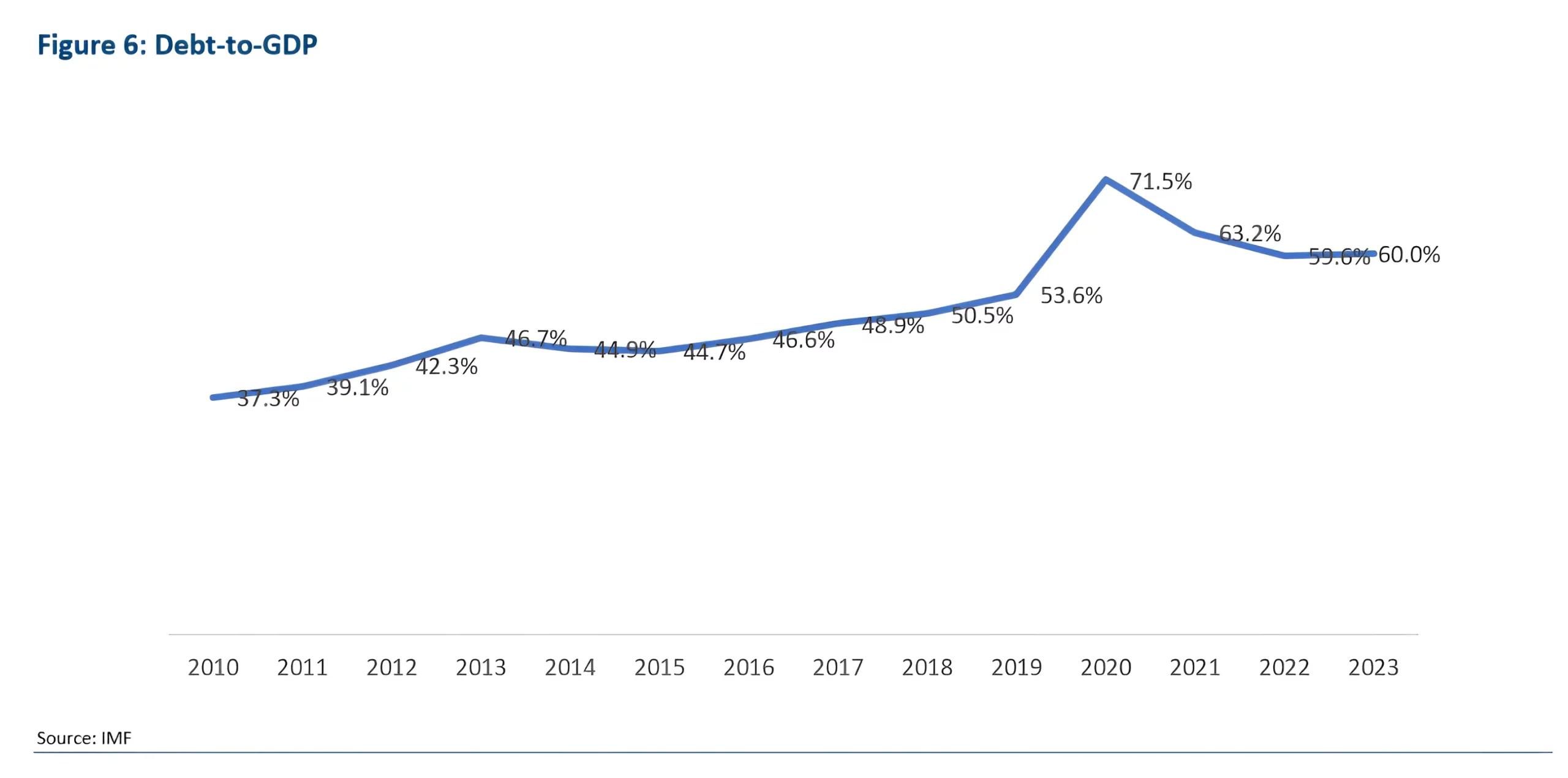

In 2023, the DR public debt rose $5.3 billion to $73.1 billion or 60.02% of the GDP. Excluding the outlier years of 2020 and 2021 when the debt-to-GDP was much higher, the country’s debt has been gradually increasing over the past decade, from about 47% in 2013 to the current 60%. A sizable portion (~70%, well above BB median of 52% as per Fitch) of this debt is sovereign external financing, relying heavily on Eurobond issuance, which poses a challenge amid volatile global rates. In June 2024, the government issued bonds equivalent to US$3 billion, comprising US$1.77 billion on an external bond in local currency due in 2036 at a 10.75% interest rate; the country’s first-ever green bond for US$750 million due in 2036 at a 6.6%; and a reopening of US$500 million for a bond due in 2031 at a 7.05%. To avoid risks of bond market saturation, the country has been increasing borrowing from multilaterals. To avoid external shocks, the government has also increased domestic borrowing (30% of total debt in 2023) despite high rates. Issuance of debt at higher rates has resulted in huge interest burden for the government.

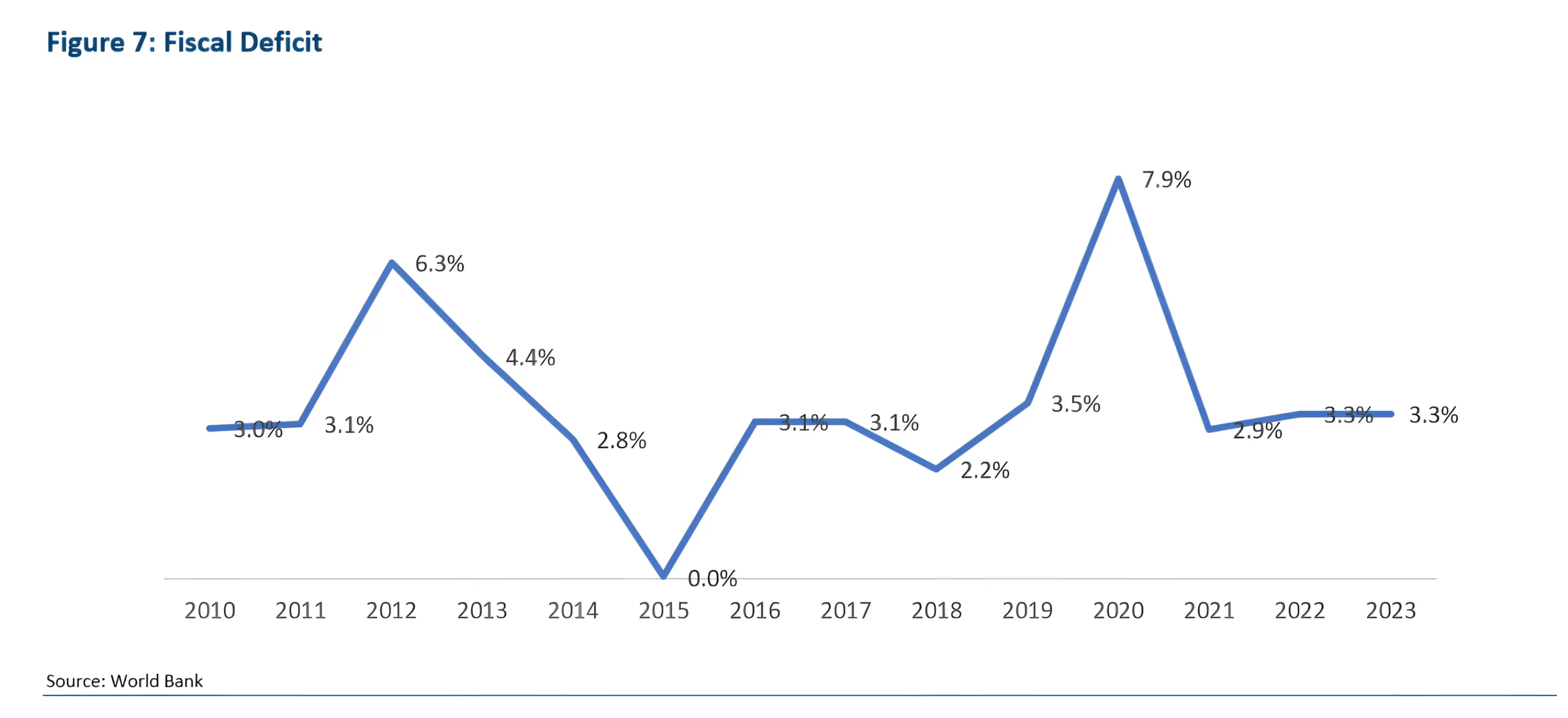

Except during the 2020 COVID year, non-financial public sector deficit has been largely in check varying between 2% and 3% over the past decade. For 2023, the deficit was 3.2% and the 2024 budget envisions a slightly lower deficit of 3.1%, balancing lower revenues with lower capex. However, the deficit is expected to rise to about 3.7% over 2024-26 due to lower revenue from the tax advances, rising salaries, and interest payments.

In the first eight months of 2024, revenues were US$14.51 billion much lower than expenditures at US$16.42 billion, which resulted in a primary deficit of US$1.9 billion or 13% of revenues, above the regional average. Although the interest/revenue ratio fell back to its pre-pandemic level of ~19% in 2022, this remains one of the highest levels in the ‘BB’ category (BB median of 8%, per Fitch) and will rise further (to ~22% in 2024) due to bond issuances at higher rates as discussed in the preceding point.

Heavily-subsidized electricity sector also remains a major drag on the fiscal front. Despite efforts to fix inefficiencies in the electricity sector to cut losses as laid out in the 2021 Electricity Pact, they remain high and are on track to reach 1.4% of GDP in 2023, the highest since 2014.

The much-anticipated tax reforms to improve fiscal consolidation took a backseat when the re-elected President Luis Abinader ordered the withdrawal of the Fiscal Modernization bill on October 22, 2024, citing lack of consensus. The bill aimed to restructure the tax system and boost revenue collection, a major problem in the country’s fiscal space. Following the withdrawal, sovereign bonds fell as much as 2.6 cents across the curve. The move also dampened hopes the country will be upgraded to investment grade by rating agencies.