Public-Private Partnerships in the Dominican Republic

September 29, 2025

The Dominican Republic utilizes Public-Private Partnerships (PPPs) to drive infrastructure development, offering various government incentives to encourage private sector participation. These incentives are outlined in the PPP Law (Law No. 47-20) enacted in 2020 and include tax exemptions, accelerated depreciation, and long-term concession contracts. The General Directorate of Public-Private Partnerships (DGAPP) is the administrative body responsible for overseeing these projects. On 20 February 2020, the Public-Private Partnerships Law 47-20 (“Law 47-20”) was enacted, to enable the creation, and regulation, of alliances between the public sector and the private sector in the Dominican Republic, in order to promote collaboration and participation of the private sector in the financing, development, and operation of public projects with the aim of improving infrastructure and public services, increasing efficiency, and reducing the cost for the State.

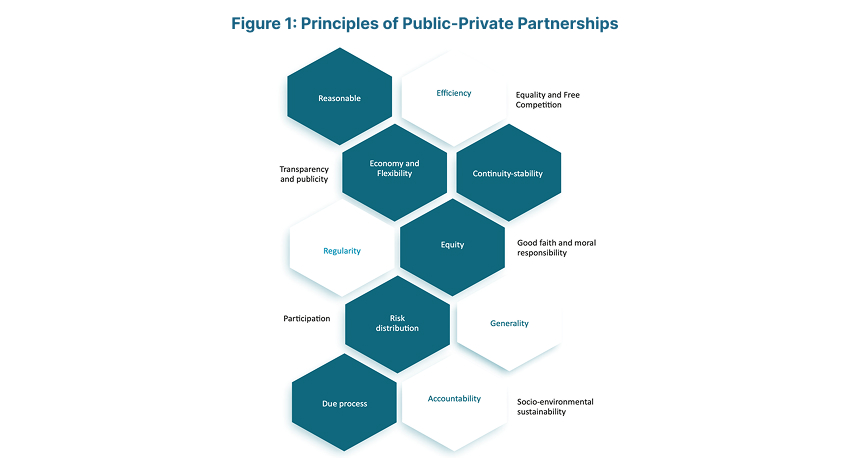

Its purpose is to establish a regulatory framework that governs the initiation, selection, awarding, contracting, execution, monitoring, and termination of public-private partnerships (PPPs). Given budgetary constraints and the growing demand for investment in the provision of public services in sectors such as transportation, energy, drinking water, health, and education, PPPs are presented as a viable mechanism for channeling private sector resources towards projects of public interest. Public Private Partnerships facilitate the joint work of the different actors, for the benefit of national development. It addresses the traditional budgetary limitations of the government, combining the contribution of resources and capabilities, guarantees investment flows, establishing long term commitments and promoting synergies to modernize and provide timely maintenance to services and public goods. Traditionally, a PPP refers to contracts between public and private sector entities with the objective of delivering a project and its service, which has historically been provided by the public sector. Under this scheme, the private sector is typically responsible for the design, construction or improvement of infrastructure, assuming risks related to the project (usually financial, commercial, technical, and operational), receiving a financial return for the provision of the service, either through user charges or through financial agreements with the public agent and may or may not have a transfer of ownership over the asset. The public sector in turn maintains responsibility for the quality of the service and its provision under equitable conditions.

The main benefits of a PPP project have been identified as follows:

- The ability to provide a service at a lower cost and in less time.

- The possibility of improving the quality of services and guaranteeing good levels of service over prolonged periods.

- More efficient management of project risks.

- The ability to attract technological innovation and provide flexibility in the provision of services.

- The financial structuring of a project can attract financial resources under more favorable conditions than if it were carried out as a public project in some cases.

Law 47-20 defines PPPs as the mechanism by which public and private agents voluntarily sign a long-term contract, as a result of a competitive process, for the provision, management, or operation of goods or services of social interest in which there is total/partial investment by private agents, tangible or intangible contributions by the public sector, risk distribution between both parties, and remuneration is associated with performance in line with the provisions of the public-private partnership agreement (the “PPP Agreement”). These are long-term contractual agreements for the provision of goods and services that are, in principle, the responsibility of the State, and which may involve the construction, financing, operation and maintenance of public infrastructure or the management of essential services.

In general terms, Law 47-20 applies to public administration under the executive branch, decentralized and autonomous non-financial institutions, social security institutions, companies or agents of the non-financial public sector, and city halls. Law 47-20 establishes the General Directorate of Public-Private Partnerships (the “DGAPP”) as the governmental body responsible for regulating, supervising, and evaluating PPP proposals. It acts as an intermediary between public entities and private investors, ensuring that PPP projects comply with established regulations and standards.

The General Directorate of Public-Private Partnerships (the “DGAPP”) is an autonomous and decentralized entity of the State, invested with legal personality, its own assets, as well as administrative, jurisdictional, financial, and technical autonomy, attached to the Ministry of the Presidency. Its mission is to promote and regulate PPPs in an orderly, efficient, and transparent manner, ensure compliance with Law 47-20, and mitigate the risks of PPP projects by regulating and supervising public agents and private agents involved in the projects.

The DGAPP is made up of:

- a collegiate body: the National Council of Public-Private Partnerships (the “CNAPP”); and

- one official: the executive director of the DGAPP, appointed by the President of the Dominican Republic, who oversees the direction, control, and representation of the DGAPP.

The CNAPP is established as the highest body of the DGAPP and is responsible for the evaluation and determination of the relevance of the PPPs presented before it. The CNAPP is made up of the following State bodies:

- Ministry of the Presidency

The Minister of the Presidency presides over the CNAPP. In this sense, he has the functions of summoning the other members to the different meetings, and if deemed necessary of also inviting other public institutions to participate within the Council. Moreover, said party also has any other function that may facilitate the application of the law.

- Ministry of Treasury

The Ministry of Treasury must assess the budget and fiscal implications of PPP projects. Likewise, it identifies fiscal costs and risks. In addition, it must issue a technical opinion where it approves or rejects the initiatives presented and evaluates that the value of the PPP contracts does not exceed the limits established in the Budget Law, as well as including the allocation of resources that the different PPP contracts may require in the General State Budget.

- Ministry of Economy, Planning and Development

The Ministry of Economy, Planning and Development oversees evaluating the economic and social impact of each initiative and the correspondence of each one with respect to the National System of Planning and Public Investment. In this sense, they must issue a technical opinion stating the economic and financial viability of the proposed initiatives and estimate the economic and social risks of each initiative before their declaration of public interest.

- Legal Counsel to the Executive Branch

The Legal Counsel to the Executive Branch must evaluate if the CNAPP’s acts are in accordance with the legal system.

- General Direction of Public Procurement

The General Direction of Public Procurement must issue a technical opinion regarding the design and structure of the competitive processes. Therefore, this member of the CNAPP has a voice and vote regarding that part of the process.

- Executive Director of the DGAPP

The Executive Director of the DGAPP has the previously indicated functions. It is part of the CNAPP, and has a voice, yet not vote, it can present and comment on the incidences of the different initiatives that are deposited.

Each Ministry must create a technical unit, department, or directorate, responsible for carrying out the studies and analyses necessary to support decision-making.

Key features of the PPP process include a competitive selection process to ensure transparency and value for money. Contracts clearly define the distribution of risks and remuneration mechanisms between the public and private partners.

The Dominican government has identified Public-Private Partnerships (PPPs) as a core strategy for developing critical infrastructure across multiple high-impact sectors. This reflects the dual goals of stimulating economic growth and improving the quality of public services, while attracting foreign capital and expertise. Below is a breakdown of the priority sectors:

Transport infrastructure forms the backbone of the Dominican Republic’s development ambitions, particularly in integrating rural areas, improving logistics, and boosting tourism access. Key focus areas being Highways, Airports and Ports. PPPs are being used to upgrade national highway corridors, reduce bottlenecks, and expand toll road networks. As air traffic rises post-COVID, there’s renewed interest in expanding and modernizing regional airports, including opportunities for private airport concessions and terminal management. The strategic Cabo Rojo Port project, located in Pedernales, is part of a broader tourism and logistics development push in the southwest. The port is being developed as a cruise terminal and gateway to eco-tourism destinations. Cabo Rojo Cruise Port (Pedernales): Being developed under a PPP model in partnership with private cruise operators and tourism developers. Includes berthing facilities, visitor terminals, and supporting infrastructure.

Tourism accounts for over 15% of DR’s GDP and is a major employment generator. The government is aggressively using PPPs to expand infrastructure in non-traditional destinations and to promote sustainable tourism models. Key areas to focus are the Ecotourism Infrastructure, Cultural Corridors, and Resort Ecosystems. Ecotourism Infrastructure includes development of protected parks, coastal walkways, and nature reserves with private operators responsible for maintenance and visitor services. Projects to revitalize colonial towns, heritage sites, and local art hubs (e.g., Santo Domingo, Puerto Plata). End-to-end development of lodging, transport, waste systems, and recreational assets in areas like Pedernales and Bahía de las Águilas, under long-term PPP frameworks. Pedernales Tourism Development Plan: A $1.2 billion initiative that combines public land grants and private hotel/resort development, with infrastructure funded and operated under PPPs.

To ensure energy security, environmental sustainability, and better service delivery, the Dominican government is promoting PPPs in utilities, particularly in green energy and sanitation. Key areas of focus are Renewable Energy, Waste-to-Energy Plants, and Water Management. Wind, solar, and biomass plants are being developed with long-term purchase agreements (PPAs) and private financing. Municipal waste treatment plants with energy capture technologies, using DBFOM (Design-Build-Finance-Operate-Maintain) structures. PPPs are being explored for desalination plants, urban wastewater systems, and rural drinking water networks.

There is growing recognition that private sector expertise can enhance the delivery of essential public services, particularly in healthcare and housing. Modern healthcare facilities are designed and operated under PPPs, with guaranteed service level contracts. Focus on underserved provinces and urban peripheries. Partnerships where private developers build low- to mid-income housing with government-provided land and fiscal incentives (e.g., VAT exemptions). Future PPPs may target vocational training centers and technical schools tied to economic development clusters (e.g., tourism zones).

The Dominican Republic’s PPP framework includes new tax and financial incentive schemes specifically designed to attract private investment into infrastructure projects. These incentives reduce the financial burden and risk for developers, making projects more attractive and feasible. For example, the government offers tax exemptions and other fiscal advantages that directly improve project profitability and cash flow for private partners. Developers operating in sectors like tourism, renewable energy, and logistics may be eligible for partial or full income tax exemptions for up to 15 years, especially in Special Development Zones such as Pedernales or border areas. Exemption from import duties and VAT on construction equipment, materials, and key inputs during the development phase. Particularly relevant for large infrastructure projects that rely heavily on imported technology or prefabricated systems. Reductions or exemptions from municipal taxes, property transfer taxes, and land use taxes for PPP projects are executed under national priority designations. Under specific investment promotion laws (e.g., Tourism Incentive Law 158-01, Renewable Energy Law 57-07), private investors can enjoy exemptions on capital gains taxes and dividend withholding taxes for projects aligned with strategic goals.

The state may offer long-term leases, concessions, or even land grants for infrastructure development — particularly in public-use facilities like ports, airports, and tourism corridors. Zoning laws can be adapted or streamlined to facilitate project-specific designations, enabling faster conversion of rural, conservation, or mixed-use land into infrastructure-ready plots.

To improve project bankability and reduce financial risk for private developers, the government can offer Minimum Revenue Guarantees. In transport (e.g., toll roads) or energy (e.g., electricity purchase contracts), the government may guarantee a baseline revenue, making returns more predictable for investors and lenders. Used primarily in social infrastructure PPPs (hospitals, schools), developers are paid fixed monthly/annual payments based on service availability, not usage — reducing demand risk. Projects involving international developers may include currency conversion guarantees or offshore escrow mechanisms to reduce exposure to peso volatility. PPP contracts can include “freezing” provisions to prevent retroactive changes in tax, environmental, or operational laws that would affect the developer’s business model. Strategic projects may benefit from government equity contributions, soft loans, or credit enhancements in partnership with multilateral banks (e.g., IDB, World Bank, CAF). For large-scale or strategic PPP projects, the Dominican government may offer sovereign guarantees on debt repayment or performance obligations to reduce investor risk.

The PPP law (Law No. 47-20) and its regulations establish clear, competitive, and transparent processes for project selection and tendering. This predictability reduces uncertainty for developers, who can trust that projects will be awarded based on merit and that contracts will be honored. The existence of a specialized government entity, the General Directorate of Public-Private Partnerships (DGAPP), further assures developers of professional oversight and support throughout the project lifecycle.

The Dominican PPP system allows both domestic and international firms to participate, including the submission of unsolicited proposals. This openness enables developers to proactively identify and propose projects that align with their expertise and interests, increasing the pool of potential participants and fostering innovation. The Dominican government actively promotes approved PPP projects worldwide, increasing their visibility and attracting qualified developers. This active promotion, combined with international funding and technical assistance (e.g., from the Inter-American Development Bank and U.S. Trade & Development Agency), further lowers entry barriers and enhances project viability. Recent legal and regulatory reforms have improved the credibility and stability of the PPP environment, addressing concerns about regulatory risk and contract enforcement. This stability is crucial for developers considering long-term infrastructure investments, as it minimizes the risk of adverse government actions or policy reversals.

The Dominican Republic presents a compelling landscape for PPPs backed by strong policy support, fiscal incentives, and institutional stability. Private developers can tap into government incentives to build transformative infrastructure while generating stable long-term returns. Government incentives in the Dominican Republic—including tax breaks, transparent processes, institutional support, and regulatory stability—significantly lower the risks and costs for developers. These measures make PPP projects more attractive, encourage participation from both local and international firms, and ultimately help mobilize private capital for infrastructure development. This improves the efficiency are quality of public services are also addresses the public sector budgetary constraints.