Why Invest in the Dominican Republic?

June 30, 2025

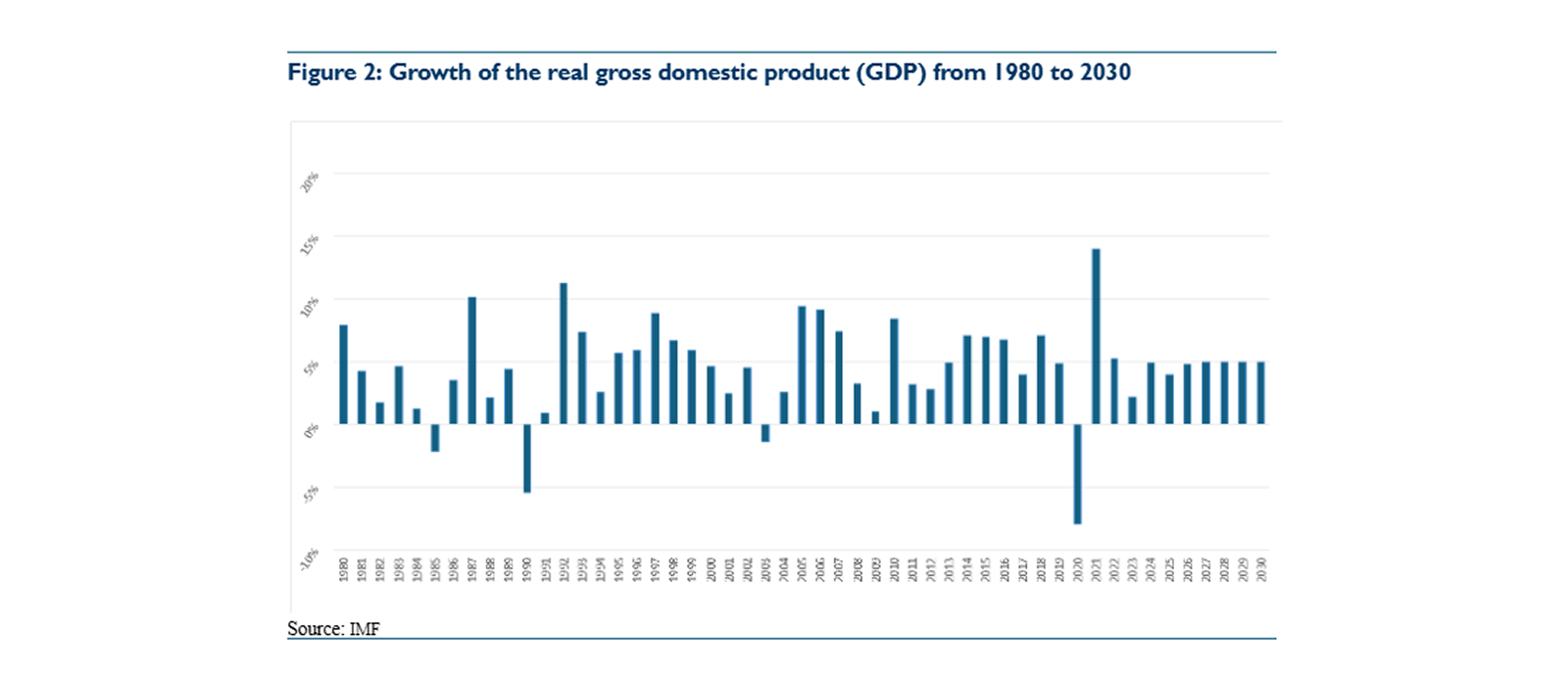

With a stable political environment, strategic geographic location, business-friendly policies, robust infrastructure development, and growing sectors such as tourism, energy, real estate, and manufacturing, the Dominican Republic offers compelling opportunities for domestic and foreign investors. With a GDP growth of 5.0% in 2024, the highest in Latin America and the Caribbean, the country remains one of the most dynamic, outperforming larger economies. For the coming years, this impressive dynamism is expected to continue, with IMF growth projections of 4.5% and 5.1% for 2025 and 2026, respectively, driven by solid political and social stability, a robust financial system, and favorable economic policies for business development. This extraordinary performance has also strengthened the confidence of international investors, reflected in the improvement of the country’s credit rating by major rating agencies such as S&P Global and Fitch Ratings. Thus, beyond its idyllic landscapes, the Dominican Republic has managed to establish itself as a key destination for Foreign Direct Investment (FDI). In 2024, according to the United Nations Conference on Trade and Development (UNCTAD), FDI in the country increased by 7.1%, representing 41% of the capital flows captured by Central America.

The country’s GDP reached $293.4 billion in purchasing power parity terms, with projections estimating it will rise to $374 billion in 2025. This growth is supported by monetary easing, increased public investment, and strong remittance inflows.

Peaceful elections and institutional continuity contribute to a secure investment climate. The DR is recognized for its political and economic stability, with a government committed to supporting and protecting foreign investors. The Dominican Republic has signed over 15 Bilateral Investment Treaties (BITs) with countries such as the United States, Spain, Canada, France, South Korea, Switzerland, and the Netherlands. These treaties are designed to promote and protect foreign investment by offering guarantees that go beyond domestic legal systems. These treaties typically guarantee Investor Protection Fair and Equitable Treatment of investors, free. Free transfer of capital and profits, and most-favored-nation and national treatment clauses, ensuring investors are treated as favorably as domestic or other foreign investors.

In addition to BITs, DR is a signatory to CAFTA-DR, a multilateral trade agreement that includes strong investment provisions and dispute resolution mechanisms. CAFTA-DR enhances market access and provides U.S. investors with protections like those in standalone BITs.

Resilient external US demand, strong aggregate income growth, and further policy loosening are among the key tailwinds supporting the economic momentum; however, Trump’s immigration policies could pose headwinds for future remittance inflows.

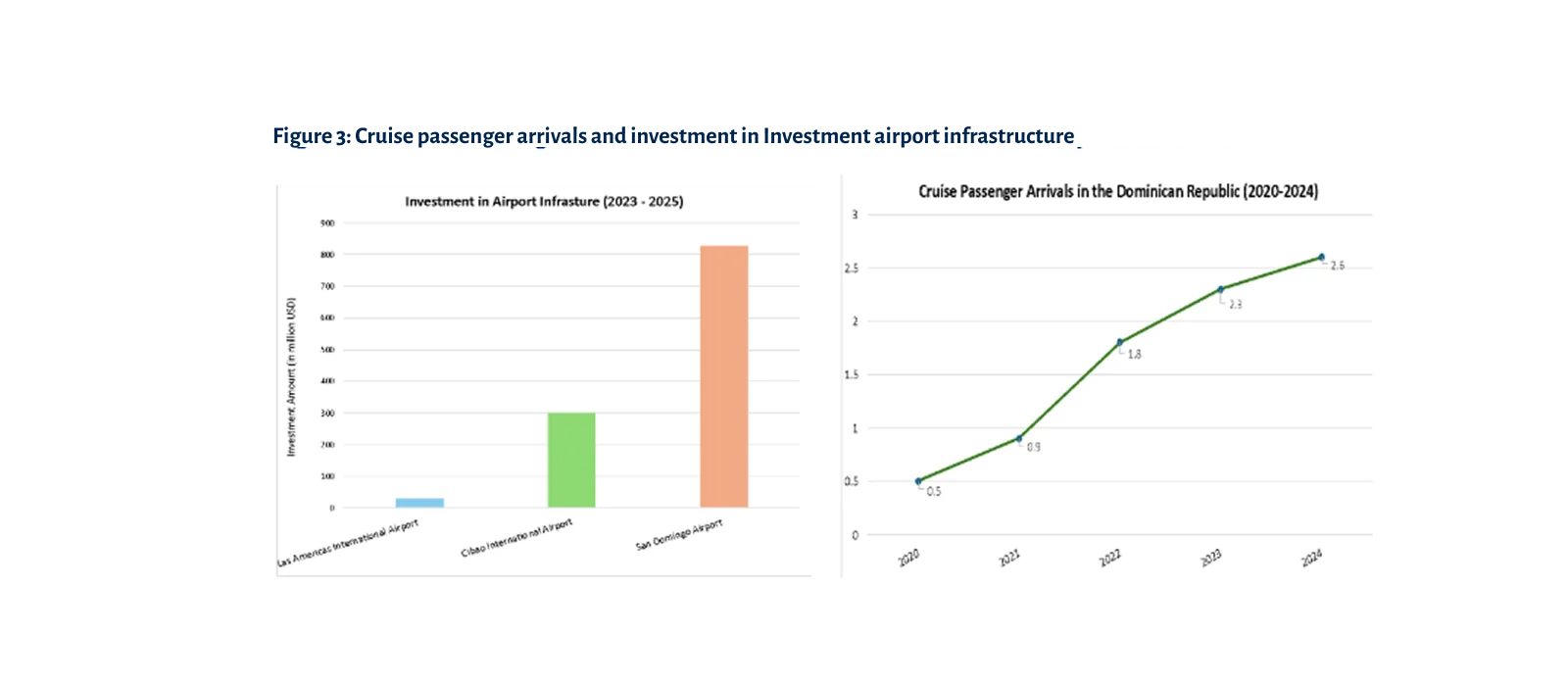

Located in the heart of the Caribbean, the DR serves as a commercial hub between North America, Latin America, and Europe. The Dominican Republic has undertaken significant infrastructure expansion in recent years, positioning itself as one of the most accessible and logistically efficient countries in the Caribbean. These developments are not only improving the quality of life for residents and tourists but are also creating favorable conditions for foreign direct investment (FDI) across multiple sectors. The country boasts an extensive and improving road network, with ongoing projects enhancing connectivity between major cities, ports, and tourist hubs. Key corridors—such as the Santo Domingo-Punta Cana and San Domingo-Santiago expressways—have reduced travel time and facilitated regional integration. Continued investment in public-private partnerships (PPPs) is funding upgrades and maintenance of national highways, bridges, and rural access roads.

The Dominican Republic is home to eight international airports, with Punta Cana International Airport consistently ranked among the busiest in the Caribbean. Recent upgrades have expanded terminal capacity and improved customs and immigration processing. Additionally, the government has prioritized maritime infrastructure, investing in port expansions in Santo Domingo, Puerto Plata, and the newly opened Cabo Rojo Port in Pedernales. These developments are boosting cruise tourism and logistics, creating new investment opportunities in shipping, warehousing, and hospitality.

The Dominican Republic is experiencing unprecedented growth in tourism, consolidating its position as the leading destination of choice in the Caribbean and Latin America. In 2024, the Dominican Republic reached a record 10.3 million visitors, an impressive figure compared to the 6.4 million in 2019, the last year before the global crisis. Tourism growth is marking an increase of over 10% compared to the previous year. This achievement reaffirms the country’s leadership as one of the most attractive destinations in the Caribbean and establishes tourism as a key pillar of the national economy. This increase translates into a hotel occupancy rate surpassing the historical average of 80%, marking a milestone for the country. The tourism sector not only generates significant income for the national economy but also drives the development of communities throughout the island. With the expansion of hotel projects and the increase in visitor arrivals, thousands of direct and indirect jobs have been created, benefiting sectors like construction, transportation, gastronomy, and commerce. Employment within the tourism industry also saw substantial growth. In 2024, the sector supported nearly 750,000 jobs across various domains, including agriculture, industry, transportation, telecommunications, and construction. This is a notable increase from the 600,000 direct and indirect jobs reported in 2023.

In 2024, the Dominican Republic’s tourism sector experienced remarkable growth, further solidifying its role as a cornerstone of the nation’s economy. Tourism’s contribution to the national GDP surged to nearly 20%, generating approximately $26 billion in revenue. This marks a significant increase from the 14.1% contribution recorded in 2023. The sector’s expansion was driven by record-breaking visitor numbers, with over 10.3 million tourists arriving in 2024, up from 10 million in the previous year. Additionally, foreign investment in the tourism sector continues to grow, attracting capital that drives new developments and strengthens the destination’s competitiveness.

The Dominican Republic Industrial Tech revolution is no longer a secret — it’s a movement. This dynamic shift is not only transforming the country’s industrial landscape but is also positioning the Dominican Republic as a central hub for technological innovation, creating exciting opportunities for growth and international partnerships. Global companies continue to choose the Dominican Republic to relocate their operations in key sectors such as medical and pharmaceutical products, electrical and electronic devices, textile manufacturing, tobacco and its derivatives, jewelry, among others. Clearly, this outlook shows that nearshoring is not an emerging trend, but a reality in the country. Innovation, investment, and talent are transforming the nation into a powerhouse of technological advancement. The growing interest in creating more resilient, sustainable, and closer supply chains to end consumer markets has made nearshoring a key competitive strategy for companies. In this context, the Dominican Republic, located just two hours by air and two days by sea from the United States, offers multiple competitive advantages:

- Geographic proximity to the world’s largest consumer markets.

- Legal security and clear, predictable rules of the game.

- Top-level connectivity and logistics infrastructure, with 8 international airports, 18 seaports, 5 logistics centers, and 33 logistics operator companies. This infrastructure includes ports that have positioned themselves as important terminal operators, playing a strategic role in the sustainability of global supply chains. Several Free Trade Agreements, including DR-CAFTA and EPA, which open the doors to more than 900 million potential consumers worldwide.

- Competitive operational costs.

Dominican Republic ranks #2 in the Caribbean and #106 globally in Startup Blink’s ecosystem rankings for 2025, with an average funding raise of about $215,000 per startup. Santo Domingo hosts around 95% of the country’s 890+ startups, with approximately $335 million raised across 49 funded companies.

The below chart shows the clear dominance of fintech, which consistently attracts the largest share of investment, mirroring global and regional patterns. However, the chart also highlights the emergence and strengthening of other sectors—such as edtech, health tech, SaaS, and Mfg.tech (manufacturing technology)—especially in the last two years. The growing presence of these sectors indicates that the Dominican Republic is not only fostering digital financial solutions but is also becoming a hub for innovation in education, healthcare, and advanced manufacturing.

This diversification of investment is a positive signal for the country’s investment environment. It suggests that the ecosystem is resilient, less dependent on a single sector, and increasingly attractive to a broader range of investors and entrepreneurs. The consistent rise in funding, coupled with sectoral expansion, demonstrates that the Dominican Republic is building a robust foundation for sustainable startup growth. This, in turn, enhances the overall investment climate by reducing risk, encouraging innovation, and positioning the country as a promising destination for venture capital in the Caribbean.

Beachfront condos and luxury villas in top tourist areas (Punta Cana, Cap Cana, Las Terrenas, Cabarete) offer the best combination of high rental yields and strong capital appreciation. Condos are particularly attractive for their affordability, liquidity, and consistent demand. Commercial properties in Santo Domingo and Punta Cana provide stable returns and benefit from the country’s economic and tourism growth but require more expertise and capital. Luxury villas in gated communities or exclusive resorts (Cap Cana, Casa de Campo) are ideal for investors seeking both lifestyle and investment returns.

The Dominican Republic has experienced a significant and sustained rise in Foreign Direct Investment (FDI) inflows over the last five years, underscoring growing international investor confidence in the country’s economic trajectory. After a temporary contraction in 2020—attributed to the global pandemic—FDI rebounded robustly in 2021 and has maintained an upward trend through 2024.

The Dominican Republic has showcased commendable macroeconomic discipline in navigating post-pandemic volatility, as reflected in the trend lines for inflation and central bank interest rates between 2020 and 2024. From a peak inflation rate of 8.6% in 2022, driven by global commodity shocks and supply chain disruptions, the country has successfully brought inflation down to a projected 4.3% in 2024, aligning closely with its long-term target band. This moderation is the result of proactive monetary policy by the Central Bank, including strategic interest rate adjustments and liquidity control measures. Simultaneously, the central bank policy rate followed a similar trajectory—rising from 3% in 2020 to 8.5% in mid-2022, before being gradually reduced to 6.5% in 2024 as inflation pressures eased and economic conditions stabilized.

Dominican Republic (DR) is a high-potential investment destination. Supported by robust FDI trends, sectoral diversification, and improving infrastructure, DR is emerging as a regional leader in economic growth and investment attractiveness. The Dominican Republic is uniquely positioned at the intersection of geographical advantage, economic reform, and sectoral opportunity. Whether for greenfield projects, expansion, or capital allocation, the DR offers competitive returns, institutional security, and long-term scalability.